Cash is king in investing, especially when you are focused on that regular stream of dividend payments. Not all cash is created equal and you need to dig a little deeper into the financial statements for the true cash generators. Make sure your dividend portfolio is loaded with cash cows that will continue to produce a healthy dividend return.

Earnings is not always Cash Flow

Too many investors focus on a company’s income statement and earnings as a sign of financial health. The amount of tricks, both legal and otherwise, that management can use to make the company’s income statement and earnings look better could fill volumes.

For the true financial health and dividend power of a company, you need to watch the Statement of Cash Flows. While this statement can be manipulated, it is generally harder for management to play with the actual flow of cash in and out of the company.

The cash flows of a company are important for another very obvious reason, because the company needs cash to pay dividends! Ultimately, you want to be looking for the free cash flows of a company. This is the cash left after dividends and capital expenditures that the company has available. Higher free cash flows means a higher stock price, higher dividends or both.

But a cursory look at the statement of cash flows isn’t going to do it. You need to look at the trend in cash generation as well as how much the company is reinvesting.

My Cash Cows Screen

I like to put my dividend stocks through a screen to see who are the real cash cows. The requirements for the screen make sure that stocks have a healthy (and growing) source of cash and that they are continuously reinvesting to grow the business.

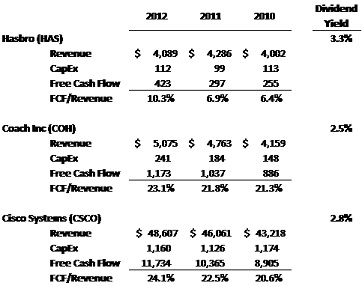

First, free cash flow must trend upwards over the last couple of years. If a company has less cash available after dividends and capital expenditures, then they may eventually have to cut the dividend or start selling assets. I also like to look at the ratio of free cash flow to sales. If this ratio is increasing, that means the company is operating more efficiently and cash flow should increase at a faster rate in the future.

One of the most important things I look for is the company’s spending on capital expenditures. This is the amount the company reinvests to grow the business. CapEx is removed from cash flow to produce Free Cash Flow, so it is important to look at the trend in both of these lines. If free cash flow is increasing, but only because the company is reinvesting less money, then the cash flows may be unsustainable. Conversely, if free cash flow is increasing even while the company is reinvesting more to grow the business, then free cash flow should continue to grow.

3 Cash Cows that beat the test

Besides direct sales of its popular brands, Hasbro (HAS) sees a good deal of its revenue from business relationships with video game and entertainment companies. The movies, games and toys all feed off each other to produce a mountain of cash. The company saw revenue fall slightly in 2012 but sales are expected to stabilize this year and rise in 2014. Spending to grow the business has been fairly strong the 3.3% dividend is supported by significantly higher free cash.

The apparel retailers have had a tough quarter with a colder-than-normal spring season and a sluggish consumer, but Coach Inc (COH) is a best of breed with an extremely strong brand. The company is able to continually increase sales with expectations for a 4.5% increase this year.

Remember when tech companies were strictly the investment of growth strategies and valuations were based on lofty expectations for earnings well into the future? Times have changed and the large, established companies like Cisco Systems (CSCO) now spin off a steady stream of cash while still solidly growing the business every year. Even in the slow tech spending environment, Cisco Systems has managed to increase sales consistently and is expected to see top-line growth of 4.7% this year. The dividend yield is one of the highest in tech and supported by the company’s rising free cash flow.

The operating cash flow growth of Cisco in recent years gives me great confidence in a growing dividend income stream from them over time.