As I attempt to manage my dividend portfolio publicly I will be making posts about stocks I purchase and stocks I sell. Last week I made a few adjustments to my holdings to better represent my long term view. I felt that I was being a little too speculative with my position in Vanguard FTSEEuro (VGK) when I could swap it out for two long term plays that I was more comfortable with. Each of these stocks are always showing up in my top dividend list and have increased their dividend for over 35 years.

I also believe each is well positioned to benefit from global growth, emerging markets and new trends. Over the next 10 years I expect each of these stocks to be worth much more than they a are today. I also expect each to continue to pay and raise dividends.

Here’s a quick breakdown of each stocks dividend fundamentals with dividend history charts from our graph tool.

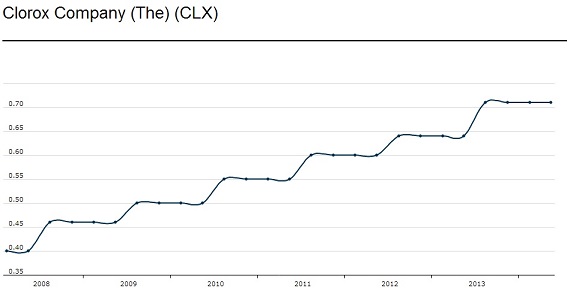

Clorox (CLX)

Currently Clorox yields 3.2% and has boosted dividends for 35 consecutive years. Dividend growth has been strong averaging around 10% over the last 3 years. The payout ratio is just 62% and the free cash flow yield is 4.4%.

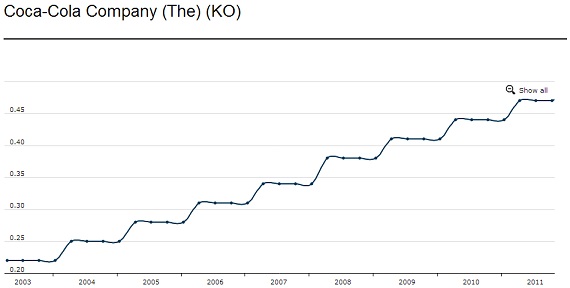

Coca-Cola (KO)

KO is yielding 3.2% and has increased its dividend for 51 years. KO has a 5 year dividend growth rate of 8.5% and a payout ratio of 56% with a free cash flow yield of 4.8%.

Alright Coke fans, I’m in the club!

Great trades, DL.

I’ve been looking at KO closely the past couple of weeks. Wish I had more reserves in my capital to pick some up.

Nice buys! I also like KO at these prices. I haven’t given Clorox a lot of thought, but I’ll look into it. Have a great day

-Bryan

Thanks Bryan. I’d love to hear your thoughts on CLX.

DL,

I own both of these. I’ve owed Coke for about 17 years and CLX I’m currently building a position with a DRIP. I’m hoping to build the CLX position to about 2k-3k and let it ride. Solid brands and products, yet plenty of room for growth. Great looking DG charts.

-RBD

17 years! That is fantastic. Thanks for the note.

Zach,

Great buys here. Solid brands!

I haven’t looked at CLX in a while due to balance sheet concerns, but KO is about as solid as they come. And the yield right now is pretty attractive compared to its historical norm.

Best wishes!

You are right the dividend yield is pretty strong despite the multiple on these stocks. Historical yield is a great valuation data point.

Great call on KO!

Mark