Investment Highlights

- Industry weakness from a slowdown in China and cheap natural gas in the United States has meant losses for coal producers

- Peabody Energy is the largest U.S. producer with quality assets in cheaper regions and international diversification through Australia mining

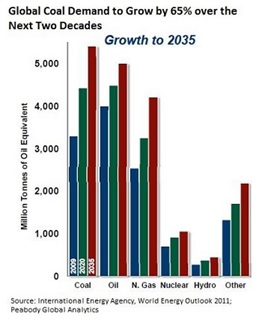

- Global coal usage is expected to increase 65% to 2035 and those willing to wait out the short-term pain stand to benefit from low valuations and cash returns

Overview

Peabody Energy (BTU) is the largest coal miner in the United States with nearly 252 million tons produced last year. The company also operates mines in Australia for exposure to faster-growing Asian markets. A slow-down in China and competition from natural gas in the United States has plagued the coal industry over the last couple of years, bringing a plunge in the share price to ten-year lows.

Investors are becoming fixated on short-term risks to the coal industry, including emissions targets in the United States that threaten to cut power plant usage by 24% over the next six years. The fact is that coal usage in electricity generation has actually increased over the last year to 40% and emissions targets look unlikely to be reached. Twelve states have already filed legal challenges against new EPA policies.

Case in point, Germany agreed to strict climate targets in 2000 with the rest of the region but has increased its use of coal to the highest level since 2007 to 45% of total generation. A phase out of nuclear energy and expensive subsidies to alternative energy is driving up electricity prices in Europe and sending the region back to cheap coal.

After Goldman Sachs joined a growing list of firms downgrading the stock, Peabody released an update on global coal fundamentals. Management’s review of recent changes in Chinese import policies found that the company’s Australian operations may actually benefit from its high-quality coal. Imports to India surprised higher in July and August and the global market for coal used in metal-making looks to be bottoming.

Even on the political focus to clean energy initiatives, the International Energy Agency forecasts coal demand to increase by 65% over the next two decades and to overtake oil as the most used energy source.

Clearly the industry is in no long-term danger, just short-term weakness as inefficient companies are forced out of production. Peabody Energy has all its U.S. mines in the less expensive Illinois Basin and Powder River Basin where coal is competitive with natural gas prices as low as $3.50 per million Btu. This compares favorably with Appalachian coal that requires natural gas prices as high as $4.50 per mmBtu to be competitive as an energy source and current prices around $3.90 per mmBtu.

Fundamentals

Sales fell more than 13% in the year to 2013 but have stabilized around $6.9 billion over the last four quarters and were 8% higher last quarter. Peabody has closed more expensive mines but has only been able to cut operating expenses so far. Earnings have been negative over the last two years and are likely to worsen this year before rebounding in 2015.

Peabody has nearly $6 billion in debt, quite high because of an acquisition before the financial crisis. While other coal producers are in danger of bankruptcy or restructuring, Peabody has plenty of liquidity with $2.0 billion in short-term assets to cover $1.8 billion in current liabilities.

While the rest of the market is looking at an operating loss over the last quarter, I am looking past it to cash flow. Much of the company’s operating loss comes from depreciation of assets, which is just an accounting item and doesn’t really affect cash. The company posted $466 million in operating cash flow over the last four quarters. Free cash flow was negative but only on $539 million in capital spending and investments.

The falling share price has boosted the dividend yield as management refuses to cut its shareholder cash return. The stock pays a 2.8% dividend yield against a five-year average of 1.4% with dividend growth of 7.6% annually over the last five years. Dividends have been paid since the company started trading thirteen years ago.

The company’s payout ratio is extremely low at just 20% of operational cash flows. The weakness in the industry over the last two years has slowed dividend growth but management has made a firm commitment to cash returns. Once earnings growth starts to rebound, likely in the second or third quarter of 2015, investors could see a boost to the dividend payout.

How low can Peabody Go?

As any investor knows, it is impossible to call a bottom in a stock’s price. As we saw in 2009, panic selling can drive prices to ridiculously low levels. Knowing when a stock is extremely cheap relative to its long-term fundamentals is possible and can help us make good investment decisions.

Shares of Peabody Energy have fallen 27% over the last year with nearly 20% of the drop just in the last month. The company is expected to lose $1.13 per share this year and $0.21 per share in 2015 even as sales increase 7.4% to $7.16 billion.

Shares already trade for 0.83 times the book value of the company’s assets and less than half (0.48) times annual sales. That compares to an industry average that is priced at 1.2 times book value and a five-year average for the company of 2.3 times book.

I cannot tell you when the coal industry will rebound but I can tell you that Peabody has some of the lowest-cost assets in the industry and will be able to weather the storm until it passes. Book value could continue to fall over the next two quarters but stronger industry fundamentals in 2015 should support it above $14 per share. Any sign of a bottom in coal prices could improve sentiment significantly and the shares are worth at least 1.25 times book value for a target price of $17.50 per share.

Morningstar has a four-star rating on the company with a price target of $17 per share, 39% higher than the current price. While I am not quite as optimistic, I think the shares offer a significant value for investors that are able to look past market fear to the long-term potential. Until the shares rebound, investors earn an attractive dividend yield and the potential for a high total return over three to five years.