The utility sector is beloved by many dividend investors. Many of these stocks are some of the most dependable of all the dividend payers by giving investors a dividend they can count on. Although these utility stocks are often treated like bonds what separates the best from the best is dividend growth. Today I’m going to look at 6 utility stocks with at least 10 years of consecutive dividend increases.

Charts and data sourced from the Dividend History tool.

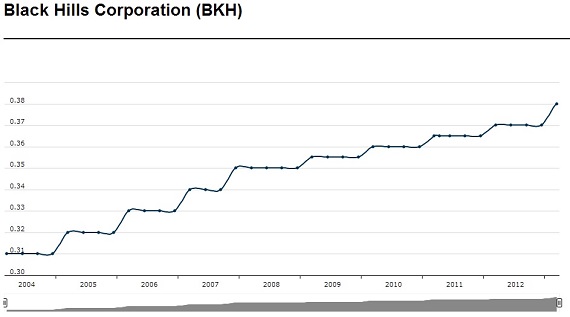

Black Hills Corporation – BKH:

Black Hills is an electric and natural gas energy company that has most of its operations in the US. BKH has over 41 years of consecutive dividend hikes. It has a 3.3% dividend yield and a 5 year dividend growth rate of just 1.5% and a payout ratio of 80%. I don’t expect the dividend growth rate to improve on BKH anytime soon.

10 Year Dividend History for BKH:

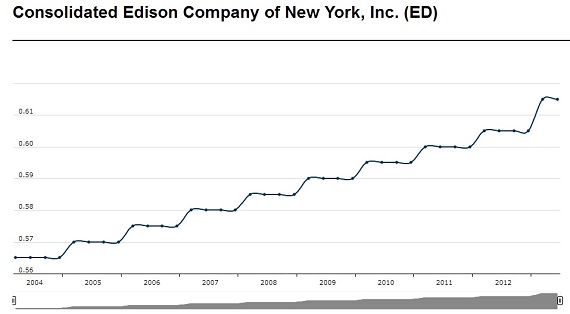

Consolidated Edison – ED:

Consolidated Edison provides its customers in New York, New Jersey and Pennsylvania with natural gas and electricity. The stock has a yield of 3.9% and has increased its dividend for 38 years in a row. It has a poor dividend growth rate of .85% and a payout ratio of 63%. There is a little room to improve on the dividend growth rate here but not much.

10 Year Dividend History for ED:

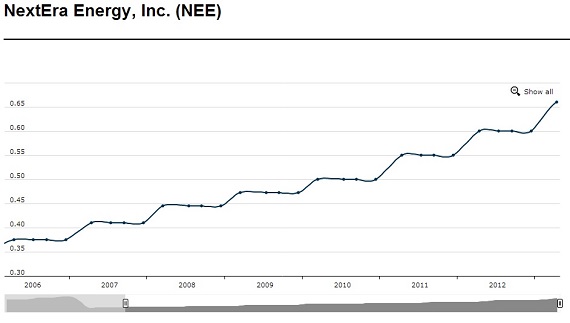

NextEra Energy – NEE:

NextEra has customers in the US and Canada. It provide electricity and renewable energy to its customers. The company has increased its dividend for 17 consecutive years and currently has a yield of 3.3%. NEE has a very solid dividend growth rate of 8% and a payout ratio of 54% which is slightly above its average.

10 Year Dividend History for NEE:

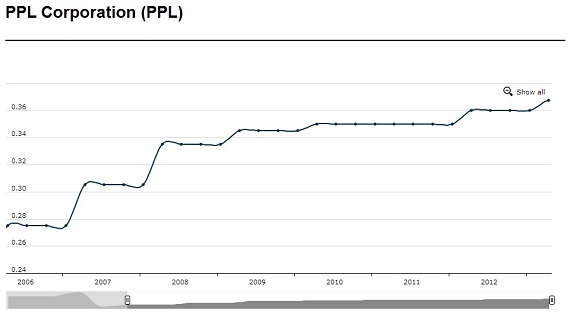

PPL Corp – PPL:

The highest yielding utility stock to make the list is PPL with a yield of 4.5%. PPL runs power plants in the US and serves customers on the East Coast. The company has increased its dividend for 13 consecutive years but has a low 3 year dividend growth rate of 1.5%. It currently has a payout ratio of 56% which is about 20% below its average.

10 Year Dividend History for PPL:

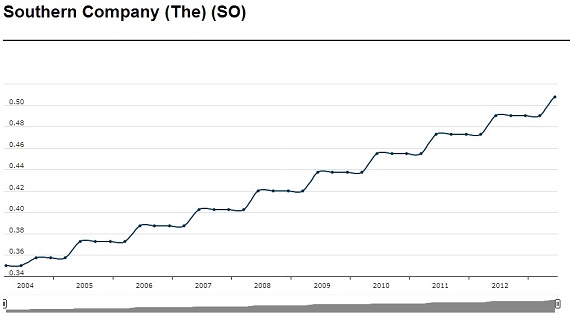

Southern Company – SO:

Southern Company acts as the holding company for other electric power companies. Southern Company has a dividend yield of 4.2% and has increased its dividend for 11 consecutive years. They currently have a payout ratio of 73% and a 5 year dividend growth rate of 4% which is better than average for this group of dividend growers.

10 Year Dividend History for SO:

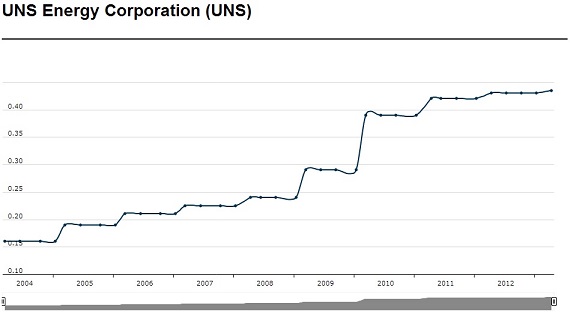

UniSource Energy – UNS:

UniSource Energy operates in many different communities throughout the US. They provide natural gas and electricity to their customers. The company has increased its dividend for 12 consecutive years and has a dividend yield of 3.5%. It has a 5 year dividend growth rate of 13.94%, making it the clear dividend growth winner of the group. UNS has a payout ratio of 78%.

10 Year Dividend History for UNS:

What’s your favorite dividend growth stock in the utility sector?

I’ve looked at Consolidated Edison before, I really like utilities for dividend payment but the MLP structure wreaks havoc on me during tax time. I need to sit down and understand the proper way to file so I can start taking advantage of some of these MLPs.