Investment Highlights

- Valero Corporation is the world’s largest independent refiner with a significant advantage to lower-cost crude oils

- Republican control of Congress could bring Keystone pipeline approval next year and could boost shares in November

- The company has increased its cash return to investors after the creation of a partnership company and yields could go even higher

We have been focusing on the S&P Dividend Aristocrats lately, those generational companies that have increased their dividend for at least 25 consecutive years. This week, I wanted to highlight a company that could get a near-term boost on the coming mid-term elections and stands to become a strong dividend payer over the long-term.

Valero Corporation (VLO) is the world’s largest independent refiner with the capacity to convert 2.9 million barrels of oil a day. Besides a traditional refinery, Valero is also one of the world’s largest renewable fuels companies with 11 corn ethanol plants. While the company owns refineries across North America, the majority of its capacity is located around the Gulf Coast. This has helped it to take advantage of lower prices for domestic crude oil while exporting refined products internationally.

The company created Valero Energy Partners (VLP), a publicly-traded master limited partnership (MLP), in 2013 to more efficiently manage assets. Their tax-advantaged status means MLPs do not pay corporate income taxes if profits are passed through to investors and the general partner.

Valero maintains 69% ownership of the MLP and expects at least a 20% average annual distribution growth over the next three years. The company will also benefit as it sells assets down to the MLP to raise cash for growth projects.

Besides the upside in cash flow from drop downs to the partnership, Valero may be in the position to divest some non-core assets as well. Valero CEO Klesse called out the two California refineries as the weakest in the company late April, just a day before PBF Energy (PBF) signaled that it was interested in buying assets in the state. Regulatory hurdles have limited California’s access to cheaper oil from Canada and have caused headaches for refiners. PBF has yet to make a big purchase but both of its first two east coast refineries were bought from Valero.

The company has a strong long-term outlook but what has me most excited is the potential over the next month and the next year. The market has been so worried about Ebola and geopolitical tensions that it has yet to factor in the potential of a Republican win of the Senate in November. While it is debatable whether Republican control of Congress is good or bad for stocks in general, it could be very good for Valero.

As of yet, the Keystone XL pipeline project has gone nowhere. President Obama has sided with environmentalists and has refused to give the project the green light. The GOP and some Democrat support in the Senate have been able to pass a symbolic measure of support but Majority Leader Reid has not allowed a vote on the project. If the Republicans win control of the Senate, which is looking increasingly likely, the new majority leader could call a vote early next year. The President could still veto any vote if it doesn’t receive two-thirds in favor but that could be politically unpopular.

The Keystone pipeline would bring Western Canadian Select (WCS) crude oil, one of the cheapest types of oil, down directly to Valero’s Gulf Coast refineries. The company would realize a significant advantage over others and shares could bounce higher if the Republicans win the six seats necessary for Senate control in November.

Fundamentals

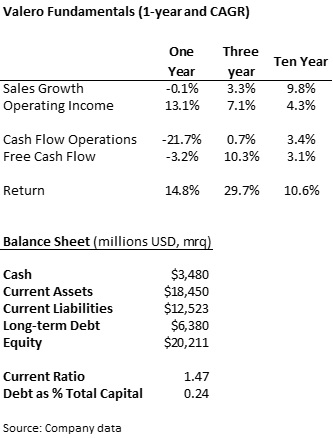

Sales growth has faltered over the last year as the spread between the price of international oil falls closer to the price of domestic crude. The company has limited the effect by controlling costs and operating income has held up very well.

Valero has a very strong balance sheet with just 24% of its capital structure from debt and current liabilities well-covered by current assets. Cash flow from operations has taken a hit over the last four quarters as the company paid down a huge amount of accounts payable. These owed payments to suppliers jumped nearly $1.5 billion to $11.0 billion in the September quarter of last year. The company used $1.64 billion in cash to pay down the liability as of the most recent quarter. This explains a lot of the swing in cash flow over the last year.

The company ramped up investment spending in the three years through 2013 but brought spending back down over the last two quarters. Investment spending is likely to increase again as cash flow increases through the company’s asset sales to the partnership.

Dividends and Growth

Shares pay a 2.4% dividend yield, above the 1.9% average over the last five years. The company has also increased its payout ratio to 18% of income from an average of 13% over the last three years.

Management has increased the dividend by a compound rate of 36% over the last five years. Valero has paid a dividend since 1997 with increases over the last three consecutive years. Before it cut the dividend in 2010 due to the financial crisis, Valero had increased payouts for nine consecutive years.

Valero has been even more aggressive at returning cash to shareholders through its share repurchase program. Over the last four quarters, the company has repurchased $823 million in shares. Along with the dividend, Valero has returned $1.33 billion to investors or almost % of the company.

Valuation

Shares trade for 9.0 times trailing earnings, well below the industry average of 13.1 times earnings. While the shares have traded at a discount to peers in the past, the current valuation is too low in my opinion. Valero’s large network of refiners can process some of the heaviest and cheapest types of crudes, translating to margins that are well above other companies.

Earnings this year are expected to jump 22% from last year to $5.50 per share and are expected at $6.08 in 2015. Just meeting expectations would put the current price at a valuation of 7.6 times earnings at the end of 2015. Besides strengthening investor cash return, there is good potential upside to the share price as well.

Discounting future cash flows is difficult because of the company’s changing structure. Over the next several years, many of the refineries will probably be sold to the partnership which will mean an increase in cash and the ability to invest in growth projects. I have estimated that the company will be able to increase its dividend by 25% a year over the next three years and 12% through the following six years. Both of these estimates, as well as the 7.5% terminal growth rate, could be overly conservative but I would rather err on the side of caution.

Even on conservative estimates for dividend growth, Valero shares are trading more than 9% below their fair market value. This valuation is in-line with my target of $55.00 per share over the next year on earnings growth and investor sentiment as the company improves management of assets through the partnership. Investors should see stronger cash returns in the future and may see a nice bump in the shares if the Republicans win control of the Senate in November.