Black Hills Corporation (BKH) stands out in the utility sector for its impressive track record of increasing its dividend for 52 consecutive years, earning it the prestigious title of a Dividend King. This achievement reflects the company’s strong financial health and commitment to returning value to its shareholders, underscoring the reliability that investors cherish. Based in Rapid City, South Dakota, Black Hills Corporation operates as a diversified energy company in the United States, engaging in electric and natural gas utility businesses across eight states.

A unique facet of Black Hills Corporation is its deep-rooted history, which dates back to 1883, making it one of the oldest energy companies in the U.S. This longevity has allowed it to develop a broad and loyal customer base, serving over 1.2 million electric and natural gas utility customers. The company’s sustained growth and expansion into various energy sectors, including power generation, mining, and exploration, demonstrate strategic adaptability and a keen eye for evolving market opportunities.

Beyond its financial achievements, Black Hills Corporation is also known for its commitment to sustainability and renewable energy. It has made significant investments in wind and solar projects, aiming to reduce its carbon footprint and support the transition to cleaner energy sources. This commitment to environmental stewardship, combined with its financial discipline and historic dividend growth, positions Black Hills Corporation as a notable player in the energy industry, balancing tradition with forward-looking innovation.

Analyst Ratings

- Anthony Crowdell of Mizuho upgraded the rating from Sell to Hold with a price target of $53 on Nov 21, 2023, indicating a perceived stabilization or slight improvement in the company’s outlook, with a modest upside potential of +6.19%.

- Julien Dumoulin-Smith of B of A Securities maintained a Sell rating but lowered the price target from $60 to $49 on Nov 20, 2023, suggesting a more bearish outlook on the stock with a slight downside of -1.82%.

- Shelby Tucker of RBC Capital maintained a Hold rating but adjusted the price target from $68 to $61 on Sep 6, 2023, offering a significant upside potential of +22.22%, possibly reflecting a conservative yet optimistic view on the company’s growth prospects.

- Sarah Akers of Wells Fargo maintained a Hold rating with a revised price target from $66 to $62 on Aug 4, 2023, indicating a positive adjustment with an upside potential of +24.22%, suggesting that the stock may offer value at its current price point.

- Throughout the period, Anthony Crowdell of Mizuho shifted his stance from Sell to Hold while progressively lowering his price target from $60 to $53, reflecting adjustments to the company’s valuation based on evolving market conditions and possibly internal performance metrics, ultimately settling on a more neutral outlook by the end of the year.

Insider Trading

Based on the provided transactions for the stock over the last 6-12 months, we observe a mix of insider selling and awards:

- Keller D Erik (CIO) sold 860 shares post-exercise at $56.89 each on August 5, 2023, totaling $48,900, leaving him with 7,223 shares. This transaction could indicate a profit-taking action following the exercise of options, which is relatively common among executives but does not necessarily signal a lack of confidence in the company’s future prospects.

- Richard Kinzley executed a significant sell transaction on May 8, 2023, disposing of 10,033 shares at $65.49 each for a total of $657,061, and concurrently reported a giveaway of 1,019 shares. Post these transactions, his holdings remained at 35,557 shares. Such a sizable sale may raise eyebrows, yet without context regarding Kinzley’s personal portfolio strategies or company performance at the time, it’s challenging to draw definitive conclusions.

The other transactions listed are awards, not direct buys or sells, indicating that the company is rewarding its executives and board members, which is a common practice to align their interests with the company’s success. These awards don’t necessarily provide direct insights into the insiders’ views on the stock’s future performance but do enhance their stake in the company’s growth.

Overall, while there is a notable sale from Kinzley, the singular nature of sell transactions within this timeframe doesn’t suggest a broad insider sentiment against the company’s stock. Insider actions can be influenced by various factors, including personal financial planning, and should not be viewed in isolation when assessing a stock’s potential.

Dividend Metrics

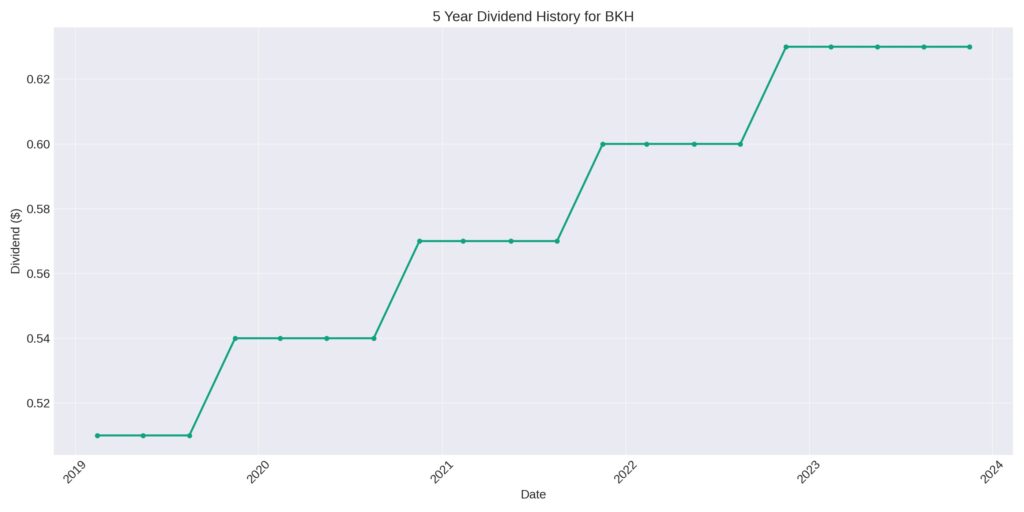

Black Hills Corporation (BKH) has demonstrated a commendable commitment to increasing its dividends for 52 consecutive years, which places it within the esteemed ranks of Dividend Kings, a testament to its long-term stability and reliability. Currently, the stock offers a generous yield of 4.99%, surpassing the five-year average yield of 3.41% by a significant margin. This higher yield, juxtaposed against the backdrop of a challenging year with a 1-year revenue decline of 12%, reflects a potentially attractive income investment, albeit with an acknowledgment of recent performance headwinds.

The company’s dividend growth rate over the last five years stands at 6.32%, underscoring its ability to grow shareholder value consistently. However, investors have faced a rough patch, as indicated by the 1-year return of -28.04%, which paints a sobering picture of the stock’s recent market performance. A payout ratio of 64% suggests that the company is managing to return a substantial portion of its earnings to shareholders in the form of dividends, which might be appealing to income-focused investors despite the recent downturn in stock price.

Dividend Value

Black Hills Corporation has demonstrated a robust commitment to returning value to shareholders, as evidenced by its 52 consecutive years of dividend increases. Currently offering a dividend yield of 4.99%, the company stands out in the market, especially when compared to its five-year average yield of 3.41%. This marked increase in yield suggests that investors are getting a significantly higher return on their investment from dividends alone compared to the company’s historical average. The high payout ratio of 64%, however, may raise questions about sustainability; although, it should be noted that the company’s track record may offer some reassurance to investors about the management’s ability to maintain dividend payments.

The contrast between the current yield and the five-year average yield could be appealing to income-focused investors, especially those who prioritize steady dividend income. The increased yield also reflects the recent price decline, as evidenced by the -28.04% one-year return, which may offer an attractive entry point for investors who believe in the company’s fundamentals and long-term prospects. With the assumption that dividends will remain stable, Black Hills Corporation could be considered a valuable stock for those seeking to leverage the company’s long history of consistent dividend growth and potentially undervalued share price.

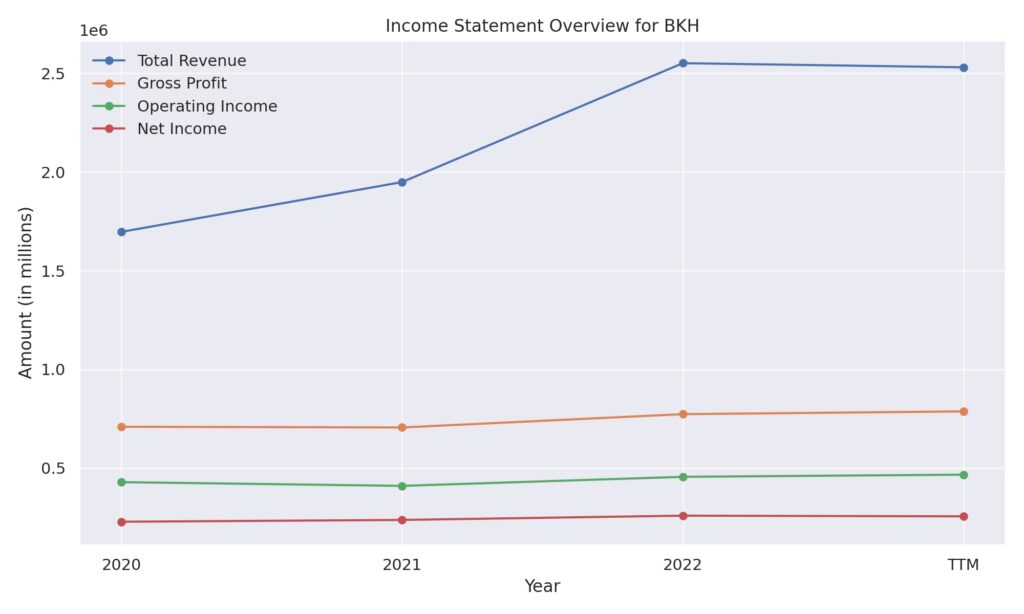

Income statement Analysis

Amidst the sea of numbers that is the income statement for Black Hills Corporation, the narrative is one of subtle steadiness rather than dramatic twists and turns. The total revenue has seen a modest dip from 2,551,816 to 2,531,007 in the trailing twelve months, suggesting a slight detour rather than a full-on roadblock in revenue generation. The cost of revenue, standing guard at 1,744,074, whispers of costs that are keeping pace with income, leaving a gross profit that would make a small village green with envy at 786,933.

As we wade through the operational expenses, which seem to have taken a leaf out of a tortoise’s book at 320,740, operating income has clocked in at a comfortable 466,193, a nod to effective cost management. Meanwhile, the net interest income appears to have taken a slight tumble down the hill, with a figure of -169,684. The pretax income and net income for common stockholders, at 293,973 and 254,993 respectively, wave the flag of profitability, albeit without the fireworks. Basic and diluted earnings per share both strut around the 3.85 mark, revealing earnings stability that would likely bore an adrenaline junkie. All in all, the financial synopsis of Black Hills Corporation presents a picture of a company that’s less about the high-octane thrills and more about the steady journey through the fiscal landscape.

Balance sheet Analysis

In the fiscal landscape of Black Hills Corporation, the asset garden has been steadily blossoming, reaching a plush greenery of $9.62 billion in 2022. This growth is no small potatoes, considering the assets stood at just over $8 billion back in 2020 – that’s a neat little increase without breaking a sweat. On the other side of the fence, liabilities have been playing catch-up, hiking from $5.43 billion to $6.53 billion in the same period, almost like they’re trying to keep the asset growth company.

Equity, the true measure of the shareholders’ stake, has seen a decent climb up the value hill, sitting pretty at $3.09 billion in 2022, a gentle nudge up from $2.66 billion in 2020. It’s worth noting the tangible book value, which strips out the intangible assets to give us the hard figures, rose to $1.69 billion. This gives investors a more down-to-earth look at the company’s worth. Meanwhile, the debt department has been busy, ringing up numbers to the tune of $4.67 billion. It seems like Black Hills Corporation has been building a mountain of assets and equity, but there’s a valley of debt not far behind.

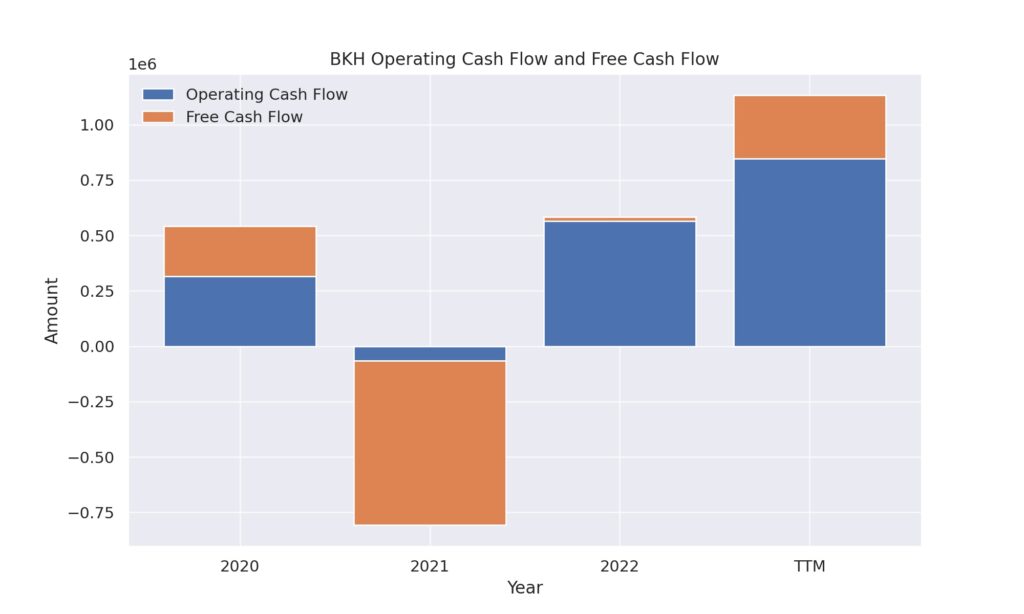

Cash Flow Statement Analysis

In the financial year that the trailing twelve months encapsulate, the company has steered its operating cash flow to a comfortable $846,566, quite the leap from the previous years, where it once dipped its toes into the negative waters. It’s not just the numbers that are operating smoothly, as this flow could almost be likened to a well-oiled machine, except, of course, without the oil or the machine.

On the adventure of investing activities, the company scaled back, spending $541,344, an effort that’s less intense than the previous year’s treasure hunt for assets. Financing activities, however, brought in a fresh breeze of $278,188, as if the company found a secret stash from a forgotten piggy bank. It’s a change in the wind from the turbulent gusts of previous years, which saw debts being paid off like a spender’s remorse after a shopping spree. The end cash position, sitting prettily at $600,502, is like a cherry on top of a fiscal sundae, sweetening the whole picture of the year’s cash comings and goings.

SWOT Analysis

Strengths:

- Diverse Energy Portfolio: With a mix of natural gas and electric utilities, the company maintains a diverse portfolio which could provide stability against market volatility.

- Long-Term Customer Contracts: These offer predictable cash flow and reduce exposure to short-term market fluctuations.

- Dividend History: A track record of increasing dividends can be indicative of financial health and management’s confidence in the company’s profitability.

Weaknesses:

- Regulatory Risks: Being in the utility sector, the company faces significant regulatory scrutiny, which can impact operations and profitability.

- Capital Intensity: The nature of the utility business requires continual investment in infrastructure, which can strain finances especially if not managed effectively.

Opportunities:

- Renewable Energy Expansion: There’s an opportunity to invest more in renewable energy sources to meet increasing demand and regulatory requirements for clean energy.

- Technological Advancements: Investing in technology to improve grid management and efficiency can lead to long-term cost savings and improved service reliability.

Threats:

- Market Competition: The energy market is becoming increasingly competitive, especially with the rise of renewable energy providers.

- Economic Downturns: Economic instability can lead to decreased energy consumption and put pressure on revenues.

- Environmental Regulations: Stricter environmental regulations could require additional investments to comply, impacting the company’s financials.