I do not think it is excessive to say that dividends have fascinated investors since the first payment was made to owners of the Dutch East India Company over 400 years ago. While the promise of price appreciation is a strong draw to the markets, seeing that regular payment in your account is a great feeling.

Recent events in the market have only made dividend-paying stocks even more popular. With interest rates at historic lows and bonds paying little above inflation, investors have found new hope for income in shares of companies with healthy dividend yields. More so, after seeing their portfolios halved in two market busts in less than 15 years, investors are embracing dividends as the only certainty in meeting their financial goals.

History of dividends in the stock market

Though investors have been reaping the dividend rewards of ownership for centuries, we will focus primarily on the domestic U.S. market for our study of dividend returns. Dividends from stocks and assets of foreign-domiciled countries are an important part of a diversified portfolio but can be accessed through American Depository Shares (ADRs) traded on the domestic exchanges.

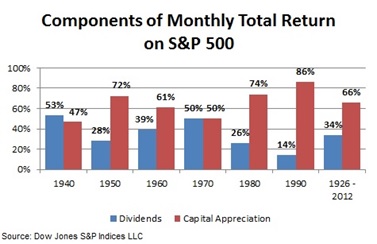

Though the contribution varies, dividends have been an important part of total returns for investors. The graphic below shows the contribution of dividends and capital appreciation to monthly total returns of the S&P 500 for each decade over the last 70 years and for the 86 years to 2012. Dividend payments have contributed a third of total stockholder returns over the longer-period and there is evidence that they may contribute more of returns in the future. The graph excludes data from the 2000s where, due to two market crashes, dividend income comprised more than 100% of the total return.

The lower contribution of dividends in the 90s is a function of the internet stock bubble which didn’t burst until the year 2000. Including the two decades around the internet bubble would show a much larger contribution from cash payments and less from runaway stock prices.

As companies continue to hold more cash on their balance sheets and find fewer suitable growth projects, dividends could increasingly offer higher contributions to total return. Economic growth in the United States and across the developed world is struggling to reach 2% a year. Stagnant wage growth and persistently high unemployment is constraining consumer spending. Without opportunities for organic growth, through higher sales, companies have turned to buying back their shares to increase their earnings per shares outstanding.

Total dividend income jumped 9.7% in 2012 and 2.9% in 2013 as companies returned more cash to owners. Share buybacks of $500 billion amounted to nearly as much as dividends in 2013. Even this was not good enough for some activist investors like Carl Icahn who has taken active management roles to force cash returns at companies like Apple (AAPL).

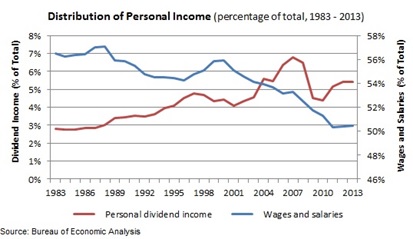

Not only are dividends an important part of total return, but Americans are increasingly relying on dividend income for their everyday needs. Data from the Bureau of Economic Analysis shows wages and dividends as percentages of total personal income over the three decades to 2013. Wages and salaries have sunk to just half of total personal income while dividend payments have grown to more than 5% of the total. In fact, more than $757 billion was collected from dividend payments in 2012. There are several reasons behind the growth in dividend income and many of them point to a yet higher dependence on dividends in the future.

Some of the increase in dividend income over the last decade is a result of the growing popularity of dividend investing with retail investors and the need for consistent returns after tough market crashes have wiped out years worth of appreciation.

As the general age of the population gets older, they rely more heavily on their investments and specifically on dividends for their financial needs. Wages become a smaller share of income as your portfolio grows and spins off more income every year. There are two important ideas here that should make dividend investing a core part of everyone’s investing strategy.

First, as the 76 million baby boomers age, they will increasingly look to the safety and income of dividend-paying stocks. We’ve already seen a shift in market demand to these stocks but I believe it will only get apparent over the next decade. This continuous demand for shares of these companies could propel the prices consistently higher, meaning high returns to price appreciation on top of a dividend yield.

Looking at the graph, another huge advantage of dividend investing should become obvious. Look at the graph not as the components over time but over your lifetime. As a young investor, you are relying heavily on your salary to pay the bills and dividend income is probably relatively small. Over the years, as your portfolio grows, dividend income grows and becomes a larger part of your total income. Dividend investing can help you reach the financial freedom to depend less on wages and more on the fruits of your labor.

The Power of Dividend Stocks and Compounding Returns

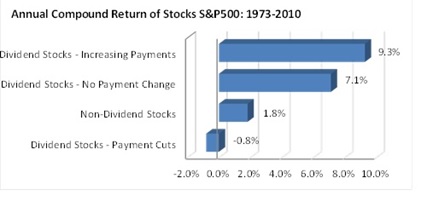

Perhaps the strongest evidence in favor of dividend investing is the actual returns in the market. The graph below shows the annual compound return to four groups of stocks in the 37 years to 2010. Shares of companies that paid dividends but did not regularly raise their payments provided investors with a 7.1% annual return over the period, well above the 1.8% annual return from companies that paid no dividends.

If this were not cause enough to start investing in dividends, shares of companies that regularly grew their dividend payments returned an annualized 9.3% over nearly four decades. In dollar terms, if you had invested $10,000 to a portfolio of dividend growth stocks in 1973, by 2010 you would have more than $268,500 in your account. Compare that to $126,500 in the portfolio of companies that paid dividends without regular payment increases and just $19,350 in the portfolio of non-dividend paying stocks. One important note is that these returns are dependent on reinvestment of dividends in the company. We will cover the advantages and disadvantages of dividend reinvestment plans in the next chapter.

The outperformance of dividend-paying stocks makes sense on a financial level. For a company to pay dividends, it must make a detailed projection of its cash flow and plan sometimes years in advance for sales and growth projects. For a company to cut its dividend to preserve cash is usually taken as a signal of weakness by investors so dividend policy must be very carefully planned. A dividend payment is a limitation on the use of free cash and helps discipline management.

Free cash flow is like a narcotic to management, clouding their judgment and often leading to overconfidence. Management sees all the money rolling in and starts to think about building their legacy through pet projects, executive perks, and billion-dollar acquisitions. A culture focused on increasing dividend payouts keeps management grounded and motivates them for growth and increased profit generation.

With management constrained by the dividend, they are only able to go with the most profitable projects and have to think twice before giving themselves the bonuses that their Fortune 500 colleagues get every year. Bonuses paid with shareholder money, your money!

An Alternative to Low Interest Rates and an Inflation Hedge

The Ten-year Treasury bond, the instrument against which all other bonds are priced, hit a record low of 1.39% in 2012. Inflation that year increased by 1.7% so the U.S. government was actually charging investors a third of a percent to hold their money each year over the next decade.

To me, that doesn’t sound like any way to meet financial goals!

Since the market uses the rate paid on risk-free treasuries to price other bonds, the yields on all fixed-income investments have come down to the point that an investor might have trouble meeting investment goals with a portfolio of bonds. Even corporate bonds only pay a 2.8% yield after accounting for inflation and with no prospect for price appreciation if held to maturity. Bonds will return their yield to maturity but many investors have rushed into higher risk investments without really understanding the true risks.

Enter dividend investing. Many companies, particularly the Dividend Aristocrats discussed later, have returned cash so consistently and are so financially stable that their shares can be a good alternative to bond investments. These companies, some paying dividends for more than a century, have stronger credit ratings than the United States government and have been able to consistently grow sales even in mature markets.

This is not to say that dividend investing should completely replace bonds in every portfolio but investors may have a hard time meeting income goals unless they increase the proportion of dividend-paying companies.

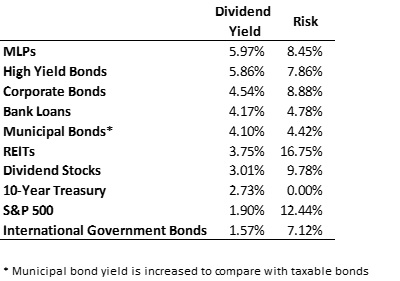

The table below shows the dividend yield and standard deviation (risk) on the list of popular income investments.

The data in the table should be used as an approximate to represent each group. Exchange Traded Funds were used to represent each group except the 10-year Treasury Yield. This was done for the availability of information on risk but the data may not be identical across all possible funds or portfolios in the group. For example, there are several funds available with a dividend stock objective and an innumerable amount of portfolios investors could construct with individual dividend-paying stocks. All will have different yields and risk characteristics.

The groups above were represented with the following funds:

Alerian MLP ETF (AMLP)

Vanguard REIT ETF (VNQ)

SPDR Barclays Capital International Treasury Bond (BWX)

Powershares Senior Loan Portfolio (BKLN)

iShares SPDR S&P 500 (SPY)

iShares Select Dividend ETF (DVY)

SPDR Barclays High Yield Bond ETF (JNK)

SPDR Barclays Long Term Corporate Bond (LWC)

iShares S&P National Municipal Bond Fund (MUB)

While dividend stocks have a lower yield than some of the bond groups, they offer the opportunity for price gains as well. Bond prices may even decline sharply on higher interest rates, eating into the dividend yield. All three bond funds shown above posted negative returns between 1.2% and 8.9% for the year to 2014. By contrast, the dividend stock fund saw its price surge by 20.2% over the period.

In fact, as rates increase closer to long-term averages over the next few years then bonds and bond funds could get hit even further. For an increase of just 2% in the rate on the Treasury bond, the price drops approximately 17% and losses would be felt across all bond investments.

Beyond bonds, you are not alone if you are looking at the table and thinking about reaching for higher yields through bank loans. The funds that hold bank loans in a portfolio have become popular in the low rate environment especially since most of the loans are variable-rate so will not lose as much when rates do rise. The problem with these loans is that, similar to the high-yield bonds, there could be a much higher risk of default that you might think. Rather than protect your portfolio when the economy weakens, these funds may actually book large losses if the companies default on the loans.

Notice that not only does the dividend fund pay a higher yield than the fund tracking the S&P 500, but it also does it with much lower risk.

While I have made the distinction between investments in MLPs, REITs and dividend stocks in the table, all three are an important part of a holistic dividend strategy. Combining the high yields and relatively low risk from all three asset classes can help smooth out market fluctuations and provide strong and stable income.

Dividend stocks can also offer protection against inflation. Sales and earnings both will tend to rise with inflation for most companies. Since dividend policies are often maintained as a percentage of earnings, the dividend payment tends to rise as well.

Besides the tendency for dividend payments to increase with inflation, there are several groups of dividend stocks that offer additional protection against rising prices. Utilities, the classic defensive dividend stocks, are often contractually allowed to raise the rate on their services by an inflation adjustment above and beyond an allowable rate of return. The adjustment may lag a year or two but will even out over many years and compensate for higher prices.

Other popular categories of dividend-paying companies exclusively invest in real assets. We’ll get into the specifics of companies that invest in real estate or energy infrastructure in a later chapter but suffice it to say that these hard-assets will tend to increase in value when the dollar losses its own value. The increase in asset value comes through as a persistent increase in the price of shares and adds to attractive dividend yields.

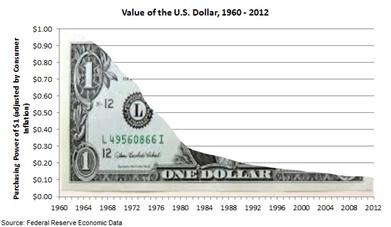

But isn’t inflation dead? Prices rose just 1.7% last year and have averaged just 2.1% over the last five. Before you shrug off the need to protect your assets against the loss of purchasing power, take a look at the graphic below.

Even at a low rate of 2.4% inflation, the value of your money halves in 30 years. Imagine getting to retirement and the value of your assets buys half as much as you were expecting. And low pricing pressure over the last decade may be the exception rather than the rule. In the 30 years to 2000, the average annual rate of inflation was 5.2%, more than double its current rate. Tack on historic programs of monetary stimulus by central banks all over the world and you’ve got a recipe for higher prices in the future. While we may not see the 7.1% rate of inflation experienced in the 70s, we are likely to see rates closer to 3% over the next several decades.

At a moderate 3% annual rise in prices, your dollar is worth just two-thirds of its value in 10 years and it takes just 23 years to halve its value.

Yield provides a safety net in market downturn

For me, all the data on dividends and market-beating returns is just icing on the cake. For many investors, these stocks are my ‘sleep-at-night investments.’ Academic studies and raw market data have shown that dividend-paying stocks are less sensitive to market changes and outperform the general market even more when stock prices come down.

Over the two decades to 2012, dividend-paying stocks within the S&P 500 posted an annualized return of 11.3% against 10.4% for stocks that paid no dividends. Again, icing on the cake but the dividend-payers also did it with lower risk and volatility in prices. The shares of dividend payers saw their prices fluctuate, as measured by a statistical term called beta, by just 92% of the market average. Shares of companies that paid no dividends saw their prices fluctuate 111% of the market average. Not only did the dividend-payers beat the non-paying stocks by nearly a percentage point on an annual basis, but they did it with much less risk.

Data from Standard & Poor’s for annual returns over the 85 years to 2012 shows that the average annual dividend return when the market is rising was 5% against price returns of 19% on average. During years when market prices fell, price returns averaged a negative 15% while dividends still provided a positive 3% return. When the market is rising, returns to dividend investing are good and adds to total returns. When the market is falling, returns to dividend investing are great and cushions you from wider losses.

Not only is dividend income always positive, but it can be relatively stable over time as well. Stock prices can fluctuate wildly on investor sentiment and stock bubbles. Dividend payments are a function of corporate financial planning, often years in advance, and much less subject to speculation. Over the three decades to 2012, stock prices swung by more than 15% on an annualized basis. In contrast, the standard deviation of dividend returns was just 0.47% over the period. Stock prices are the manic-depressives of the investing world, taking investors up to great heights before dropping them hundreds of feet straight down. Dividend returns are that slow, steady hike upwards until you reach the summit of your financial goals.

I like the idea of doing “history of finance” centric posts. You’ve inspired me to do a history of black-scholes for my blog the next time I’m out of trades to post.

Great! Let me know when that post is up.

I don’t think you mentioned how easy buy/hold dividend investing is. You take the initial time to research a company then once you pull the trigger and buy, your job is done. Each month you collect your dividend paycheck and eventually you can have enough to retire and live off the dividend income. It’s pretty incredible and the practice of a lot of dividend investors.

For me the hardest part about dividend investing is that some of the companies I really love like Google and Amazon don’t have dividends and thus aren’t typically a part of the dividend investing strategies. Still there are a large handful of companies that pay dividends and those companies usually aim for increasing those dividends when they can. So essentially you’ll get tiny pay raises for just owning stock in dividend-paying companies.

Yea…. It’s easy to get excited about this. =P

Hi Div Ladder,

This was a great article and fully reaffirms my decision to stick with dividend growth investing. Based on the logic in this article why would anyone invest in any other strategy.

Thanks and cheers,

DFG