The passing of the Affordable Care Act added a 3.8% net investment tax to a growing list of reasons to pay closer attention to the taxes you pay on dividends. Beyond the 20% marginal tax rate you could pay on your federal tax return, state tax rates can eat into the income you collect from dividends.

The net investment income tax is applied to interest, dividends, capital gains and basically any investment income for many individuals, estates and trusts. If your modified adjusted gross income is over $250,000 (married) or over $200,000 (single) then you will be subject to the tax.

I enjoy my public services just as much as the next and don’t mind paying taxes to live in this great nation of ours. Like many investors, the increase in tax rates over the years and the increase in what is taxed is something that has caught my eye. Taxes are heading higher and creeping into more areas of income and spending.

I’ll continue to do my part every April 15th but that doesn’t mean I can’t try to keep my tax burden in check.

The Best States for Dividend Taxes

Most states tax your dividends as ordinary income, making states with higher income tax rates public enemy #1 for your dividend portfolio.

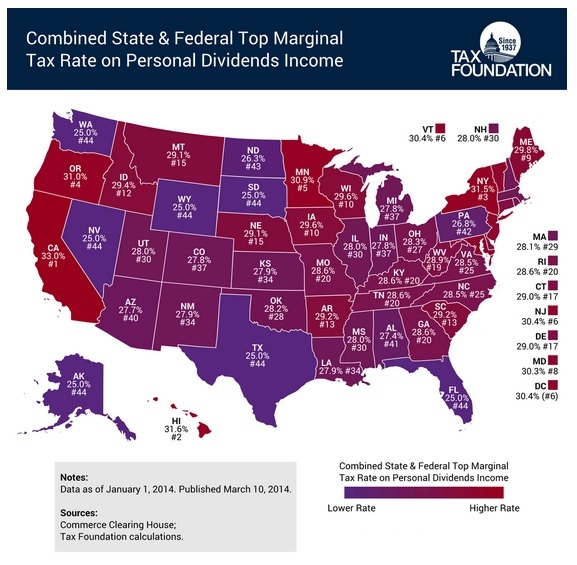

The graphic below, from the Tax Foundation, shows the combined state and federal top marginal tax rate on dividend income for each state. The map takes into account deductibility of state and local taxes at the federal level as well as tax rates to provide a total combined rate.

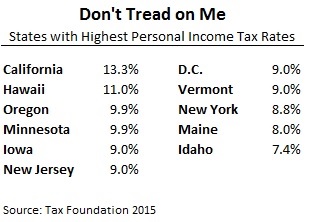

As you might expect, the states with the highest personal income tax rates have the most burdensome dividend taxes on a combined federal/state basis. California tops the list with its 13.3% rate on personal income, followed closely by New York and Oregon. The table below shows the eleven states with the highest personal income tax rates.

Seven states do not tax dividends at all including Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. This means your combined rate on dividend taxes falls to 25%, all at the federal level.

While Tennessee and New Hampshire do not tax personal income, they both apply a special tax on dividends, Tennessee through the 6% Hall Tax and New Hampshire through the 5% personal dividend tax.

Moving your legal residence to save a few percent on dividend taxes and other income may not make much sense but the answer gets clearer when you are talking about a difference of up to 8% between some of the lowest and highest-taxed states. Decide to call California your home and your $35,000 in annual dividends just became $23,450 rather than the $26,250 you would keep in Nevada.

Before loading up the family and moving to the nearest tax-free dividend state, you should consider other factors like the state’s sales tax and your own spending. Five states impose no sales tax including Oregon, Montana, New Hampshire, Delaware and Alaska though you might pay a local sales tax of 1.76% in Alaska. If you are able to save a greater portion of your income, instead of spending it on expenses, then the sales tax burden in a particular state might not be as big a factor.

If you cannot move to save money on dividend taxes, and are not able to at least change your legal residence, then you might consider putting some of your dividend stocks in a tax-advantaged account like an IRA or a Roth IRA. You will not be able to touch the income generated by the dividend stocks in your retirement accounts until you reach 59 ½ but you’ll enjoy the benefits of deferring taxes in the meantime.

Taxes are not the only factor you’ll consider when deciding where to call home but they can be an important one. Higher state and federal deficits mean rates are more likely to go up than down. Take advantage of favorable dividend taxes in select states to save while you can.