This is part two of a series on setting up an investment account. In part one we talked about how to open a trading account which is of course is needed to buy stocks. Today you can follow along as I buy shares in Microsoft and show you how I did it step by step.

Series Summary

Part 1: How to open an investment account

Part 2: How and where to buy dividend stocks

Part 3: Pick the best dividend-paying stocks

Buying dividend-paying stocks is not any different than buying a stock that does not pay a dividend. The act of buying the stock is the same. Today I’ll walk you through the process of buying a stock that pays dividends and explain the different choices you have when making the purchase.

Before we begin, this post assumes you have an account with TD Ameritrade, my proffered broker. You can learn more about how to create an account with TD Ameritrade in part one of this series.

Let’s get started.

Step 1: Get the current price

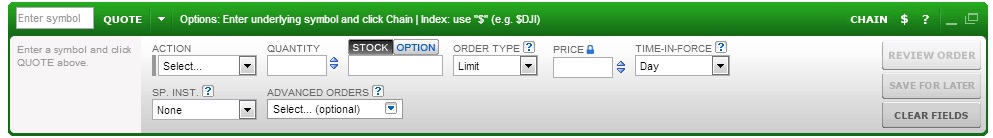

After you have logged in and identified the stock you want to purchase its important to find out what price the stock is currently trading at. Today I’ve decided to buy 30 shares of Microsoft. Look down at the bottom of the screen until you find the snapticket which looks like this:

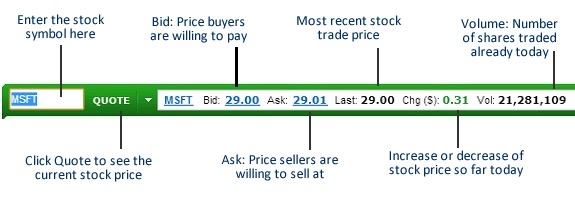

Enter the stock symbol and note the current bid and ask prices. For this example we will use Microsoft (Symbol: MSFT)

You get three important data points here. The bid (what buyers are offering to pay), the ask (what sellers are willing to sell for) and the last trade (the last stock transaction price). These values are normally different because buyers and sellers are out in the market making their offers. With a stock like Microsoft the market is moving so fast that every time you refresh your screen another set of shares will be sold which you will know because the volume will increase. As you can see I labeled everything in the screen shot above.

Now we can see not only what the sellers are asking for but also what the last trade was priced at. We now know what we need to offer at least $29.01 to buy that stock right away because that will match the lowest sellers asking price. You don’t have to put in a bid at that price though. If you put in a higher price Ameritrade will try to get it for you as cheaply as possible.

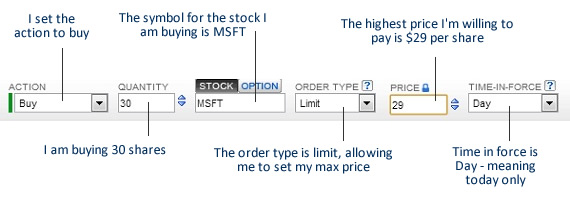

Step 2: Putting in the order

Now let’s get our order in. I am going to buy 30 shares and put my offer price in at $29 a share.

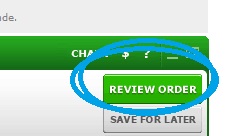

Once I’m ready to place my order I click review order:

Step 3: Confirm the order

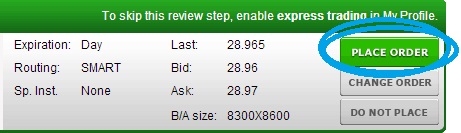

I’m just about ready to place the trade but before I do I want to make sure I didn’t make any mistakes. Here I can see that I’m all set to buy 30 shares of Microsoft at $29 per share or less. I also get to see what the total cost to me for the shares will be.

When I’m ready I click place order. As you can see the price of MSFT has dropped a few cents since I started this process.

Step 4: The order is in

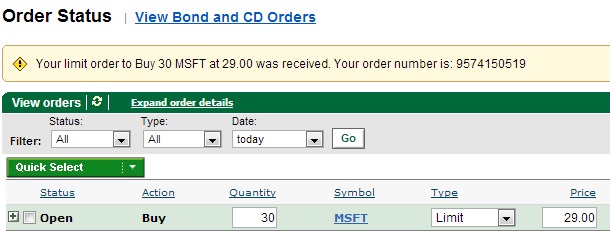

Now my order is in and I go to the order confirmation page where I can see my pending trade. The order is usually filled in seconds, especially with a stock like Microsoft.

From this page you can also cancel or change your order if it has not gone through. For example if Microsoft suddenly shot up over $29 a share and my order did not get processed I could increase my offer from this page.

Step 5: View the portfolio

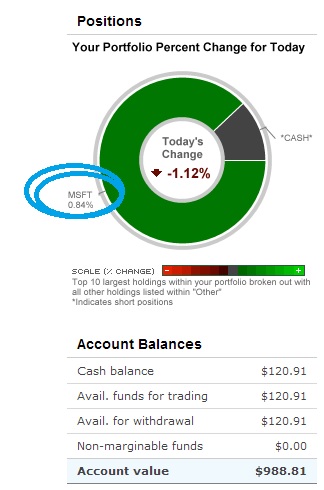

Next I click the home button to back to the homepage and view my portfolio. As you can see I was able to purchase the 30 shares of Microsoft at or below $29 a share.

And that’s it, I’m done. I now own 30 shares of Microsoft. Each quarter when the company pays a dividend I will receive the dividend directly in my account as a cash deposit from Microsoft.

But what price did I pay exactly?

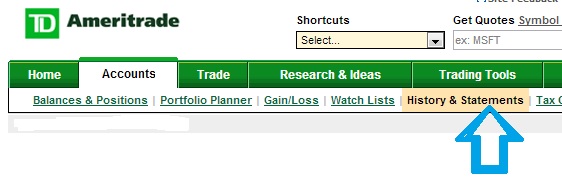

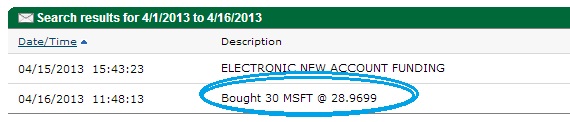

It’s easy to see what you paid for the stock with TD Ameritrade by going to the history section of your account.

From this screen you can view all of your account history. All data for the last two weeks is displayed automatically and as you can see I paid $28.9699 per share which is below my max price of $29 per share.

Tracking Performace

As time goes by you will want to see how you’ve done with the stocks you decide to purchase. This is easy done by going to the home page and clicking Positions:

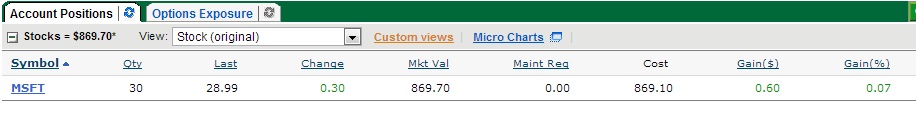

You will get a lot of information from this page. All of the stocks you own will be listed here. You can find your cost basis, market value, dollar gain and percentage gain for each stock you own. It’s a little hard to see because this section is wider than my blog post allows but as you can see I have already made a small (very small) gain which is relected in the details here:

That’s all there is to it. Selling a dividend stock is just as easy as buying one. To sell a stock you simply choose sell instead of buy in the drop down menu. If you have any questions please let me know.

Full Disclosure: Links in this post to TD Ameritrade are my affiliate links and if you use the link I provide to setup an account with Ameritrade I will receive a small one time sign up commission. I do use their service exclusively for all of my stock trading needs so everything I have said in this series of posts is true. Thanks!