Investment Highlights

- Chubb is a best of breed among P&C insurers for its strength in the high net-worth segment and strong cash yield.

- Low rates and a strong dollar could continue to weigh on shares this year but higher rates could come through in earnings soon.

- Shares are fairly valued and investors may want to wait for a better price o take a long-term position.

Chubb Corporation (NYSE: CB) is a $23.6 billion property & casualty insurer, primarily in the high net-worth and specialty insurance segments. Property & casualty insurers have had a tough time in the low-rate environment. They hold most of their assets in bonds to make sure they can meet policyholder claims. While bond prices have gone up over the last several years, returns for bonds held to maturity have offered very low payoffs.

Chubb does better than other insurers with its profitable high net-worth segment. The company was recently named the Insurance Solution award from the Family Wealth Report, following another reward in the high net-worth segment just a month earlier. Margins are better in this segment and there is less switching because of the requirement for appraisals on assets.

Following the general theme from other U.S. companies, Chubb CEO Joh Finnegan warned investors last week that the strong dollar could hit earnings this year. Chubb writes nearly a quarter of its premiums in international markets and takes a hit on profits when weaker currencies are translated back into the surging greenback.

The CEO warned that sluggish global economic growth could hit sales as well but asset prices continue to move higher even if general growth is slower. This should help support policy growth from high net-worth clients.

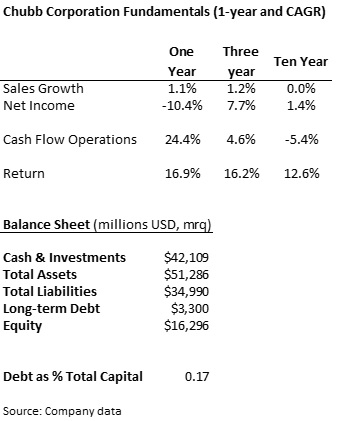

Fundamentals

Revenue growth has been sluggish and net income took a hit last year on a jump in policyholder benefits. Claims increased $465 million in 2014, 7% from the prior year. Management did a good job of cutting costs, decreasing Selling, General & Administrative expenses by 18% but this only decreased costs by $54 million.

Cash flow got a boost last year from a change in reserves for claims but this won’t be a repeatable event. Despite the weakness on the income statement and in cash flows, the company has an extremely healthy balance sheet. Short-term assets more than cover potential claims and debt is just 17% of the capital structure. Since insurance companies keep much of their assets in fixed-income bonds, paying very low rates presently, using debt to leverage up the balance sheet does not make as much sense as with other sectors.

Dividends and Growth

Shares of Chubb pay a 2.3% yield, slightly above the average 2.2% yield over the last five years. The company is only paying out 24% of earnings, under the 25% average over the last five years and leaving plenty of room for dividend growth.

The company has grown the dividend at a 7.9% pace over the past five years and has increased it for 28 consecutive years. Chubb has aggressively increased its buyback program over the last two years, up to $1.55 billion last year. In fact, the company has so consistently bought back shares that the diluted share count is down 42% since 2006. The diluted share count over the last eight years has been reduced by 179 million shares to 244 million.

Between the dividend and buyback program, the company returned just over $2 billion to shareholders for a total cash yield of almost 9% on the market capitalization.

Valuation

Shares trade for 13.3 times trailing earnings, well above the five-year average of 10.7 times earnings but only slightly above the industry average of 12.3 times earnings. The market is expecting a modes 2.4% increase in sales to $12.9 billion for 2015 but only a 0.6% increase in earnings to $7.68 per share.

Earnings over the last two quarters have surprised higher and I think the trend could continue for at least $8.20 in per share earnings accounting for fewer shares outstanding. Even on a surprise in earnings, the shares are still fairly valued and upside is probably limited. On forward earnings, the shares are already close to my $105 target for the next twelve months.

While higher rates towards the end of the year will help drive revenue and higher earnings, it could take a few quarters into 2016 before this really starts coming through. Even if the affect isn’t immediate, investor sentiment should support high valuations on the insurer group.

Shares of Chubb have provided a steady return even in the low-rate environment, mostly due to the strong cash yield on the shares. I am a little worried about the price of the shares and would put an alert at $94.30 to really get interested. This would be 7.6% below the current price and 11.5 times expected 2015 earnings.

Chubb is a nice stock to follow. I can’t say it’s among my favorite aristocrats yet. Maybe because I didn’t think it was fair value. Good analysis!