Shares of McDonald’s Corporation (MCD) have not been the market darling they once were but still provide consistent and reliable cash at much lower risk. The stock is priced well-below peers and undervalued on a cash flow basis. The company is planning an aggressive breakfast campaign that could improve sentiment and drive shares higher. Even without a return to higher revenue growth, investors should still see total returns between 6% and 8% over the long-term.

Investment Highlights

- Leader in the quick-service restaurant industry with the brand and scale to drive growth

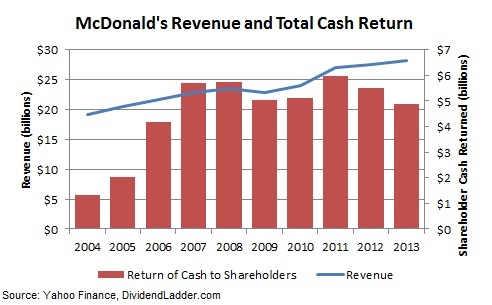

- A commitment of returning cash to shareholders through dividends and buybacks

- Slightly undervalued even on conservative estimates of growth and a stable outlook with much less risk compared to the general market

Overview

Serving under the golden arches for almost 75 years, McDonald’s has expanded into 120 countries and is one of the most recognizable brands on the planet. The company operates largely under a franchisee model which helps control its own risks and costs. Of the 35,400 global locations, approximately 80% are franchised and affiliate-owned with 90% franchised in the United States.

Shares of McDonald’s have recently fallen out of favor with investors as competition heats up from other quick-service restaurants. Its historical dominance in the space made it slow to react to competitive threats over the last couple of years and the company has made some mistakes in its product-pipeline and marketing. Despite the recent weakness, the company is still the clear leader in its industry with an average $2.5 million in sales per restaurant against an average of $1 million per restaurant across the industry.

The company is planning a turnaround focused around its breakfast offering which could include longer breakfast hours, an expanded menu and stronger marketing of its McCafe gourmet coffee product. The word “breakfast” was mentioned nine times during the fourth quarter conference call though no specifics were given on the plan. The morning segment has been an extremely important one for the company, making up 25% of sales.

Fundamentals

The company’s balance sheet is healthy though debt has increased over the last six consecutive years. Cash increased to $2.8 billion against long-term debt of $14.1 billion last year. Current assets of $5 billion are more than enough to cover the $3.2 billion in current liabilities.

While McDonald’s may be seeing lower revenue growth, operational efficiency is seeing significant improvement off what was arguably already one of the best run companies in the market. The company’s operating margin has increased from 18.6% a decade ago to 31.2% last year on better cost management and the continued shift to the franchise model.

Despite higher capital spending to growth the business, McDonald’s is still a cash flow machine. The company increased free cash flow to $4.3 billion last year, more than enough to cover a healthy cash return to shareholders.

Growth and Dividends

The company has grown revenue at an annualized 3.6% pace over the last five years though sales grew just 1.9% in 2013. Despite the slowdown in sales growth, the company has been able to manage expenses and earnings have increased consistently. The company’s scale and brand really give it the power to push through competitive pressure.

Even if competitive pressure continues to weigh on sales growth, the company should be able to stabilize revenue growth around 3% while still keeping expenses relatively low. A 20% profit margin and strong use of leverage should translate to consistent earnings and cash flow growth.

Given a reliable stream of earnings, the company should have no problem continuing its record of strong cash return to shareholders. The shares currently pay a 3.3% dividend yield and the company regularly returns cash to shareholders in the form of a stock buyback program. MCD has increased its dividend for 38 consecutive years.

Dividends per share have increased at an annualized pace of 10.1% since 2009 and the company pays out 56% of its earnings as dividends. An aggressive buyback program has lowered the share count by an annualized 2.3% over the last decade.

Valuation

Shares trade for 18.0 times trailing earnings, just slightly higher than the 17.0 times average over the last five years but still well below peers. Shares of Wendy’s (WEN) trade for 27.4 times earnings and Burger King Worldwide (BKW) trades for 29.6 times earnings, both offering lower dividend yields.

One interesting and overlooked benefit on shares of McDonalds is the ability to use it as a play on global real estate as well as a stable cash return. The company owns approximately 45% of the land and 70% of the buildings in its network. With more than 35,000 locations, this is a considerable investment across the globe, much of it in high-growth emerging markets. I believe that, as real estate appreciates in these markets, the company has the opportunity to realize significant gains on assets and will pass these gains on to investors.

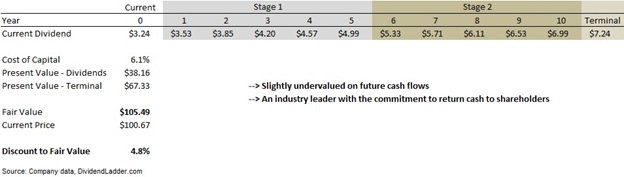

The shares have a fair value of $105.49 on a discounted cash flow basis. This is calculated using the company’s cost of debt and equity capital (6.1%) and estimating future payments of dividends. While the dividend has grown at a 10.1% annual pace over the last five years, I estimated a more conservative 9% over the next five and 7% over the consecutive five years. The terminal growth rate of 3.5% is likely to be way too conservative since the company has already been operating for nearly 75 years and still grows dividends by double-digits per year.

Even on these conservative estimates, investors could see a nearly 5% increase in the shares to fair value on top of the annual dividend yield and appreciation.

Conclusion

A buy or sell recommendation will depend on your own needs and risk tolerance as an investor. Shares of McDonald’s should provide a stable and consistent return over the long-term, on the order of 3% annual dividend return and 3% to 5% in share price appreciation. While the total return on the shares may lag the overall market, it comes with much lower risk and volatility.

For investors that want nearly certain return or need a stable cash flow from their portfolio, shares of McDonalds are a Buy at these levels on a slight undervaluation and forecasts for consistent growth in the future.

McDonald’s just missed making our top 50 dividend list with an HPR rating of 94.

What do you think of McDonald’s at these levels? Let me know in the comments.

What a timely post! I just had some MCD this morning. I like MCD personally. I had watched them for a couple years before I bought at the start of 2012 @100, since then they have hung out a little bit lower. Which is great for me, I just add a little bit here and there.

It is hard to find value right now, but I think you won’t be disappointed in 5 years if you buy some today.

Thanks for the analysis!

Hey ILG. Glad to see you can be so patient. Thanks for stopping by.

I love both MCD and YUM and own both for many years in my dividend income portfolio. However, at this stage I would favor YUM going forward for growth. Not to knock MCD bu I find it hard to make additional purchases of MCD at these levels.