Investment Highlights

• Shares of Sherwin Williams offer a dividend yield of just 1% and are priced at $229 per share, but that is not the reason I am avoiding them

• Management has aggressively bought back shares and investors have been rewarded with a 39% annualized return over the last three years

• The current price is just too high relative to earnings and next year’s expectations may be too high

Sherwin-Williams (SHW) is the largest paint retailer in the United States, where 80% of its revenue originates. Much of the international sales are from the company’s Canadian stores with about 8% of revenue from Latin America and only marginal exposure in China and Europe. Acquisitions have been a big part of the company’s growth strategy over the last several years, primarily to extend its geographic reach.

Sherwin Williams canceled its bid to acquire Mexico’s largest paint maker Consorcio Comex SA earlier this year when regulators blocked the deal on antitrust concerns. Sherwin Williams has held that the company tried to complete the acquisition in good faith though Comex is still seeking a fee for the termination.

In January, a California judge ordered Sherwin Williams and two other paint makers to pay $1.15 billion to replace or contain lead paint in the homes of 10 California cities and counties. The ruling sets a precedent for others across the U.S. and could increase legal expenses for the company.

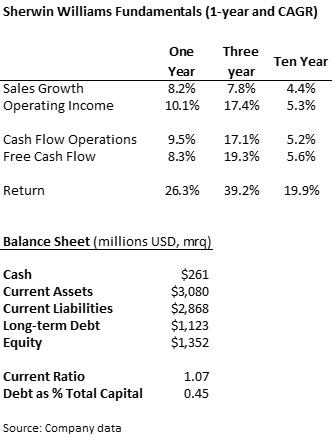

Fundamentals

Sales have grown at a strong rate over the last several years, almost double the average over the last ten years. Beyond strong top-line growth, management has also done a good job controlling expenses and operating income has grown at a faster rate than sales.

Due to its aggressive acquisition strategy, the company has taken on quite a bit of debt recently. Long-term debt now stands at $1.7 billion or 45% of the capital structure. The company has $500 million maturing in December and another $700 maturing in December of 2017. Refinancing the debt should not be a problem but it may limit the amount of cash that can be returned to shareholders or the company’s future acquisition plans.

Dividends and Growth

While the company is one of the prestigious S&P Dividend Aristocrats, paying a dividend since 1979 and increasing its payout for 34 consecutive years, it offers one of the lowest yields of the group. The dividend yield of 1% would not normally even make it on my radar and it’s not much higher than the 1.3% average over the last five years. The company currently pays out 25% of earnings as dividends, just below the 29% average rate paid out over the last five years.

While the dividend has grown by a compound rate of 9% over the last five years, it has not kept up with the increasing share price. I normally would not even consider a stock with a dividend yield as low as Sherwin-Williams but the company’s yield is just a fraction of the cash return. The company is an active buyer of its own shares with $1.37 billion repurchased over the last year, more than six times the dividend payout. Including the share repurchase program, the shares offer a very attractive 7.2% yield.

Valuation

Shares trade for a hefty 26.3 times trailing earnings, slightly above the multiple of 23 times on shares of other home improvement stores but well above the multiple on other retailers. Over the past five years, shares have averaged a multiple of 21.5 times trailing earnings.

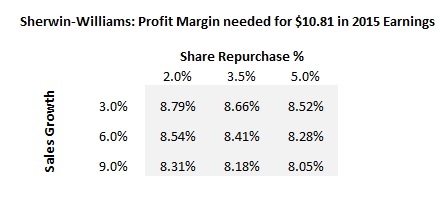

Earnings are forecast 23% higher to $10.81 next year against a gain of 16% in 2014. Even on expectations of strong earnings growth, the shares still trade at their long-term average multiple of 21 times earnings. While I think the housing rebound has more room to run and American consumers are pretty healthy, it might be difficult for the company to meet earnings expectations next year. Sales are only expected to increase by 6.2% which means the company needs to improve cost controls and/or continue its strong share repurchase program.

To show just how hard it will be for the company to meet earnings expectations, I’ve put together the matrix below. The table shows the profit margin the company will need depending on how many shares are repurchased and what kind of sales growth is achieved.

Despite the strong share repurchase over the last year, the average over the last five years has been $520 million shares repurchased. This is still a respectable 2.4% but I am not sure the company can do much more with $500 billion in debt maturing this year.

Sales have grown quickly over the last few years but have only averaged 4.4% growth over the long-term. There is the possibility that sales will exceed the 6% expectations, even that they’ll grow faster than the 9% below, but it may not be realistic. Interest rates will be increasing over the next year which means the housing market may face the headwind of higher mortgage rates.

While the company has boosted its profit margin to 7.7% over the last four quarters, its five-year average is 6.2% so making it to a margin above 8% is going to take some serious cost-cutting. This is all beside the fact that even at next year’s expectations, the shares are still priced at their average price-earnings multiple. To provide any return beyond the dividend, the shares would have to increase and the stock would still be expensively priced.

Sherwin Williams offered a great cash return over the past year and a strong price return but it may find it a hard act to follow next year. With the high level of debt, share repurchases and acquisitions could be limited. I would be more comfortable recommending the stock around $180 per share or a price multiple of 20 times earnings.

Thanks for the insight on the stock as I never bothered to look them up. Too bad dividend is so low as many investors need a bit more capital return.