Genuine Parts Company (GPC) stands as a venerable institution in the distribution of automotive replacement parts, industrial parts, and materials. With its inception in 1928, GPC has woven itself into the fabric of the automotive and industrial parts industry, showcasing resilience, adaptability, and consistent growth over the decades. The company operates globally, serving customers through a vast network of distribution centers and stores, including its well-known NAPA Auto Parts stores in North America.

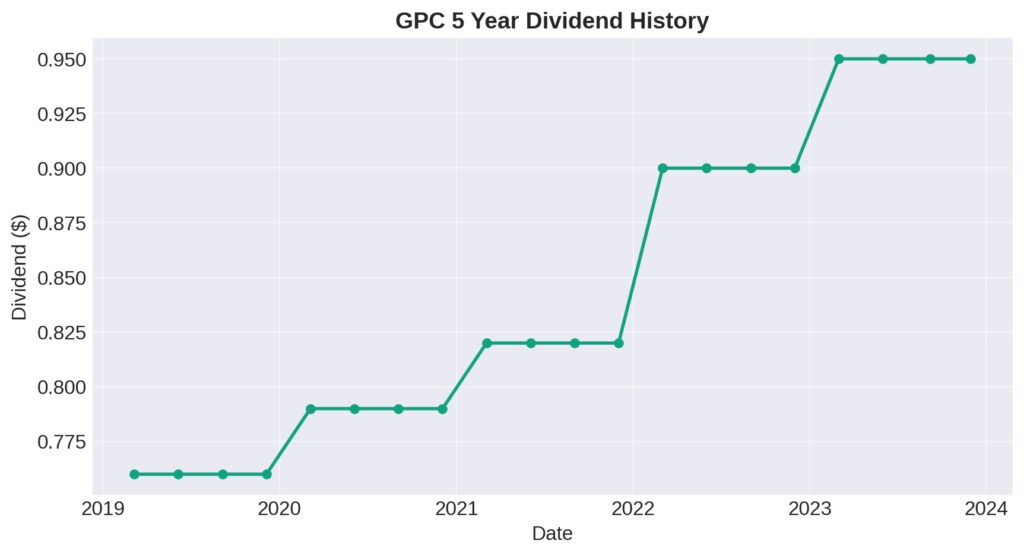

A noteworthy hallmark of GPC’s financial stewardship and commitment to shareholder value is its distinguished track record of increasing dividends. The company has achieved the remarkable feat of raising its dividend for 66 consecutive years, cementing its status among the elite group known as the Dividend Kings. This group comprises companies with a history of increasing dividends for at least 50 consecutive years, underscoring their financial stability, reliability, and dedication to returning value to shareholders. GPC’s inclusion in this prestigious category reflects its solid financial performance, strategic business operations, and unwavering commitment to its shareholders, making it a standout example of corporate endurance and fiscal responsibility.

Analyst Ratings

- Scot Ciccarelli from Truist Securities maintained a “Strong Buy” rating on Oct 20, 2023, lowering the price target from $172 to $155, suggesting a potential upside of +10.56%.

- Kate McShane of Goldman Sachs kept a “Hold” rating on Oct 20, 2023, adjusting the price target from $178 to $152, indicating a potential upside of +8.42%.

- Seth Basham from Wedbush maintained a “Hold” rating on Oct 20, 2023, with a price target adjustment from $160 to $140, showing a slight potential downside of -0.14%.

- Christopher Horvers of JP Morgan retained a “Buy” rating on Oct 16, 2023, increasing the price target from $184 to $189, forecasting a significant potential upside of +34.81%.

- Michael Lasser from UBS initiated coverage with a “Hold” rating on Oct 12, 2023, setting a price target of $160, implying a potential upside of +14.12%.

- Earlier, Scot Ciccarelli of Truist Securities also reiterated a “Strong Buy” rating on Oct 5, 2023, reducing the price target from $191 to $172, with a potential upside of +22.68%.

Insider Trading

Analyzing the insider buying and selling activities for the stock over the last 6-12 months and focusing solely on buy and sell transactions (excluding awards and transfers), we observe the following notable transactions:

- Robert C Loudermilk Jr engaged in a significant buy transaction on June 2, 2023, purchasing 2,000 shares at $151.75 each, totaling $303,501. This increased his holdings to 33,162 shares, representing 0.0236% of the company after the transaction.

- Randall P Breaux (Div. Pres.) also made a buy transaction on June 1, 2023, acquiring 500 shares at $149.44 each, with a transaction total of $74,720. This purchase brought his total holdings to 20,523 shares, or 0.0146%.

- Several executives executed sale post-exercise transactions on May 3, 2023, indicating they sold shares following the exercise of options. Notable among these were:

- James R Neill (CHRO) sold 575 shares at $171.4265, totaling $98,570, with his holdings adjusting to 24,603 shares, or 0.0175%.

- Paul D Donahue (Chair & CEO), on the same day, sold 4,630 shares at $171.4654 each, totaling $793,885, reducing his holdings to 94,973 shares or 0.0676%.

- On March 24, 2023, Paul D Donahue (Chair & CEO) further demonstrated confidence in the company by buying 1,600 shares at $156.08 each, amounting to $249,728. This transaction increased his holdings to 143,163 shares, showing a significant stake of 0.1017%.

These transactions reveal a mix of insider confidence through direct purchases and the realization of gains through the sale of shares post-exercise of options. The activities, especially the buying transactions by high-ranking officials like Robert C Loudermilk Jr and Paul D Donahue, could signal insider confidence in the company’s future prospects.

Dividend Metrics

Genuine Parts Company, traded under the symbol GPC, demonstrates a commendable history in shareholder returns, having increased its dividend for 66 years in a row. The company boasts a current dividend yield of 2.65%, with a five-year dividend growth rate of 5.12%, signaling a steady increase in the amount returned to shareholders over time.

In the past year, Genuine Parts Company experienced a revenue growth of 2.60%, reflecting a modest increase in its top-line earnings. The payout ratio stands at 42%, which suggests that the company retains more than half of its earnings for reinvestment or other financial strategies. Interestingly, the average dividend yield over the past five years has been slightly higher at 2.77%, indicating a potential variance in stock price or dividend adjustments. In terms of stock performance, GPC has seen a decline of 15.02% over the last year, which could be indicative of market sentiment or external factors affecting the stock price during this period. Despite this downturn, the company’s long history of dividend growth remains an attractive feature for investors focused on long-term income.

Dividend Value

Genuine Parts Company (GPC) presents a current dividend yield of 2.65%, which, when juxtaposed with its 5-year average yield of 2.77%, suggests a nuanced narrative in its valuation. Typically, a current yield that lags behind the historical average could imply that the stock price has appreciated faster than the growth in dividends, or it might reflect a recent adjustment in dividend policy that has yet to be mirrored in the average. This variance could potentially signal to value-oriented investors that GPC’s stock might be trading at a higher valuation relative to its own historical yield performance.

For those seeking income, the yield still offers a respectable return, especially in a sector known for its defensive nature. Nonetheless, the slight dip below the average yield might attract investors who are also interested in the capital appreciation aspect of the stock, banking on a continued robust performance that could potentially push the yield back towards or above its historical norm.

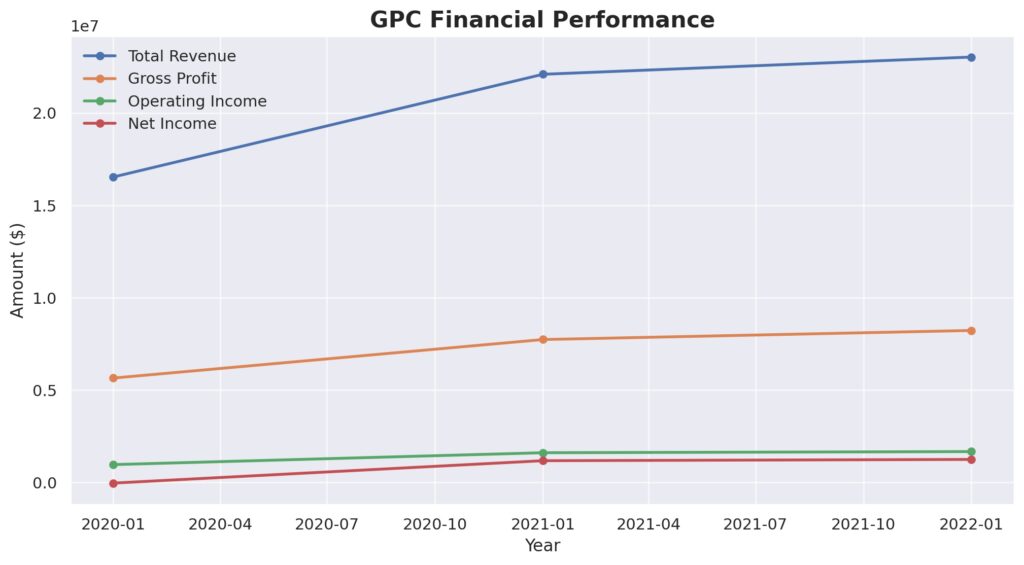

Income statement Analysis

The income statement of our character in question, the Genuine Parts Company, humorously known in the financial narratives as the ‘revenue reveler’, has been showing off a growing total revenue, waltzing up from $16,537,433 TTM in 2020 to a more opulent $23,028,376 TTM by the close of 2022. While the cost of revenue also decided to join the party, increasing from $10,882,592 TTM to $14,797,300 TTM, the gross profit didn’t shy away from the spotlight, striking a pose at $8,231,076 TTM, up from $5,654,841 TTM, marking a steady ascent in profitability.

The plot thickens in the operational realm, where operating expenses, perhaps envious of the gross profit’s performance, surged from $4,683,158 TTM to $6,555,154 TTM. Nevertheless, operating income, like a seasoned actor waiting in the wings, took a bow with $1,675,922 TTM, up from a modest $971,683 TTM. The grand finale, net income available to common stockholders, not to be upstaged, delivered a standing ovation-worthy performance, catapulting from a rather dramatic $-29,102 TTM to a triumphant $1,251,625 TTM. In this financial theatre, basic and diluted EPS echoed the net income’s sentiment, staging a comeback from a tragic $-0.20 to an applaudable $8.86 and $8.90, respectively, ensuring the audience, a.k.a. the shareholders, left with a smile.

Balance sheet Analysis

On the balance sheet stage, Genuine Parts Company’s total assets, ever the protagonist, have been on an upward trajectory, growing from $13,440,215 TTM in 2020 to a grand $16,495,379 TTM by the end of 2022, showing a penchant for accumulation that would make a dragon envious. In a parallel plotline, total liabilities also seem to have ambitions of grandeur, swelling from $10,222,212 TTM to $12,690,932 TTM, suggesting that with great assets come great liabilities. Total equity, not one to be left in the dust, has steadily marched up from $3,218,003 TTM to $3,804,447 TTM, modestly flexing its financial muscles in the equity gym.

Diving into the more tangible aspects, Genuine Parts Company’s net tangible assets took a slight detour into the negatives at -$610,260 TTM in 2022, perhaps after a risky adventure into intangible asset investments that might raise a Vulcan eyebrow. Meanwhile, working capital appears to be maintaining its composure at $1,130,629 TTM, albeit with a slight dip, suggesting a well-managed liquidity scenario akin to a juggler who hasn’t dropped a ball yet. The debt narrative unfolds with total debt reaching $4,164,842 TTM, and net debt at $2,675,360 TTM, hinting that while the company is no stranger to leveraging, it keeps its debt in check like a disciplined borrower with an eye on the credit score.

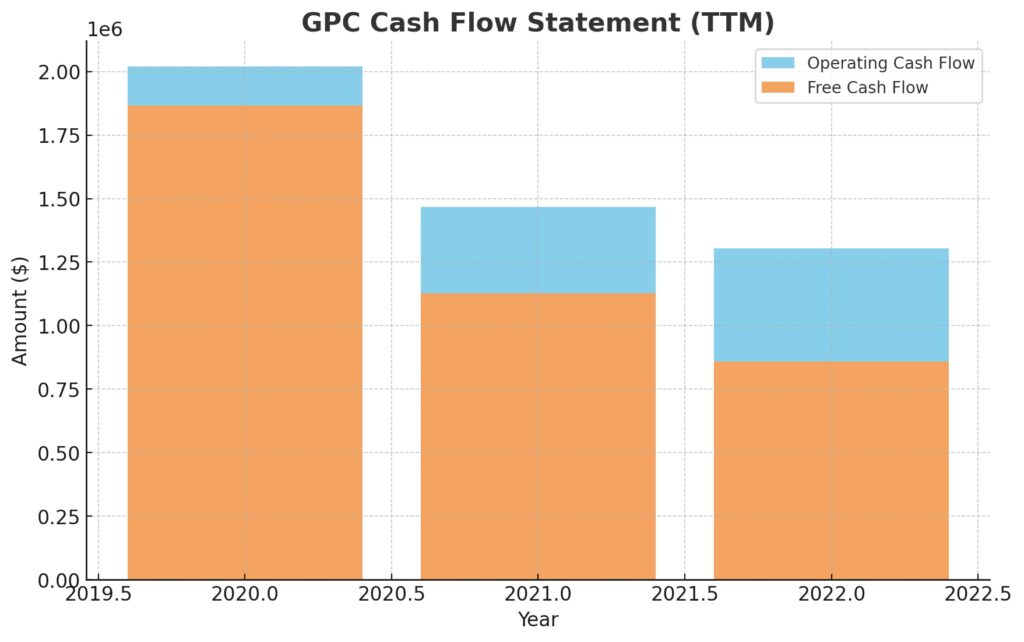

Cash Flow Statement Analysis

In the fiscal theatre, Genuine Parts Company’s operating cash flow has been performing a dynamic routine, pirouetting from a high of $2,019,561 TTM in 2020 to a graceful $1,304,826 TTM by 2022, showing that while the inflow from operations may ebb and flow, the show must go on. The investing cash flow, however, seems to have taken a dramatic leap into the realm of the substantial outflow, marking a notable $-500,707 TTM in 2022, as if it decided to fund a blockbuster investment saga, contrasting sharply with a surprising cameo of $171,637 TTM inflow back in 2020.

The financing cash flow appears to have embraced a bit of stage fright, retreating from an encouraging $205,101 TTM in 2021 to a timid $-779,952 TTM in 2022, perhaps after taking cues from a thrifty financier. The end cash position, sitting comfortably at $653,365 TTM, has seen more modest fluctuations, suggesting that while the other figures dance the tango of finance, the end cash prefers a steady waltz. Free cash flow, not to be upstaged, has held onto its positive rhythm, albeit with a dip to $859,334 TTM, much like a prudent saver who still enjoys the occasional splurge.

SWOT Analysis

A SWOT analysis for Genuine Parts Company (GPC) provides a comprehensive overview of its strengths, weaknesses, opportunities, and threats, which can help in understanding its strategic position in the automotive and industrial parts distribution industry.

Strengths:

- Established Market Presence: GPC, with its extensive network of NAPA Auto Parts stores, has a strong market presence and brand recognition in the automotive parts industry, contributing to its solid customer base.

- Diverse Product Offering: The company offers a wide range of automotive and industrial parts, catering to various customer needs and reducing dependency on any single product category.

- Consistent Dividend Growth: GPC’s impressive track record of 66 consecutive years of dividend increases demonstrates its financial stability and commitment to shareholder value.

Weaknesses:

- Dependence on Economic Cycles: The automotive and industrial sectors are sensitive to economic fluctuations, which can impact demand for GPC’s products.

- Competition: Intense competition from both brick-and-mortar and online retailers can pressure margins and market share.

Opportunities:

- Expansion into Emerging Markets: There’s potential for GPC to expand its international footprint, especially in emerging markets where automotive and industrial growth is more robust.

- E-Commerce and Digital Transformation: Investing in e-commerce platforms and digital operations could open new revenue streams and improve operational efficiencies.

Threats:

- Supply Chain Disruptions: Global supply chain vulnerabilities, as seen during the COVID-19 pandemic, can affect inventory availability and lead to increased costs.

- Regulatory Changes: Environmental regulations and policies affecting the automotive industry, such as the push towards electric vehicles, could necessitate adjustments in product offerings and strategies.

This SWOT analysis underscores GPC’s solid foundation and potential for strategic growth, while also highlighting areas of vulnerability that require proactive management to navigate industry challenges and capitalize on emerging opportunities.

Competitors

Genuine Parts Company (GPC), a key player in the automotive and industrial parts distribution sector, faces competition from several well-established companies. Here’s a summary of GPC’s top five competitors:

- AutoZone, Inc. (AZO): Specializing in aftermarket automotive parts and accessories, AutoZone is one of GPC’s most formidable competitors, with a strong retail and commercial presence across the United States, Mexico, and Brazil. AutoZone’s extensive inventory and focus on customer service make it a go-to for DIY enthusiasts and professional mechanics alike.

- Advance Auto Parts (AAP): Another leading automotive parts provider, Advance Auto Parts operates stores in the U.S., Canada, Puerto Rico, and the U.S. Virgin Islands. It serves both the do-it-yourself and professional installer markets, competing directly with GPC’s NAPA Auto Parts in terms of product range, service, and geographic footprint.

- O’Reilly Automotive, Inc. (ORLY): O’Reilly Automotive offers a broad mix of aftermarket auto parts, tools, supplies, equipment, and accessories, catering to both the professional service providers and do-it-yourself customers. Its widespread store network and strong supply chain capabilities position it as a key competitor to GPC.

- LKQ Corporation (LKQ): LKQ stands out as a leading provider of alternative and specialty parts to repair and accessorize automobiles and other vehicles. LKQ has a robust presence in North America and Europe, offering recycled and remanufactured automotive products, competing with GPC in the alternative parts market.

- Fastenal Company (FAST): While primarily known for its distribution of industrial and construction supplies, Fastenal also competes with GPC in the industrial parts sector. Fastenal’s wide product offering, including fasteners, tools, and supplies, alongside its vending machine solutions, places it as a competitor in GPC’s industrial parts division.