Federal Realty Investment Trust (FRT) stands out in the real estate sector for its remarkable achievement of increasing its dividend for 55 consecutive years, earning it the prestigious title of a Dividend King. This remarkable track record underscores the company’s commitment to delivering consistent shareholder value and its ability to adapt and thrive through various economic cycles. Federal Realty Investment Trust specializes in the ownership, management, and redevelopment of premium retail properties, primarily in major coastal markets in the United States. Its portfolio includes community and neighborhood shopping centers and mixed-use properties, which benefit from the strategic location in densely populated, affluent areas.

A Real Estate Investment Trust (REIT) like Federal Realty Investment Trust is a company that owns, operates, or finances income-producing real estate. REITs allow individual investors to earn a share of the income produced through commercial real estate ownership without actually having to buy, manage, or finance any properties themselves. By law, REITs are required to distribute at least 90% of their taxable income to shareholders annually in the form of dividends, a rule that supports their significant and consistent dividend payouts. This structure not only provides investors with regular income streams but also offers the potential for long-term capital appreciation. Federal Realty’s success can be attributed to its high-quality portfolio and strategic asset management, which have supported its exceptional dividend history.

Analyst Ratings

- Anthony Powell from Barclays maintains a “Buy” rating on the stock, increasing the price target from $119 to $120, suggesting an 18.99% upside from the current level as of January 19, 2024. This adjustment reflects a positive outlook on the stock’s potential for growth.

- Ki Bin Kim from Truist Securities upgraded the stock from “Hold” to “Strong Buy” on January 16, 2024, with a price target of $117, indicating a 16.01% upside. This significant upgrade signals a bullish stance on the stock’s future performance.

- Vikram Malhorta of Mizuho kept a “Hold” rating but raised the price target from $98 to $104 as of January 10, 2024, offering a modest 3.12% upside. This suggests a cautious but slightly optimistic view on the stock’s valuation.

- Alexander Goldfarb from Piper Sandler continues with a “Buy” rating, raising the price target from $116 to $122 on December 20, 2023, which implies a substantial 20.97% upside. This indicates strong confidence in the stock’s market position and growth prospects.

- Haendel St. Juste, also from Mizuho, maintains a “Hold” rating but adjusted the price target down from $101 to $98 on December 1, 2023, resulting in a -2.83% downside. This revision suggests some concerns or a cautious approach to the stock’s future valuation.

Insider Trading

Over the past 6-12 months, insider transactions for the stock have shown a mix of activities that could be of interest to investors assessing the company’s internal sentiment. Notably, a significant sell transaction by Donald C Wood, the CEO, involved 20,345 shares at a price of $98.7452, resulting in a transaction value of over $2 million. This sell-off reduced his holdings to 328,326 shares, indicating a substantial move but still leaving him with a significant stake in the company, amounting to a 0.4027% holding. This action could suggest various interpretations, such as portfolio diversification or cashing in on stock performance, but it certainly marks a notable reduction in his investment in the company.

Similarly, Jeffrey S Berkes, the COO, and Daniel Guglielmone, the CFO & Treasurer, also engaged in sales of their holdings, with Berkes selling 4,870 shares at $94.86 each and Guglielmone making two separate sales amounting to a total of 1,259 shares sold at prices above $99. These sales, while smaller in scale compared to the CEO’s, still indicate a pattern of insiders taking profits. Guglielmone’s activities are particularly interesting, showing a consistent decision to sell post-exercise, possibly to realize gains or for personal financial planning. On the other hand, the awards granted to insiders such as Thomas A McEachin, Gail P Steinel, and others, which are typically part of compensation packages, don’t directly indicate market sentiment but do increase the individual’s stake in the company, albeit slightly in terms of percentage held. These activities provide a nuanced view of insider confidence, with significant sales potentially signaling a moment for caution among investors, while awards increase insider alignment with shareholder interests.

Dividend Metrics

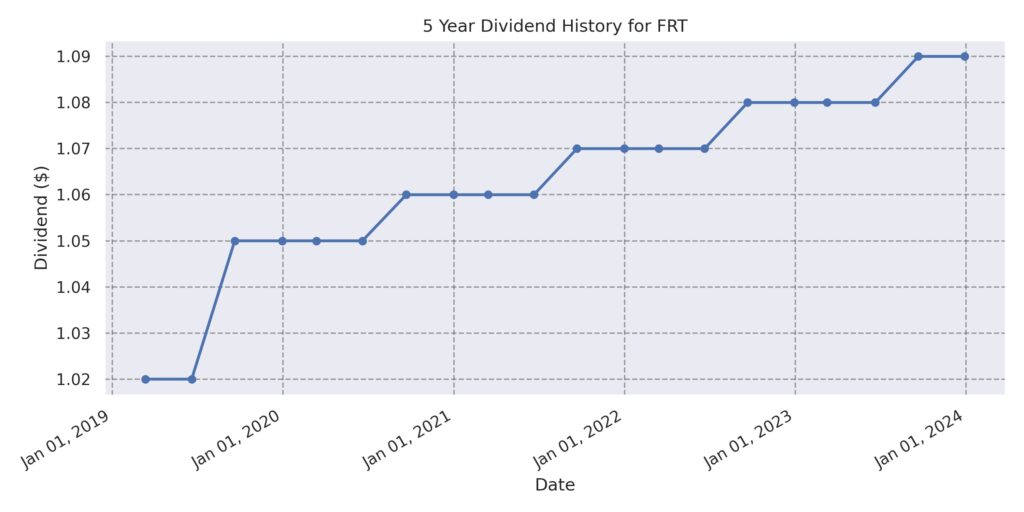

Federal Realty Investment Trust, recognized by its symbol FRT, has demonstrated a strong track record in its dividend history, with 55 consecutive years of dividend increases. This consistency in enhancing shareholder value is reflected in a solid yield of 4.21%, which showcases the trust’s commitment to delivering returns to its investors. In the last year, the trust achieved a 4.60% growth in revenue, indicating a positive trajectory in its operational performance. However, this positive operational momentum contrasts with the one-year return percentage, which stood at -7.53%, highlighting a potential disconnect between the company’s operational achievements and market performance.

Moving on to the dividend growth rate, FRT has seen a modest increase of 1.77% over the past five years. This growth rate, while conservative, demonstrates the trust’s stability and a careful balance between maintaining income for investors and reinvesting in the business. The average yield over five years has hovered around 4.05%, slightly below the current yield, which might suggest an improving dividend outlook. The negative one-year return does bring to light the challenges that REITs face in the market, often heavily influenced by broader economic conditions and interest rate movements. However, FRT’s longstanding history of dividend increases places it among the elite group of dividend kings, underscoring its resilience and strategic financial management.

Dividend Value

Federal Realty Investment Trust, with its long-standing history of increasing dividends for 55 years, presents a compelling yield profile when examined through the lens of its current yield relative to its 5-year average. Currently offering a 4.21% yield, it stands noticeably above the 5-year average of 4.05%. This indicates a favorable scenario for income-focused investors, suggesting that the trust has not only committed to but has also managed to sustain and increase shareholder returns over time. The slight uptick in yield also reflects a resilience that might appeal to those looking for stability in their income-generating investments, especially within the typically consistent realm of REITs. Despite the higher yield potentially raising questions about sustainability given the 125% payout ratio, investors might find reassurance in the trust’s history and market position, inferring a level of confidence in the trust’s future revenue and dividend-paying capabilities.

Income statement Analysis

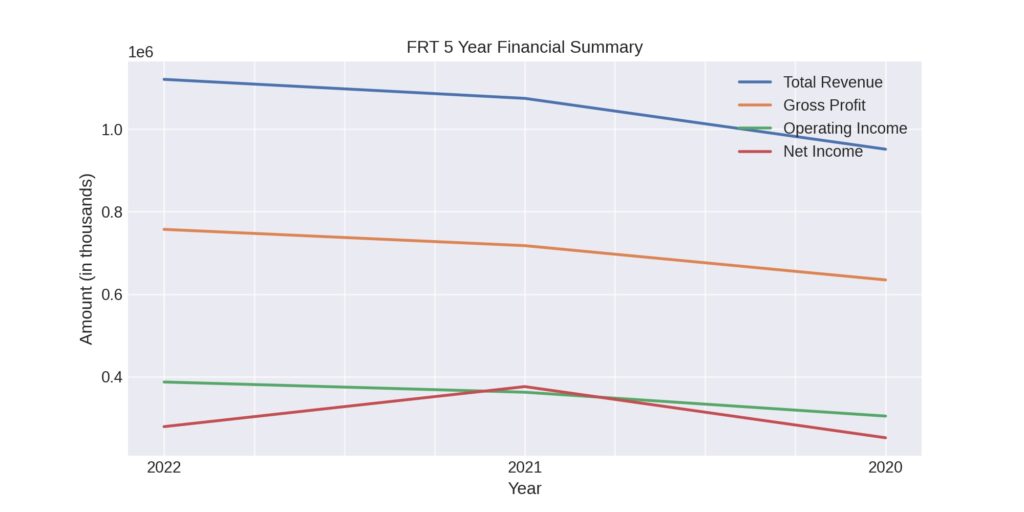

In a performance that might make even the most stoic of accountants raise an eyebrow, Federal Realty Investment Trust showcased a revenue climb up the financial ladder, topping at $1.12 billion TTM as of December 2022. This ascent represents a consistent year-over-year increase from $835.5 million in 2020—a testament to the trust’s sturdy revenue-generating steps, even when the economic dance floor has seen better days.

Diving into the pool of numbers, the operating income did a graceful dive from the high board, reaching nearly $387 million TTM, compared to the more modest $248.6 million splash made in 2020. It’s worth noting, however, that net income for common shareholders also enjoyed a similar uptick, arriving at a cozy $279.2 million TTM. It’s almost as if the trust’s income statement is saying, “Keep calm and carry on collecting rent,” reflecting a business model that’s less about thrilling twists and more about the slow and steady wins the race—especially when that race involves a 55-year streak of dividend growth.

Balance sheet Analysis

In the land of real estate investment trusts (REITs), where cash flow is king, the balance sheet of Federal Realty Investment Trust stands like a well-constructed plaza. At the close of the most recent TTM period, the company’s total assets stood at a sturdy $8.23 billion. Now, that’s not exactly pocket change you find under couch cushions. These figures show a consistent climb from $7.62 billion the year before, indicating that the trust is more builder than demolisher when it comes to its asset portfolio.

Liabilities, the necessary evil of any business, didn’t put a dent in the Trust’s fiscal facade, totaling just over $5 billion. Equity, the true measure of a company’s worth, is like the foundation of a building, and for Federal Realty, it’s as solid as the concrete in a shopping center’s foundation, accumulating to $3.21 billion. Not to be overshadowed, the company’s net tangible assets also saw a healthy uptick, demonstrating that their tangible worth isn’t just in prime locations, but also in the numbers. While the working capital might have seemed like someone misplaced the rent checks for a moment, it’s a minor blip in an otherwise robust financial picture.

Cash Flow Statement Analysis

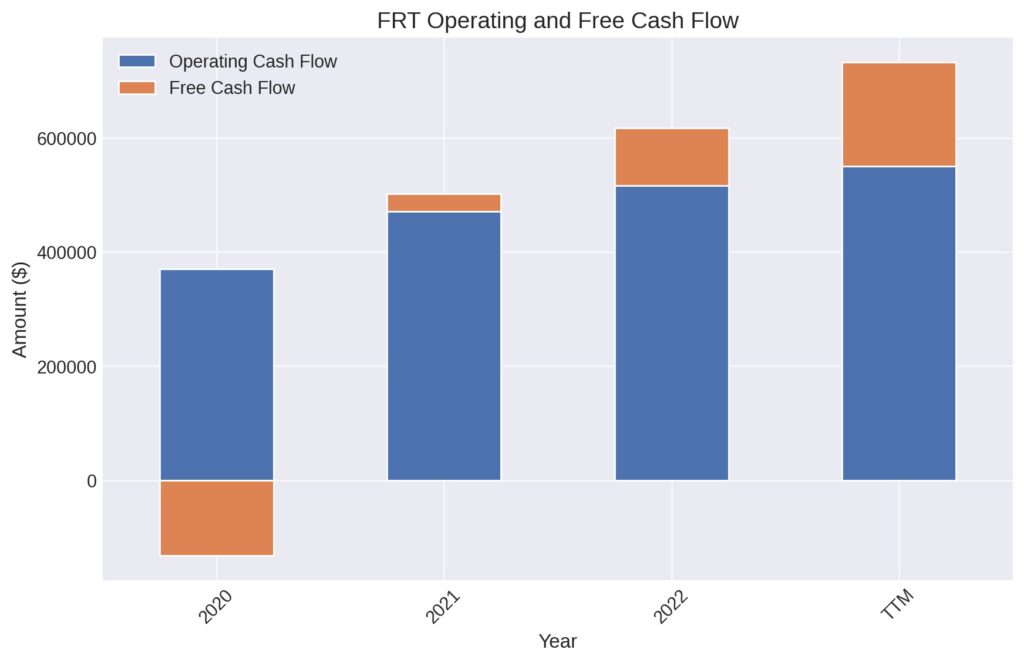

For the trailing twelve months, their operating cash flow was a robust $550,691, a solid increase from the previous year’s $516,769. This figure is a testament to the trust’s ability to generate reliable cash flow, as steady as the foot traffic in their shopping centers.

On the flip side, FRT’s investing cash flow paints a picture of strategic investment, with an outflow of $404,485. This isn’t surprising for a REIT, which is required to continuously invest in property to ensure growth and stability. It’s part of the deal – quite literally – when you’re in the business of commercial real estate. Financing activities, however, had their ups and downs, culminating in a cash flow shift to -$202,051. But let’s not dwell on the drama of finance – after all, for a REIT like FRT, it’s all about building a portfolio brick by brick, or in this case, dollar by dollar.

SWOT Analysis

Strengths:

- Diverse Property Portfolio: Federal Realty boasts a varied portfolio of retail properties, which includes high-end shopping centers and mixed-use developments. This diversity helps in risk management and attracts a broad tenant base.

- Strategic Locations: Their properties are often situated in affluent regions with high consumer spending, contributing to steady rental income streams.

- Experienced Management: The trust is managed by a team with a solid track record in real estate, demonstrating strategic foresight in acquisitions and developments.

Weaknesses:

- Market Sensitivity: As a REIT, the performance is closely tied to the health of the real estate market, which can be volatile and influenced by economic downturns.

- Tenant Dependence: Relying on tenants’ business success, particularly retail, means that a shift in consumer behavior or economic stress could affect rental revenues.

Opportunities:

- E-commerce Resistance: Federal Realty’s focus on locations with experience-based retail offers some resistance against the e-commerce trend that challenges traditional retail spaces.

- Development Projects: There are opportunities to further increase value through development and redevelopment projects, adapting to changing consumer preferences and urban growth.

Threats:

- Economic Fluctuations: Interest rate hikes and economic slowdowns can negatively impact property values and investment capacity.

- Changing Retail Landscape: The ongoing shift towards online shopping could continue to pressure the retail sector, impacting tenants’ ability to pay rent.

Competitors

Federal Realty Investment Trust, as a prominent player in the retail real estate sector, faces competition from several key industry participants. Among these competitors are Simon Property Group, known for its extensive portfolio of shopping malls and premium outlets across the United States; Regency Centers Corporation, which specializes in owning, operating, and developing grocery-anchored shopping centers; Kimco Realty Corporation, focusing on open-air, neighborhood, and community shopping centers; Brixmor Property Group, which owns and operates a significant number of open-air shopping centers; and Macerich, which focuses on the management and development of high-end shopping centers. Each of these competitors has its unique strategy and market focus, contributing to the dynamic nature of the retail real estate market.