Colgate-Palmolive (CL) is a leading global consumer products company, well-known for its focus on oral care, personal care, home care, and pet nutrition products. With its iconic brand, Colgate, the company has established a strong presence in over 200 countries, providing products that are essential in daily hygiene routines.

Colgate-Palmolive’s commitment to innovation, sustainability, and social responsibility has helped it maintain a competitive edge in the consumer goods industry. A significant aspect of its financial health and attractiveness to investors is its consistent dividend policy. Colgate-Palmolive has achieved a remarkable feat by increasing its dividend for 59 consecutive years, making it a member of the prestigious group known as the Dividend Kings.

This group comprises companies that have a history of raising their dividends for at least 50 consecutive years. This track record reflects the company’s stable earnings, strong cash flow generation, and commitment to returning value to shareholders, making it a potentially attractive investment for those looking for steady income through dividends.

Analyst Ratings

– Dara Mohsenian from Morgan Stanley maintains a “Buy” rating with a price target increase from $85 to $93, indicating a potential upside of +10.60% (Date: Jan 29, 2024).

– Peter Grom of UBS maintains a “Strong Buy” rating with a price target increase from $93 to $95, suggesting a potential upside of +12.97% (Date: Jan 29, 2024).

– Chris Carey from Wells Fargo maintains a “Hold” rating with a price target increase from $80 to $88, showing a potential upside of +4.65% (Date: Jan 29, 2024).

– Olivia Tong at Raymond James upgrades the rating from “Hold” to “Buy” with a new price target of $91, indicating a potential upside of +8.22% (Date: Jan 29, 2024).

– Andrea Teixeira from JP Morgan maintains a “Buy” rating with a price target increase from $88 to $90, suggesting a potential upside of +7.03% (Date: Jan 18, 2024).

– Lauren Lieberman of Barclays maintains a “Hold” rating with a price target increase from $75 to $82, indicating a potential downside of -2.49% (Date: Jan 16, 2024).

Insider Trading

Analyzing the buy and sell transactions for the stock over the last 6-12 months, while ignoring awards and transfers, we observe the following patterns in insider activity:

Insider Sales:

- Significant Sales Post-Exercise: There have been several instances of insiders selling shares post-exercise of options, at prices that generally indicate a profit from the exercise price. For example, Gregory Malcolm, Jennifer Daniels, Deshamanya C Martin Harris, Panagiotis Tsourapas, and Noel R Wallace executed sales post-exercise, with transaction totals amounting to considerable sums, indicating a common strategy of exercising options and selling the acquired shares at market price for profit.

- Prices and Profits: The sale prices ranged from $73.8501 to $85.3510 per share, with transaction totals varying significantly, from as low as $3,642 to as high as $5,172,697 (Jennifer Daniels on 02/01/24), reflecting both the varying number of shares sold and the market price at the time of sale.

Insider Buys:

- Contract Buys: There were contract buys by insiders, including John P. Bilbrey, Lorrie M Norrington, Lisa M Edwards, and Steven A. Cahillane, at prices ranging from $72.7600 to $78.1800 per share. These buys are relatively small compared to sales, indicating a cautious approach to acquiring stock or fulfilling contractual obligations.

Key Observations:

- Exercise and Sell Strategy: A notable pattern is the exercise of options followed by immediate sales, suggesting insiders are taking advantage of the difference between the market price and their exercise price to realize gains.

- Post-Exercise Sales Dominance: The majority of transactions by insiders are sales following the exercise of options, indicating that insiders may view the current stock prices as favorable for taking profits.

- Limited Direct Purchases: Direct purchases (contract buys) by insiders are less frequent and involve smaller amounts of shares compared to sales, which could suggest a varied perspective on the stock’s future performance among insiders.

Conclusion:

Over the past 6-12 months, insider activity in the stock has been characterized by a significant number of sales post-exercise of options, reflecting a strategy to capitalize on the difference between exercise prices and market prices. Direct insider buys are present but less significant in volume, highlighting a cautious or strategic approach to increasing holdings in the stock.

Dividend Metrics

The Colgate-Palmolive Company, trading under the symbol CL, has consistently raised its dividend for 59 years, showcasing a strong commitment to shareholder returns. The current dividend yield stands at 2.28%. Over the past five years, the company has seen its dividend grow by an average of 3% annually.

Revenue growth over the last year has been healthy at 6.90%, reflecting a positive trend in the company’s earnings. Despite this growth, the payout ratio is quite high at 68%, which suggests that a significant portion of earnings is being distributed as dividends. Over a five-year period, the average dividend yield has been slightly higher at 2.37%, indicating a stable return for investors seeking income. The stock has also delivered a solid one-year return of 12.32%, which is reflective of both the company’s performance and investor confidence in its stock.

Dividend Value

The Colgate-Palmolive Company (CL) currently presents a dividend yield of 2.28%, which, when compared to its 5-year average yield of 2.37%, is slightly below the longer-term average. This comparative deficit indicates that, at present, the stock may be offering a marginally lower income return for investors relative to its own historical yield performance.

Such a yield analysis could suggest that the stock might be slightly overvalued based on dividend returns alone, as investors are receiving a slightly lower return on investment in terms of dividend income. This also implies that the market price of the stock has increased at a pace that surpasses the growth of its dividend payouts, leading to a reduced yield. Investors looking for income might find this yield discrepancy a consideration for their investment decision, weighing the current yield against historical averages to determine the attractiveness of the stock in terms of value. However, this does not account for potential capital gains or other strategic investor considerations and is strictly a reflection of yield performance against a historical benchmark.

Income statement Analysis

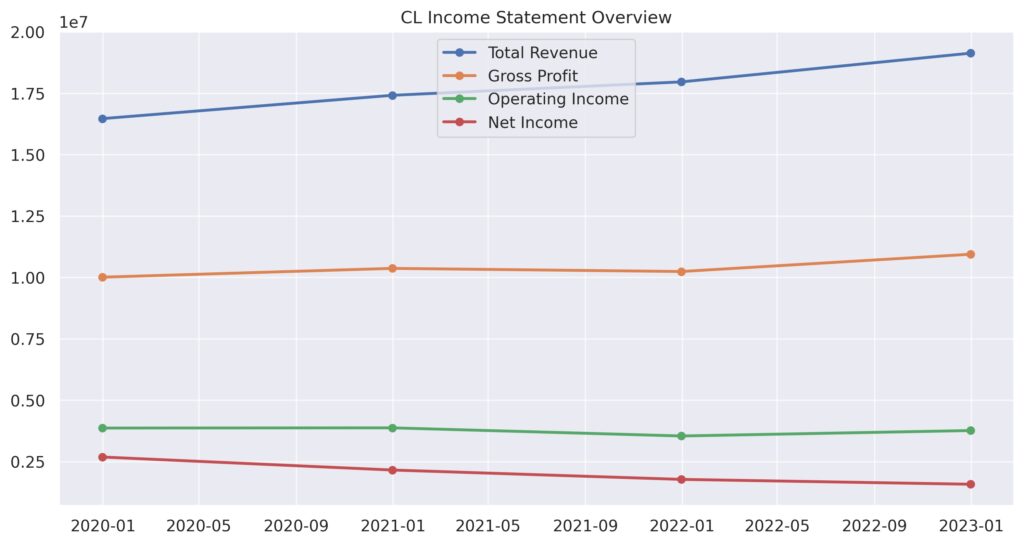

The revenue story for our protagonist, the Colgate-Palmolive Company, reads a bit like a “whodunit” with a twist: the numbers keep going up. From 2019 to 2022, total revenue climbed steadily from $16.47 billion to an impressive $19.14 billion, as if the sales team mistook growth targets for temperature readings and decided to set them ever higher. This upward trend wasn’t just a fluke; it’s as if their products found their way into more bathrooms and kitchens globally, with the exception of 2021, where gross profit played a little hide and seek, peeking slightly lower than in 2020.

Diving into the sea of numbers, the cost of revenue also decided to keep pace with the total revenue, as if saying, “You go up, I go up,” rising from $6.45 billion in 2019 to $8.19 billion in the trailing twelve months ending December 2022. Meanwhile, operating income seemed to have ridden a modest merry-go-round, reaching highs and lows from $3.88 billion in 2020 to a more grounded $3.77 billion in 2022. The net income available to common stockholders, however, decided to take a different path, diminishing from $2.69 billion in 2019 to $1.59 billion in 2022, perhaps after deciding that a diet was in order. Basic and diluted EPS figures echoed this, shrinking from 3.15 and 3.14 to 1.92 and 1.91 respectively, as if the EPS figures went on a New Year’s resolution spree to trim down.

Balance sheet Analysis

The balance sheet of Colgate-Palmolive Company tells a story of assets and liabilities doing a delicate tango, where total assets increased from $15.04 billion in 2021 to $15.73 billion in the trailing twelve months ending December 2022. It’s as if the assets got a motivational speech and decided to bulk up for the fiscal fitness contest. Liabilities, not wanting to be left behind, also heaved up from $14.07 billion to nearly $14.93 billion in the same period, mirroring the asset’s growth with a competitive spirit. Equity, however, seems to have misunderstood the assignment, shrinking from $1.10 billion in 2020 to $806 million, almost as if it went on a diet without telling anyone.

Diving deeper, the tangible book value has been submerged in negative territory, sinking even lower from -$5.97 billion in 2020 to -$4.87 billion, suggesting that when it comes to tangible assets, Colgate-Palmolive might be playing a game of limbo, challenging itself to go lower. Meanwhile, total debt has risen sharply to $9.27 billion, as if the company saw low-interest rates and couldn’t resist swiping the corporate credit card. On the flip side, working capital turned from a negative $66 million to a positive $1.11 billion, hinting that the company’s short-term financial health got a rejuvenating spa treatment. Overall, the balance sheet paints a picture of a company that’s not afraid to leverage up and invest, even if its equity is on a vanishing act.

Cash Flow Statement Analysis

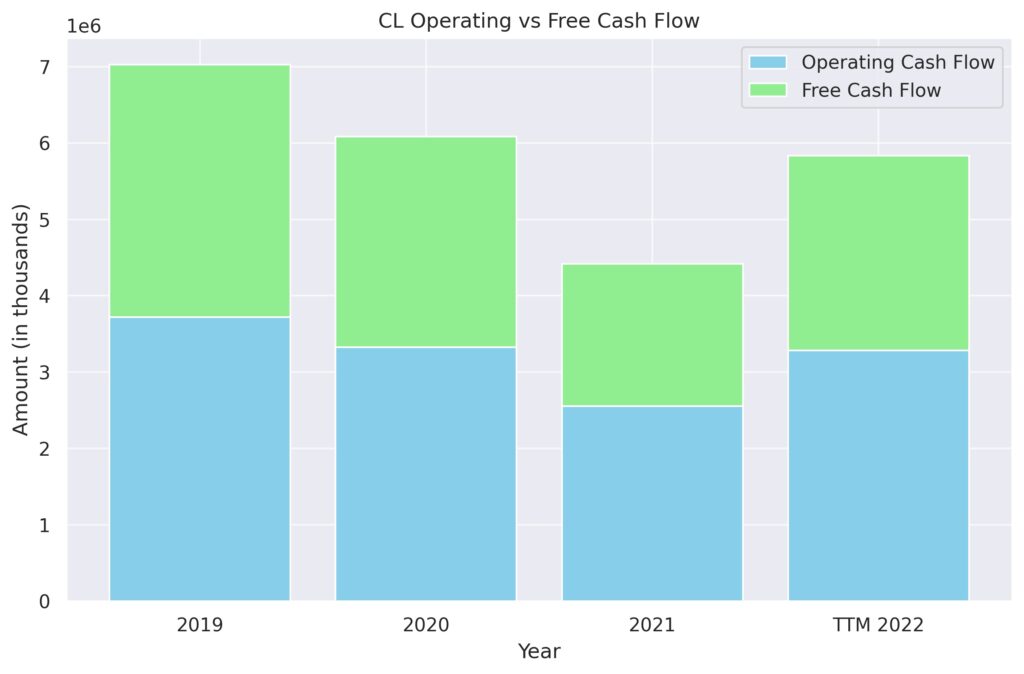

In the fiscal narrative of Colgate-Palmolive Company, the Operating Cash Flow has made a commendable leap from $2.56 billion in 2021 to $3.28 billion in the TTM, as if the company’s cash registers were doing extra reps at the gym. This influx is like the lifeblood for the company, suggesting that its operational health is robust and the business is adept at converting its toothpaste and soap sales into cold, hard cash. The Investing Cash Flow, meanwhile, has a plot twist, improving from a spendthrift -$1.6 billion to a more conservative -$772,000, possibly indicating a strategic pause in treasure hunting for new assets or a newfound frugality.

As for Financing Cash Flow, it looks like someone opened the monetary floodgates, rushing out from -$952,000 to a more torrential -$2.47 billion, almost as if the company decided to pay back a friend it had been owing for ages. Amidst this, the End Cash Position grew modestly from $775,000 to $981,000, resembling a squirrel that’s been slightly more successful at hoarding nuts for the winter. Capital expenditures have remained consistent, showing a commitment to reinvestment, whereas debt maneuvers have been a dance of issuance and repayment, reflecting a dynamic approach to managing leverage. Free Cash Flow, the oxygen to the company’s ambitions, has taken a slight dip from its 2020 peak but remains in the healthy billions, indicating the company’s enduring ability to keep its financial lungs inflated without gasping for breath.

SWOT Analysis

A SWOT analysis for Colgate-Palmolive (CL) involves examining the company’s internal strengths and weaknesses, as well as external opportunities and threats. This analysis provides insights into the company’s competitive position and potential strategic directions.

Strengths:

- Brand Recognition: Colgate-Palmolive boasts strong brand recognition worldwide, especially for its flagship Colgate oral care products, positioning it as a leader in several markets.

- Diverse Product Portfolio: The company’s diverse range of products across oral care, personal care, home care, and pet nutrition reduces its dependence on a single market segment.

- Global Presence: With operations in over 200 countries, Colgate-Palmolive benefits from a broad geographic footprint, enabling it to tap into emerging markets and spread its risk.

- Consistent Dividend Growth: As a Dividend King, having increased its dividend for 59 consecutive years, CL demonstrates strong financial health and commitment to returning value to shareholders.

Weaknesses:

- Competition: The company faces intense competition in all its segments from other global giants and local players, which can pressure margins and market share.

- Reliance on Retail Channels: Changes in retail landscapes, such as the growth of e-commerce and discount retailers, could disrupt traditional sales channels.

- Product Recalls and Legal Challenges: Occasional product recalls and legal challenges can harm the brand’s reputation and result in financial losses.

Opportunities:

- Expansion in Emerging Markets: Increasing disposable incomes and consumer awareness in emerging markets present opportunities for growth, especially in oral and personal care segments.

- Innovation and Sustainability: There’s growing consumer interest in sustainable and innovative products. Investing in eco-friendly practices and product innovations could attract a broader consumer base.

- Digital Transformation: Enhancing digital marketing strategies and e-commerce capabilities can cater to the changing shopping behaviors, improving sales and customer engagement.

Threats:

- Regulatory Risks: The company operates in a highly regulated environment. Changes in regulations, especially related to health and environmental standards, can impact operations and costs.

- Currency Fluctuations: As a global company, Colgate-Palmolive is exposed to currency exchange risks, which can affect its financial results.

- Global Economic Downturns: Economic recessions in key markets can reduce consumer spending on non-essential goods, impacting sales.

This SWOT analysis highlights Colgate-Palmolive’s solid market position and avenues for growth, balanced by challenges from competition, market conditions, and regulatory environments. Strategic investments in innovation, sustainability, and digital channels, along with a focus on expanding in high-growth markets, could further strengthen its competitive edge.

Competitors

Colgate-Palmolive (CL) faces stiff competition in the consumer goods sector, particularly in oral care, personal care, home care, and pet nutrition. Its top five competitors are global companies with diverse product offerings and extensive market reach:

- Procter & Gamble (P&G): A powerhouse in the consumer goods industry, P&G competes across multiple segments with CL. With leading brands like Crest in oral care and Tide in home care, P&G’s extensive product portfolio and innovation capabilities present significant competition.

- Unilever: Another giant with a vast portfolio of brands across personal care, home care, and foods. Unilever’s products, such as Dove in personal care and Cif in home cleaning, directly compete with Colgate-Palmolive’s offerings, leveraging strong global distribution channels.

- Johnson & Johnson (J&J): While primarily known for its presence in the healthcare and pharmaceutical sectors, J&J also offers a range of consumer health products that compete with Colgate-Palmolive, especially in personal care categories.

- Henkel: A German multinational company that operates in both consumer and industrial sectors. In the consumer goods domain, Henkel’s brands like Persil, Schwarzkopf, and Dial compete with Colgate-Palmolive’s products, particularly in Europe and emerging markets.

- GlaxoSmithKline Consumer Healthcare (GSK): Prior to its merger with Pfizer’s consumer health division to form Haleon, GSK was a key competitor in the oral health segment with brands like Sensodyne and Aquafresh. The combined entity continues to be a strong competitor in the global oral care market.