The market loves a good drama and the recent tension over the Ukraine has satisfied a news industry based on the advertising model. Rational investors need to look through the hype and understand long-term fundamentals. While sentiment will likely keep shares of Russian companies volatile for the next month or so, there is strong value and an attractive cash yield in the market and larger names.

Should you believe the hype on Ukraine tensions?

Ever since CNN started broadcasting around the clock in 1980, the media has reached for anything to fill the time between commercial breaks. Since the business model for television channels is based on selling advertising spots, more viewers means more revenue and content is king in attracting viewers.

The internet has only amplified this need for dramatic content that can attract eyeballs. Financial websites need a story to sell so readers keep coming back for the latest update.

And no story is as gripping as East versus West.

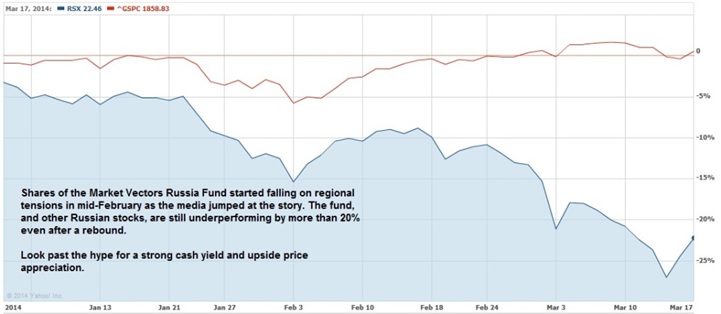

The Russian Micex index entered a bear market earlier this month on fears that international sanctions on an annexation of Crimea would depress economic growth and sentiment would fall further.The chart below compares the year-to-date performance of the Market Vectors Russia ETF (RSX) with the S&P 500. While Russian shares have been weakening since late last year, the fund really started to underperform last month.

Source: Yahoo Finance

I’ll be the first to admit that the Russian economy is not the strongest in the world and that Putin would love to see the country return to its role as global superpower. I would not pay the same multiples on earnings for Russian companies as I would companies in the United States, but the market is overplaying the tensions and these shares are ripe for a rebound.

Exported goods from the E.U. to Russia amount to $150 billion, more than 7% of total exports. Russia sends $250 billion in exports to the eurozone countries, 53% of its total exports. The Russian economy grew just 1.3% last year and the economy of the European Union barely clawed its way out of six consecutive quarters of negative growth. While ideology and democracy may be buzzwords for news events, neither the E.U. nor Russia can afford for tensions to weaken growth and the need for cooperation will rule negotiations.

Besides the economic reasons to avoid an escalation, it will be hard for the west to rationalize tougher sanctions after Crimea voted to separate from Ukraine and join the Russian Federation. The region is 60% ethnically Russian and the decision on March 16th was nearly universal among voters. Western leaders can claim Russian intervention but the fact is that the vote reflected the will of the people.

Even after last week’s rebound, shares of the Market Vectors Russia fund are still well below their 52-week high and pay an attractive 3.3% dividend yield. Shares of Russian equities are cheapest among the 21 developing countries tracked by Bloomberg with prices just 4.3 times forward earnings. Shares of the Market Vectors fund trade for 5.6 times trailing earnings, less than a third of the current on companies in the S&P 500. Shares are heavily weighted to the energy sector (42% of holdings), reflecting the general economy, but also carry large positions in materials (16.6%), telecommunications (12.4%) and financials (11.2%). The fund has traded in a tight range between $25 and $30 per share since 2011 and there is no reason to believe that underlying fundamentals have changed significantly.

Telecom giant VimpelCom (VIP) is a strong bet for investors looking to individual names. The $14.5 billion company is the sixth-largest mobile operator in the world with operations in 18 countries. Recent acquisition activity is driving service bundling and cash flows. Shares are down almost 30% since the beginning of the year and 13% since the geo-political tensions escalated in mid-February. Shares trade for just 7.0 times trailing earnings and pay a 10.3% dividend yield. While the company still has to prove it can rebound from two quarters of disappointing earnings results, the recent selloff is unwarranted and shares are worth more than the current price.

Long-term investors need to be able to look past these short-term fancies of an ad-driven media. Shares of Russian companies may be volatile over the next several months but valuations are incredibly low on mega-cap companies that should have no problem weathering the storm. Cash yields are high and investors are being paid handsomely to wait out for market jitters to subside.

I don’t know many Russian dividend companies, but Yandex is a russian player that has certainly caught my eye with recent price falls.

While I think most stocks (and stock markets) are overvalued at this point…..the spread between Chinese (or Russian) stocks and the developed markets (like North America and Europe) seem overdone.

-Bryan

It can be difficult to get information on Russian stocks.

VIP slashed their dividend in January, from .80 to .035, and cancelled the already announced Nov 2013 dividend. That’s the main reason they’re down 30% this year. For whatever reason, morningstar and the rest don’t update very often or reliably on foreign stocks, so approach them with caution.

http://finance.yahoo.com/news/vimpelcom-tumbles-dividend-cut-213003318.html