Commerce Bancshares, Inc. (CBSH) is a regional bank holding company that operates primarily in the Midwest, including states such as Missouri, Kansas, Illinois, Oklahoma, and Colorado. Established in 1865, the company provides a broad range of banking services, including retail banking, commercial banking, investment, and wealth management services. Over the years, CBSH has built a reputation for financial stability, strong customer service, and community involvement.

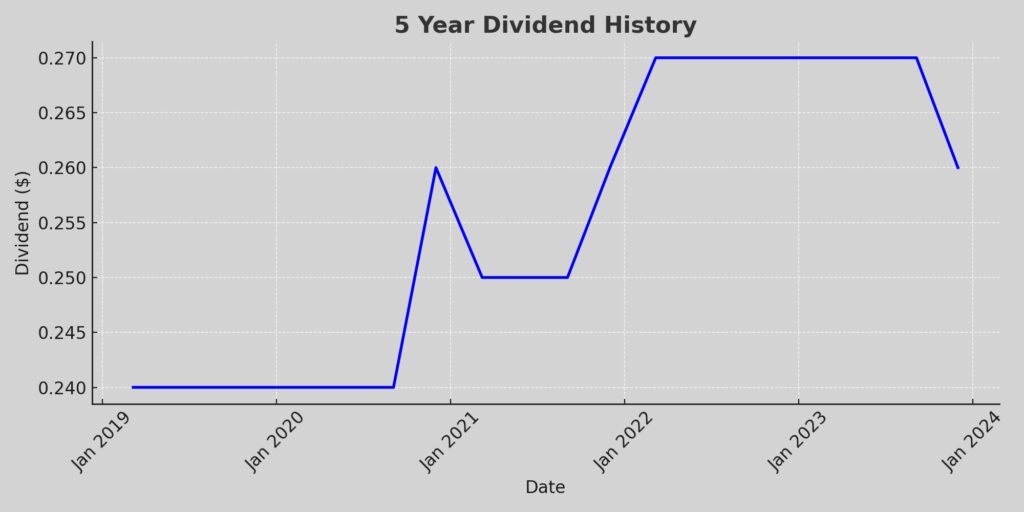

A standout feature of Commerce Bancshares is its impressive track record of increasing dividends, marking it as a distinguished member of the Dividend Kings. This elite group consists of companies that have raised their dividends for at least 50 consecutive years. CBSH has increased its dividend for 54 consecutive years, showcasing its commitment to returning value to shareholders and its financial health. This achievement reflects the company’s prudent management, operational efficiency, and ability to generate consistent profits, even in challenging economic environments.

The bank’s focus on conservative banking practices and its strategic growth initiatives have enabled it to maintain a steady performance and uphold its dividend growth streak, solidifying its status as a reliable investment for income-focused investors.

Analyst Ratings

Recent analyst ratings for the stock provide a consensus view of a “Hold” status, with several financial institutions maintaining their positions and adjusting target prices. Here’s a summary:

- Christopher McGratty at Keefe, Bruyette & Woods maintained a “Hold” rating on January 19, 2024, without specifying a target price.

- Brandon Berman at BofA Securities initiated coverage with a “Hold” rating and set a target price of $55, suggesting a potential upside of +8.41%, on January 11, 2024.

- Manan Gosalia at Morgan Stanley maintained a “Hold” rating, adjusting the target price from $47 to $46, indicating a -9.33% change, on December 4, 2023. This followed a previous adjustment from $49 to $47 (a -8.01% change) on December 1, 2023.

- Nathan Race at Piper Sandler maintained a “Hold” rating, with a target price adjustment from $50 to $49, representing a -4.27% change, on October 20, 2023.

- Steven Shaw at Wells Fargo also maintained a “Hold” rating, adjusting the target price from $50 to $48, which translates to a -6.14% change, on the same day as Nathan Race.

These ratings indicate a cautious outlook from analysts, with minor adjustments in target prices reflecting a nuanced view of the stock’s future performance. The general consensus leans towards maintaining current positions, with slight variations in target prices suggesting a range of expectations for the stock’s valuation.

Insider Trading

Analyzing the insider buying and selling transactions for the stock over the last 6 months, focusing solely on buy and sell activities and excluding awards and transfers, provides insight into the behavior of the company’s insiders. Here’s a summary of the relevant transactions:

Insider Selling:

- Sale Post-exercise Transactions:

- A number of senior executives sold shares following the exercise of options, which typically indicates they are converting their options into shares and selling a portion of those shares, possibly to cover the cost of the exercise or for personal financial planning. Notably, transactions occurred at prices ranging from approximately $51.81 to $54.79 per share.

- Significant sales post-exercise included Jonathan M. Kemper with the largest volume, selling over 10,000 shares at one point, indicating a significant transaction.

- Direct Sales:

- Apart from post-exercise sales, there were direct sales without the mention of option exercises. For instance, Benjamin F. Rassieur III and John K. Handy made notable sales at prices above $53 per share, suggesting potential profit-taking or diversification of personal investments.

Insider Buying:

- Contract Buy:

- There were contract buys recorded for Kevin G. Barth, David W. Kemper, Jonathan M. Kemper, and Thomas J. Noack in December, indicating direct purchases of shares. These buys, particularly by high-ranking executives like the Chair and EVPs, could signal confidence in the company’s future prospects.

- Direct Buys:

- Blackford F. Brauer made significant direct purchases, buying 5,000 shares on two separate occasions, once at $48.10 and another time at $49.13 per share. These transactions suggest a strong belief in the value of the stock at those price levels.

Observations:

- Selling Patterns: The majority of the selling transactions were post-exercise sales, common among executives as part of compensation and stock option plans. These sales often do not indicate a lack of confidence in the company but rather are part of standard financial planning and obligations.

- Buying Patterns: Direct buys, especially by board members or high-level executives, are typically seen as a positive signal, indicating that insiders may believe the stock is undervalued or has strong future prospects.

- Overall Insight: The presence of both insider buying and selling within the same period can reflect a variety of strategies and personal financial decisions by insiders. While the selling provides liquidity and diversification for insiders, the buying activities, especially those not associated with option exercises, could indicate optimism about the company’s future performance.

This analysis excludes awards and transfers, focusing solely on transactions that reflect potential confidence or profit-taking actions by insiders. Insider buying, particularly in substantial amounts or by high-ranking executives, is often viewed positively, whereas selling is more nuanced and requires consideration of the context (e.g., post-exercise sales).

Dividend Metrics

Commerce Bancshares, Inc. (CBSH) demonstrates a strong history of dividend growth, with dividends increasing for 54 consecutive years. The stock currently offers a dividend yield of 1.99%, which is slightly higher than its 5-year average yield of 1.64%. Over the past five years, the company’s dividend growth rate has been 8.65%, reflecting a commitment to increasing shareholder value. Revenue growth over the past year has been modest at 2.40%, which is relatively stable.

The payout ratio, which indicates what proportion of earnings a company pays out as dividends, stands at 28%. This suggests that the company retains a majority of its earnings for reinvestment and is not over-distributing to shareholders, which can be a sign of a sustainable dividend policy.

Despite these positive dividend metrics, the stock has experienced a significant downturn in its 1-year return, posting a -17.97% return. This suggests that while the company has been increasing its dividend and maintaining a stable payout ratio, external factors or broader market movements may have negatively impacted the stock’s price over the past year.

Dividend Value

Commerce Bancshares, Inc. (CBSH) presents a current dividend yield of 1.99%, which notably exceeds its 5-year average yield of 1.64%. This higher yield could suggest that the stock is offering greater value now compared to its historical average, potentially indicating an attractive entry point for dividend investors.

A yield above the 5-year average may imply that the stock’s price has declined, assuming dividend payouts have remained consistent, thereby elevating the yield. Investors might interpret this as an opportunity to capture a higher income stream relative to the stock’s own historical payout performance.

However, a discerning investor should also consider why the yield has risen—whether due to market undervaluation or underlying challenges faced by the company. Without assuming stability in dividends, the yield’s increase demands a thorough analysis of the company’s financial health to confirm whether the current yield accurately reflects a true increase in value or if it signals potential red flags in the company’s future prospects.

Income statement Analysis

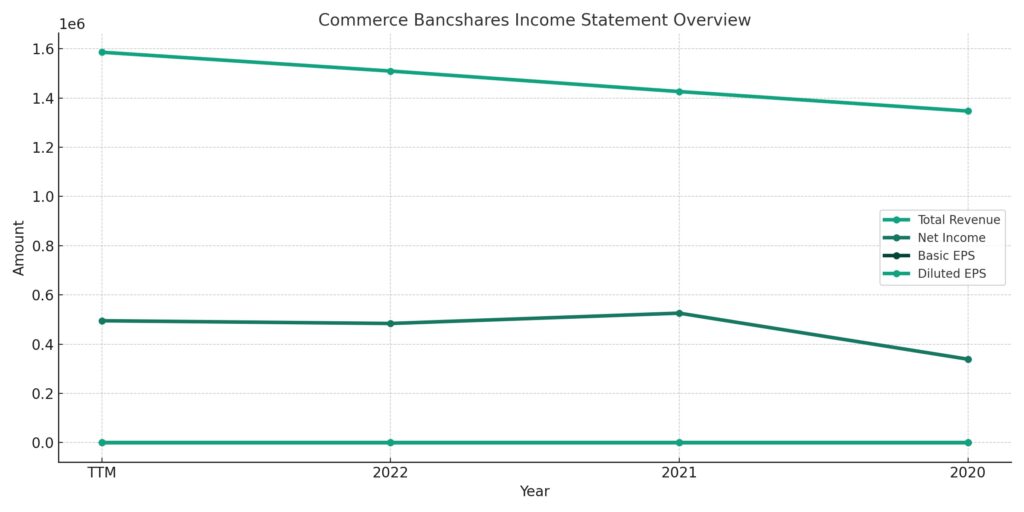

Commerce Bancshares, Inc. has demonstrated a consistent and modest growth in total revenue over the last four years, inching its way from $1,346,746 to $1,585,628, as if it’s quietly tiptoeing upwards each year. This gentle climb in revenue might not be the stuff of legends, but it certainly could be the envy of tortoises everywhere, proving slow and steady can win the financial race. The provision for credit losses has seen a bit of a dance, dipping into the negatives in the most recent year, which suggests that the bank has been recovering well from any previously set aside funds to cover bad loans. It’s a bit like finding extra change under the couch cushions, except in this case, it’s about $45,049 worth of change.

Operating expenses have been following the same upward trend as revenue, suggesting that the bank is either investing in growth or that costs simply have a case of ‘upward-itis’. Net income for common stockholders has had its ups and downs, peaking in 2020 at $525,919 and settling at $494,999 in the trailing twelve months (TTM). Basic and diluted EPS figures show a similar pattern, with the diluted EPS currently standing at $3.78, which is just a whisper away from the basic EPS. This whispers the sweet nothings of minimal dilution to investors’ ears. Interestingly, the average number of shares has decreased over time, which could mean the company is buying back stock, inadvertently giving remaining shareholders a slightly larger piece of the pie, albeit without any actual increase in the size of the pie itself.

Balance sheet Analysis

Commerce Bancshares, Inc.’s balance sheet is like a seesaw at the playground, but instead of children, we have assets and liabilities trying to balance each other out. As of December 31, 2022, the total assets seem to have taken a diet, slimming down from their 2021 figure of $36,689,088 to $31,875,931. On the other side of the seesaw, total liabilities also decided to shed some weight, dropping from $33,240,764 in 2021 to $29,394,354. This balancing act reflects a noticeable decrease in both assets and liabilities, suggesting a contraction in the company’s balance sheet size, which could be due to various strategic maneuvers, such as asset sales or debt repayments.

Equity has done a bit of a Houdini, making some of its value disappear from $3,448,324 to $2,481,577 within a year. In the equity circus, common stock equity also followed the act, stepping down from $3,437,298 to $2,465,291. The tangible book value, the magician’s favorite, almost pulled off a vanishing trick, reducing from $3,282,807 to $2,311,136. All the while, total debt decided it was too lightweight for this show, maintaining a low profile at $9,672, probably because it knows how quickly debt can become the unwanted star of the financial statements. Share issued and ordinary shares numbers have seen a slight decrease, suggesting the company might have been buying back some shares, giving a little more elbow room for the remaining shareholders in the equity playground.

Cash Flow Statement Analysis

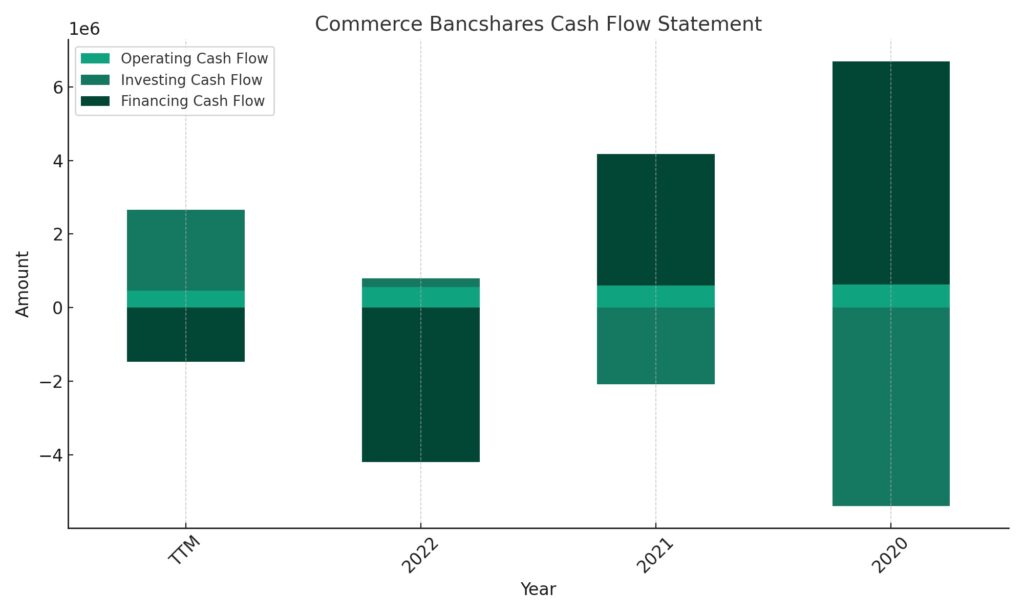

The cash flow statement for Commerce Bancshares, Inc. could be mistaken for an unexpected plot twist in a financial thriller, with numbers taking dramatic turns year over year. The operating cash flow, our protagonist, has been on a gentle decline from a heroic $623,992 to a more humble $457,345, perhaps hinting that the operations team has been taking a more relaxed approach lately, or maybe the customers are just taking longer strolls before reaching for their wallets.

Investing cash flow, the wildcard of our story, has turned from villain to hero, going from a monstrous outflow of -$5,390,504 to a staggering inflow of $2,207,802. It’s like the company suddenly found a treasure map in the attic, leading to a windfall of investment returns or divestitures. Meanwhile, the financing cash flow has decided to leave the party early, swinging from a robust inflow to a farewell wave of -$1,465,707. In the background, the end cash position stands tall at $2,208,516, likely puffing its chest with pride after a rocky journey. All this action leaves the free cash flow with a solid performance, though slightly less than its peak, still delivering a respectable $366,227, ready to fund dividends or a spontaneous corporate shopping spree.

SWOT Analysis

A SWOT analysis evaluates the Strengths, Weaknesses, Opportunities, and Threats facing Commerce Bancshares, Inc. (CBSH). This analysis provides a strategic overview based on the available financial data and market position:

Strengths:

- Consistent Dividend Growth: CBSH has increased its dividend for 54 consecutive years, showcasing its financial stability and commitment to returning value to shareholders.

- Strong Financial Performance: The company has demonstrated consistent revenue growth and maintained a healthy net income, reflecting its operational efficiency.

- Low Payout Ratio: The relatively low payout ratio indicates that CBSH retains a significant portion of its earnings for reinvestment, which is a positive sign for future growth.

Weaknesses:

- Revenue Growth Potential: While the company has shown consistent revenue growth, the rate of growth is modest, indicating potential challenges in significantly expanding its market share or revenue streams.

- Dependence on Regional Markets: CBSH’s operations are primarily focused in the Midwest. This geographical concentration could limit its growth potential and expose it to regional economic downturns.

Opportunities:

- Expansion into New Markets: By extending its reach beyond the Midwest, CBSH has the opportunity to tap into new customer bases and diversify its revenue streams.

- Digital Banking Services: Investing in and expanding digital banking services could attract younger customers and respond to the growing demand for online and mobile banking solutions.

- Strategic Acquisitions: Acquiring smaller banks or fintech companies could provide new capabilities, technologies, and market presence.

Threats:

- Economic Fluctuations: Being a financial institution, CBSH is susceptible to economic downturns that can affect loan repayment rates and overall financial performance.

- Regulatory Changes: The banking industry is highly regulated, and any changes in banking laws or regulations could impact operations and profitability.

- Competition: The banking sector is highly competitive, with numerous players offering similar services, including large national banks and emerging fintech companies.

This SWOT analysis highlights that while Commerce Bancshares, Inc. has a solid foundation and promising opportunities for expansion and digital innovation, it must also navigate potential challenges related to market competition, economic conditions, and regulatory changes.

Competitors

Commerce Bancshares, Inc. (CBSH) operates in a competitive banking sector, particularly within the Midwest region of the United States. Its competitors range from other regional banks to national financial institutions that offer similar banking and financial services. Here is a summary of five notable competitors, considering factors like market presence, range of services, and geographical coverage:

- U.S. Bancorp (USB): As one of the largest banks in the United States, U.S. Bancorp presents significant competition due to its extensive network of branches, wide range of financial products, and substantial resources for technology and marketing. Its broad service offering includes retail banking, commercial banking, wealth management, and payment services.

- PNC Financial Services Group, Inc. (PNC): PNC is another major player, offering a mix of services that compete directly with CBSH, including retail and business banking, asset management, and mortgage banking. PNC’s strong foothold in the Midwest and its strategic acquisitions to expand its national presence make it a formidable competitor.

- Regions Financial Corporation (RF): With a strong presence in the Midwest and Southeastern United States, Regions Financial offers comprehensive banking and financial services similar to those of CBSH. Its focus on retail banking, commercial banking, wealth management, and mortgage services positions it as a key competitor.

- Fifth Third Bancorp (FITB): Fifth Third operates across multiple states and offers a range of financial services, including retail banking, commercial banking, and wealth & asset management. Its innovative approach to banking solutions and customer service, combined with a significant Midwestern presence, makes it a direct competitor to CBSH.

- BMO Financial Group (BMO): Though headquartered in Canada, BMO has a substantial presence in the Midwest through its subsidiary BMO Harris Bank. It offers a broad portfolio of financial services, including personal and commercial banking, wealth management, and investment banking services, competing in many of the same markets as CBSH.