The Coca-Cola Company (KO) is a global leader in the beverage industry, offering over 500 brands in more than 200 countries and territories. Founded in 1886, Coca-Cola has grown from a single product to a vast portfolio that includes sparkling soft drinks, water, juice, tea, coffee, and energy drinks. The company’s commitment to innovation and diversification, along with its strong distribution network, has solidified its position as a staple in the global market.

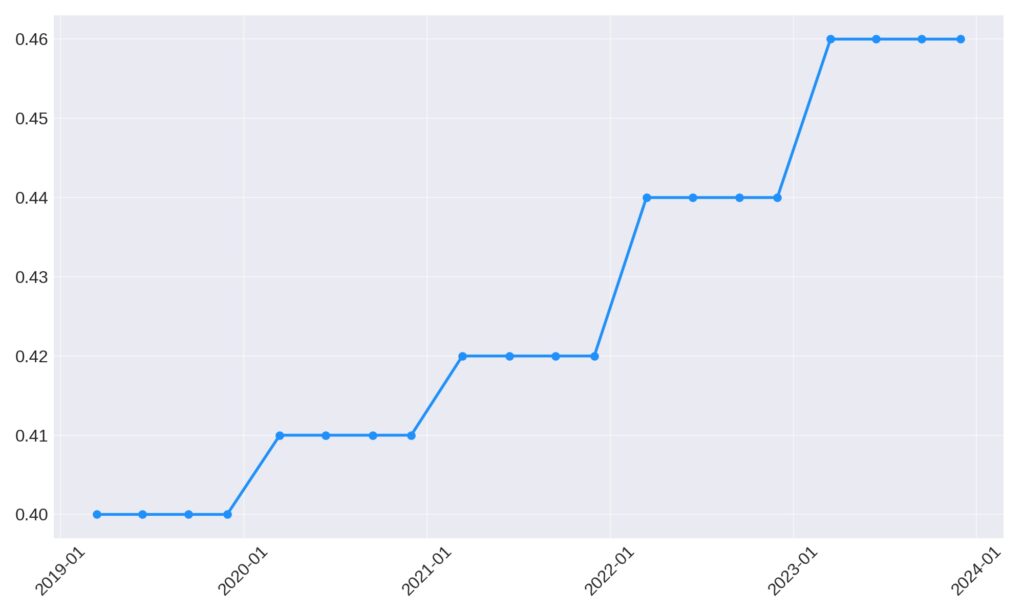

A remarkable testament to Coca-Cola’s financial stability and commitment to shareholder value is its dividend history. The company has achieved the distinguished status of being a Dividend King, having increased its dividend for 60 consecutive years. This achievement underscores Coca-Cola’s consistent performance, prudent management, and ability to generate steady cash flows even in challenging economic times. For investors, KO’s track record of dividend growth highlights its reliability and attractiveness as a long-term investment, embodying a rare blend of growth and income opportunities in the competitive consumer goods sector.

Analyst Ratings

Recent analyst ratings for the stock show a generally positive outlook, with most analysts recommending a Buy or Strong Buy, and only one Hold. The price targets set by analysts suggest varying levels of upside potential:

- Lauren Lieberman of Barclays maintains a Buy rating, raising the price target from $60 to $66, indicating a +9.99% upside as of January 16, 2024.

- Kaumil Gajrawala of Jefferies initiates coverage with a Hold rating and a price target of $64, suggesting a +6.66% upside as of November 13, 2023.

- Andrea Teixeira of JP Morgan maintains a Buy rating, with a price target adjustment from $59 to $62, reflecting a +3.32% upside as of October 25, 2023.

- Dara Mohsenian of Morgan Stanley maintains a Buy rating, adjusting the price target from $70 to $65, which implies an +8.32% upside also as of October 25, 2023.

- Bryan Spillane of B of A Securities maintains a Strong Buy rating but lowers the price target from $74 to $60, indicating virtually no change (-0.01%) as of October 17, 2023.

Overall, the analyst consensus leans towards a bullish perspective on the stock, with expectations of growth and positive adjustments to price targets, albeit with some variance in the degree of optimism.

Insider Trading

Analyzing the insider buy and sell transactions for the stock over the last 6-12 months, we observe a pattern of insiders exercising their options and subsequently selling the exercised shares, often at a significantly higher price than the exercise cost. This activity reflects a combination of realizing gains from stock options and potentially adjusting personal investment positions rather than indicative of bearish sentiment towards the company’s future prospects. Here’s a summary of the notable transactions:

- Beatriz R Perez (Comms) engaged in multiple transactions, including a notable sale post-exercise on January 31, 2024, selling 75,000 shares at $60.0407 each, totaling $4,503,052, with her holdings adjusted to 165,808 shares.

- James Quincey (Chair & CEO) showed significant activity, with multiple sales post-exercise across different dates. For instance, on December 18, 2023, he sold 92,028 shares at $59.0622, totaling $5,435,377, maintaining a consistent pattern of exercising options and selling.

- Nikolaos Koumettis (Reg. CEO) and Henrique Braun (Reg. CEO) both participated in sales post-exercise, indicating similar behavior of leveraging stock options for gains.

- John Murphy (CFO) executed a large transaction on August 2, 2023, selling 156,290 shares at $62.0982 each, for a total of $9,705,327, after exercising options at significantly lower prices.

- Notable sales without immediate preceding exercises within the 6-month window, suggesting these might be direct sales rather than post-exercise actions.

The transactions reveal a consistent pattern where insiders exercise their options at lower prices (generally around $37.2050) and sell the shares at market prices, securing profits. This is a common practice among corporate insiders and does not necessarily indicate a lack of confidence in the company’s future performance. It’s also worth noting that the %Held After transactions remain relatively small, suggesting these insiders still retain a majority of their holdings or have a modest impact on their overall investment in the company.

Dividend Metrics

The Coca-Cola Company (KO) has demonstrated a strong track record in terms of dividend reliability and growth. The company has consistently increased its dividends for 60 years, showcasing its position as a Dividend King—a title given to stocks with 50 or more consecutive years of dividend increases. The dividend yield stands at 3.07%, with a 5-year dividend growth rate of 3.62%, indicating a steady rise in the dividend payouts over time.

Revenue growth over the last year was recorded at 8.00%, reflecting a solid increase in the company’s sales or services. However, the payout ratio is relatively high at 73%, which means that 73% of the company’s earnings are being paid out as dividends, potentially limiting the amount available for reinvestment in the business.

Value

In assessing the value of The Coca-Cola Company’s stock (KO) through the lens of its dividend yield, the stock presents a subtly enhanced yield of 3.07% against its 5-year average of 3.05%.

This incremental increase may signal a potential undervaluation when looked at through the dividend yield metric, as investors typically correlate higher yields with lower stock prices, all else being equal. The close proximity of the current yield to the historical average indicates a stable yield trend, which could attract investors looking for consistency in dividend returns. This stability, particularly in a dynamic market environment, might suggest that the stock is maintaining its appeal to those who prioritize income generation through dividends.

However, as yields can be influenced by varying market conditions and company-specific factors, the slight elevation above the historical average does not conclusively denote a significant undervaluation but rather points towards a potentially favorable condition for yield-seeking shareholders.

Income statement Analysis

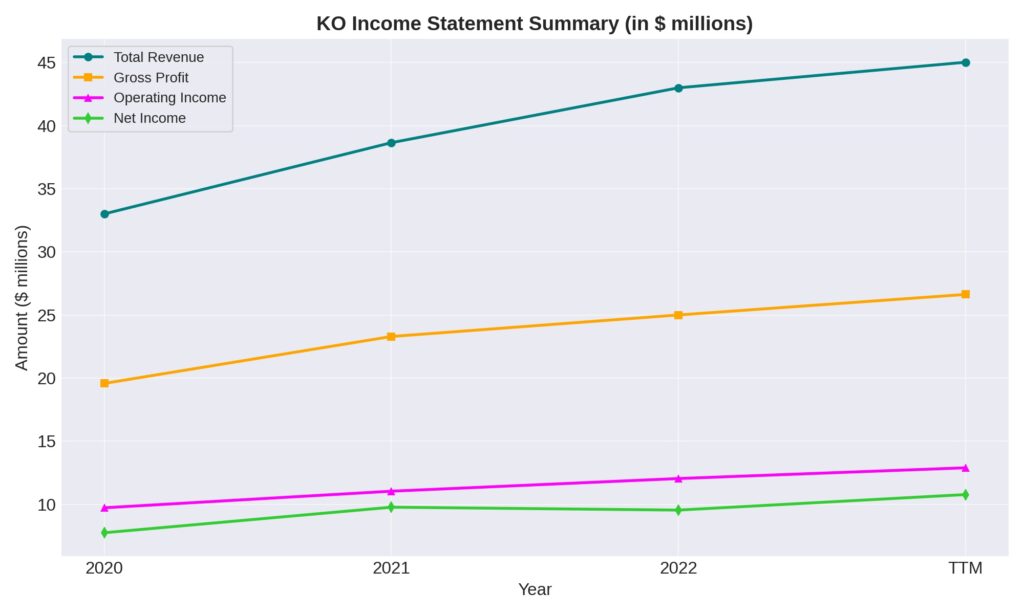

In the thrilling world of income statements, The Coca-Cola Company has put a fizzy spin on the numbers, showing a bubbly trend in total revenue which has risen from $33,014,000 in the trailing twelve months (TTM) to a refreshing $45,030,000 by the end of 2022. The cost of goods sold, possibly including the secret ingredient X, has also hiked up to $18,399,000 from $13,433,000 in the TTM period. Gross profit has sweetened from $19,581,000 to a delectable $26,631,000, suggesting that the company has been adept at keeping costs from going flat.

Diving deeper, operating income has effervesced from $9,725,000 in the TTM to a robust $12,894,000 by the end of 2022, despite the operating expenses climbing up the expense chart like a kid on a sugar rush—from $9,856,000 to $13,737,000 in the same period. Net income for common shareholders has been squeezed up from $7,747,000 to a juicy $10,772,000, with diluted earnings per share (EPS) showing a modest uptick from $1.79 to $2.47. Clearly, the company isn’t just trading in sweet sips; they’re also delivering a hearty toast to their stockholders.

Balance sheet Analysis

The Coca-Cola Company’s balance sheet provides a snapshot that’s as effervescent as its beverages. As of December 31, 2022, the company’s assets were bubbling at $92,763,000, a slight dip from the $94,354,000 reported the previous year, yet still significantly higher than the $87,296,000 from two fizzing years ago. On the liabilities front, the figures have taken a gentle slide from $69,494,000 in 2021 to $66,937,000, potentially a sign that the company is not drowning in its financial obligations. The equity section reflects a positive trend, with total equity gross minority interest inflating from $21,284,000 in 2020 to a more robust $25,826,000 in 2022.

Meanwhile, in the land of net tangible assets, the company seems to be playing a game of financial hide-and-seek, with numbers still in the negatives but improving from a hibernating -$11,614,000 in 2021 to a less chilly -$9,526,000 in 2022. The debt narrative is also intriguing, with total debt simmering down from the high of $42,793,000 in 2020 to a cooler $39,149,000 in the latest report, while the net debt has also sweetly descended from $35,998,000 to $29,630,000, hinting that the company is perhaps trying to be less leveraged than a soda can waiting to be popped open at a party. The treasury shares have remained relatively flat, suggesting that the company’s share repurchase plan is moving at the pace of a lazy river rather than a whitewater rafting expedition.

Cash Flow Statement Analysis

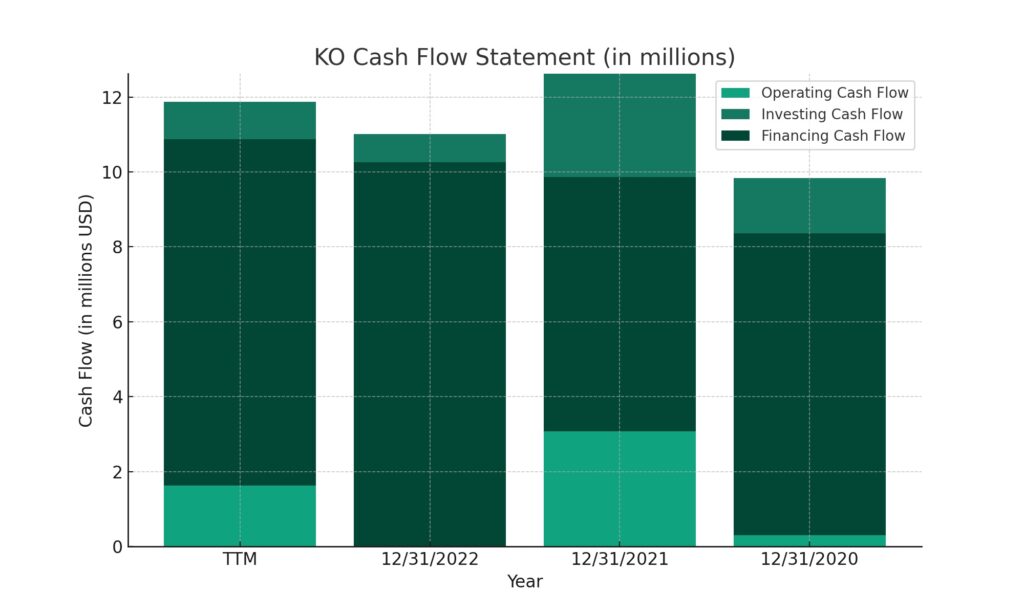

The Coca-Cola Company’s cash flow statement flows smoother than its signature drink, with operating cash flow showing a spritzy uptick to $11,879,000 in the trailing twelve months from $9,844,000 a couple of years back. This suggests that the company is as adept at generating cash as it is at quenching thirst worldwide. Investing cash flow has seen less volatility than a soda left out overnight, with a slight effervescence of activity at -$997,000 compared to the previous gulps of -$1,477,000 and -$2,765,000. This might hint at a more conservative approach to investing or simply a pause to catch its breath after a period of more robust activity.

When it comes to financing cash flow, there’s been a bit of a diet trend, with outflows slimming down to -$9,257,000, which could be the financial equivalent of switching from classic to zero sugar. Despite this, the end cash position has fattened up nicely to $12,059,000. Free cash flow, the lifeblood of the company, after deducting capital expenditures, sits comfortably at $10,170,000, which is enough liquidity to fill many corporate swimming pools. This free cash flow performance could be the envy of many lesser effervescent peers, ensuring the company isn’t just fizzing out when it comes to maintaining a healthy cash buffer.

SWOT Analysis

SWOT analysis is a framework used to evaluate the competitive position of a company by identifying its Strengths, Weaknesses, Opportunities, and Threats. Here’s a brief SWOT analysis for The Coca-Cola Company (KO):

Strengths:

- Brand Equity: Coca-Cola has one of the most recognizable brands globally, which has been carefully cultivated over decades.

- Distribution Network: The company has an extensive global distribution system that allows it to reach consumers almost everywhere.

- Diverse Product Portfolio: Aside from its flagship product, Coca-Cola’s portfolio includes a wide range of beverages, including water, juices, and energy drinks.

- Financial Stability: Consistent dividend increases over 60 years highlight its financial strength and shareholder commitment.

Weaknesses:

- Health Concerns: Increasing awareness of the health implications of sugary drinks puts pressure on Coca-Cola’s main product line.

- Reliance on Soft Drinks: Despite diversification, a significant portion of revenue is still tied to soft drinks, which are in decline in many markets.

- Litigations and Regulations: The company faces legal challenges and the threat of sugar taxes in various jurisdictions.

Opportunities:

- Expansion in Emerging Markets: There’s potential growth in emerging markets where demand for consumer goods is increasing.

- Innovation in Healthy Beverages: Coca-Cola can capitalize on the trend towards health and wellness by expanding its portfolio in this area.

- Sustainability Initiatives: Increasing its focus on sustainability can improve its brand image and cater to consumer preferences.

Threats:

- Competition: The beverage market is highly competitive, with several players vying for market share.

- Changing Consumer Preferences: There’s a trend towards healthier options and away from sugary drinks.

- Economic Downturns: Economic instability can affect consumer purchasing power, impacting sales of non-essential goods like soft drinks.

This analysis of Coca-Cola illustrates a company with a solid foundation and significant market presence, facing challenges in adapting to a changing consumer landscape while maintaining its financial strength.

Competitors

The Coca-Cola Company, as a global leader in the beverage industry, faces competition from various companies across different markets. Here’s a summary of its top 5 competitors:

- PepsiCo, Inc. (PEP): PepsiCo is Coca-Cola’s most direct and formidable competitor, with a wide range of beverage products including Pepsi, Mountain Dew, and Gatorade. Beyond beverages, PepsiCo’s diverse portfolio includes snack foods, which gives it a broader base and diversification in the consumer goods sector.

- Nestlé S.A.: Nestlé, the world’s largest food and beverage company, competes with Coca-Cola in the water, juice, and ready-to-drink segments with brands like Nestea, San Pellegrino, and Pure Life. Nestlé’s extensive portfolio in food, baby nutrition, and coffee also provides a strong foundation for cross-category competition.

- Dr Pepper Snapple Group (now part of Keurig Dr Pepper): This company offers a competitive range of soft drinks, juices, and tea, including Dr Pepper, 7UP, and Snapple. Keurig Dr Pepper’s unique position with its coffee and beverage systems adds another dimension to its rivalry with Coca-Cola.

- Red Bull GmbH: Specializing in energy drinks, Red Bull is a significant competitor in the high-growth energy segment. Its global brand presence and marketing prowess make it a key player in the beverage industry, directly competing with Coca-Cola’s energy drink offerings.

- Monster Beverage Corporation: As a leading marketer and distributor of energy drinks and alternative beverages, Monster is a direct competitor to Coca-Cola’s energy drink line. Coca-Cola is also a significant investor in Monster, which represents a strategic partnership as well as competition in the energy drink market.

These competitors represent significant challenges to Coca-Cola in various segments of the global beverage market, from soft drinks and energy drinks to water and juices. Each brings unique strengths and product offerings to the table, contributing to a dynamic competitive landscape.