California Water Service Group (CWT) is a leading utility company specializing in water supply and wastewater services across the United States. With a history of providing reliable and high-quality water services, CWT has established itself as a significant player in the water industry, catering to both residential and commercial customers. Notably, CWT has demonstrated a strong commitment to rewarding its shareholders through consistent dividend payments. This commitment is evidenced by its impressive track record of increasing its dividend for 55 consecutive years, a feat that has earned it a coveted spot among the Dividend Kings.

The Dividend Kings are an elite group of publicly traded companies known for their exceptional dividend growth, having raised their payouts annually for at least 50 years. This achievement underscores CWT’s financial stability, operational efficiency, and dedication to delivering shareholder value over the long term. By maintaining a focus on sustainable business practices and strategic growth initiatives, California Water Service Group continues to solidify its position as a resilient and dependable investment in the utility sector.

Analyst Ratings

- Michael Gaugler from Janney Montgomery Scott upgraded the stock from Hold to Strong Buy on July 28, 2023, without specifying a price target.

- Jonathan Reeder from Wells Fargo upgraded the stock from Sell to Hold on June 28, 2023, adjusting the price target from $58 to $56, indicating a potential upside of +24.20%.

- Gregg Orrill from UBS downgraded the stock from Hold to Strong Sell on June 14, 2023, with a revised price target from $59 to $51, suggesting a potential upside of +13.11%.

Insider Trading

Analyzing the insider buying and selling transactions for the stock over the last 6-12 months, focusing on buy and sell activities and ignoring awards and transfers, we observe the following trends:

- Sell Transactions:

- Dr. Thomas M. Krummel engaged in multiple sell transactions, with the most recent one on January 3, 2024, selling 555 shares at $51.90 each. Earlier, on December 20, 2023, and December 6, 2023, he sold the same number of shares at slightly higher prices of $53.45 and $53.06, respectively. His transactions in November show sales of 555 shares at $51.7669 on the 15th and a larger transaction of 2,220 shares at $50.00 on November 2, 2023.

- Michelle R. Mortensen, the Corporate Secretary, sold 675 shares on December 12, 2023, at $52.56 each, and earlier, on June 3, 2023, she sold 115 shares post-exercise at a higher price.

- Martin A. Kropelnicki, Chair & CEO, had a notable post-exercise sale on December 3, 2023, of 559 shares at $51.69 each, and again on September 3, 2023, at $50.10 each.

- Other executives, including Michael B. Luu (CRO), Shannon C. Dean (Division VP.), Ronald D. Webb (HR), and more, have also been involved in sale post-exercise transactions, indicating a pattern of selling after exercising options across various dates and prices.

- Notable Price Variations: The transaction prices for sell activities ranged from around $50.00 to $57.0165, reflecting the stock’s market price fluctuations over the period.

- Shares After Transaction: After these transactions, the insiders held varying amounts of shares, with Martin A. Kropelnicki holding a significant amount, indicating a varied level of investment in the company by different insiders.

- Percentage Held After Transactions: The percentage of holdings after transactions also varied, with Dr. Thomas M. Krummel and Martin A. Kropelnicki showing a more considerable stake in the company compared to other insiders, which could indicate their confidence in the company’s future performance.

These transactions highlight a trend of insiders selling shares over the last 6-12 months, particularly through sale post-exercise transactions, which could be for personal financial management or other reasons not necessarily related to the company’s future outlook. The absence of buy transactions in the provided data suggests a lack of insider purchases during this period, which could be a point of interest for investors analyzing insider confidence in the stock’s future performance.

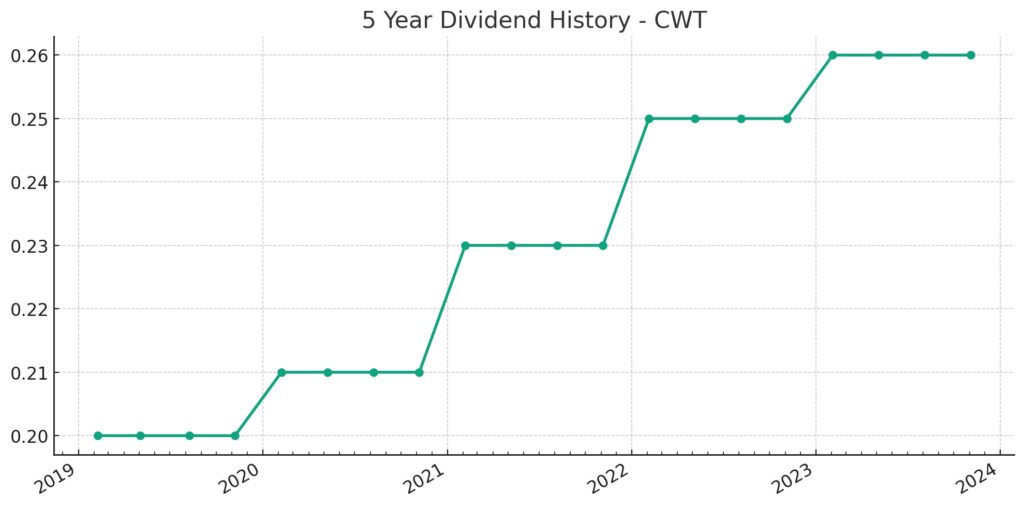

Dividend Metrics

The stock metrics for California Water Service Group (CWT) indicate a robust history of dividend reliability, with the company increasing its dividend for 55 consecutive years. The current dividend yield stands at 2.45%, while the five-year dividend growth rate is 6.37%, reflecting a consistent increase in dividend payments over time.

However, the one-year revenue growth percentage is at -4.30%, suggesting a recent downturn in revenue. The payout ratio is relatively high at 139%, which may raise concerns about the sustainability of the dividend if earnings are not sufficient to cover the payouts. Over a five-year period, the average yield has been 1.65%, which is lower than the current yield, indicating that the yield has been increasing. Lastly, the one-year return for CWT is -26.94%, showing that the stock has faced significant downward pressure in the market over the past year.

Dividend Value

The current yield of California Water Service Group (CWT) stands at 2.45%, which represents a substantial increase over its 5-year average yield of 1.65%. This marked elevation in the dividend yield could signal several potential market perceptions or operational shifts. A higher-than-average yield might suggest that the stock price has depreciated, offering investors an opportunity for a higher income return relative to the price paid per share.

Investors often view an elevated yield with cautious optimism, as it could indicate a stock that is undervalued or has been oversold, presenting a buying opportunity if the fundamentals remain strong.

On the other hand, a yield significantly above the historical average could also raise questions about the sustainability of the dividend in relation to earnings, despite the historical increases. Therefore, a comprehensive value analysis would weigh this current yield against the historical average within the broader context of market conditions, the company’s financial health, and industry trends, without making presumptions about the stability of future dividends.

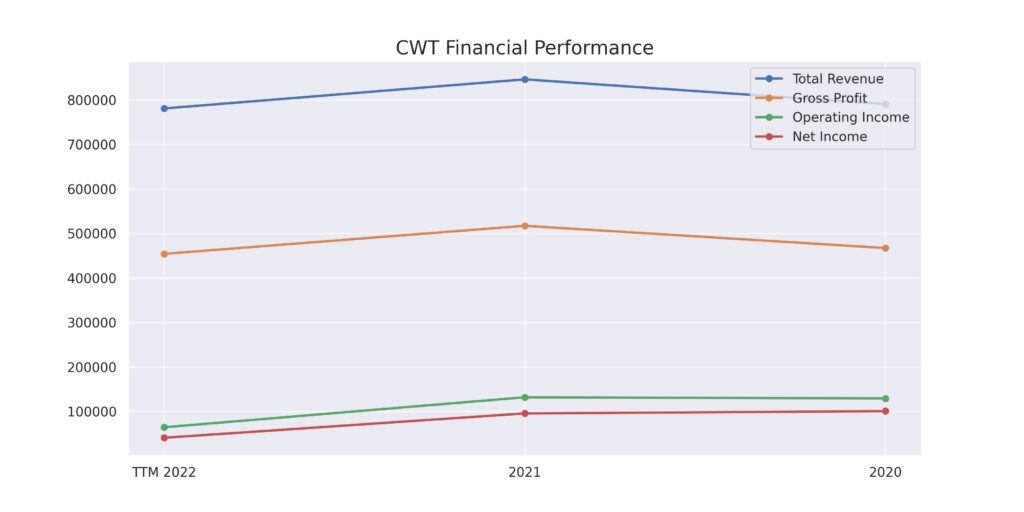

Income statement Analysis

California Water Service Group’s income statement over the trailing twelve months (TTM) ending December 31, 2022, paints a picture less vibrant than its preceding years. Total revenue took a dip from a bubbly $846,431 in 2021 to a more sedate $781,057, representing a slight descent that might have shareholders reaching for a financial dramamine. This comedown aligns with a rise in the cost of revenue, albeit marginally, from $318,306 in 2020 to $326,639, which, let’s face it, wasn’t the budget-friendly move customers were hoping for.

On the flip side, it wasn’t all about the numbers going south. The company maintained a relatively steady gross profit above the $450,000 mark, but it’s the operating income that took a notable slide from $146,430 in 2020 to $64,916, leaving us wondering if someone in the finance department isn’t secretly moonlighting as a downhill skier. The net income available to common stockholders also saw a reduction, dropping from a cheerful $101,125 in 2020 to a more modest $41,352, mirroring the trend in basic and diluted earnings per share (EPS), both of which halved faster than a magician’s act, from $1.97 in 2020 to $0.74 TTM. It’s not quite the magic trick shareholders applaud for, but it certainly keeps things interesting.

Balance sheet Analysis

The balance sheet for California Water Service Group reveals a treasure chest that’s been steadily filling up, with total assets climbing from $3,394,248 in 2020 to a more bloated $3,850,752 by the end of 2022. It’s a growth that could make even the most stoic accountant crack a smile. Liabilities, while also growing, seem to have taken a more leisurely path, stepping up from $2,472,904 in 2020 to $2,528,358 in 2022, which is a relief because nobody likes liabilities that multiply like rabbits in spring.

Equity investors will be popping the cork as the total equity has grown from a modest $921,344 to a more robust $1,317,590 over the same period, reflecting a balance sheet that’s getting beefier in the right places. Meanwhile, the company’s net debt has been playing a game of snakes and ladders, ending up at $1,063,697 in 2022 after a brief slide from 2020’s $1,111,672. It’s like the company’s financials are on a diet and debt is the first thing they’re cutting. Working capital, however, seems to have taken a minor detour from $28,521 in 2021 to just $885, leaving us to wonder if someone left the fiscal tap running.

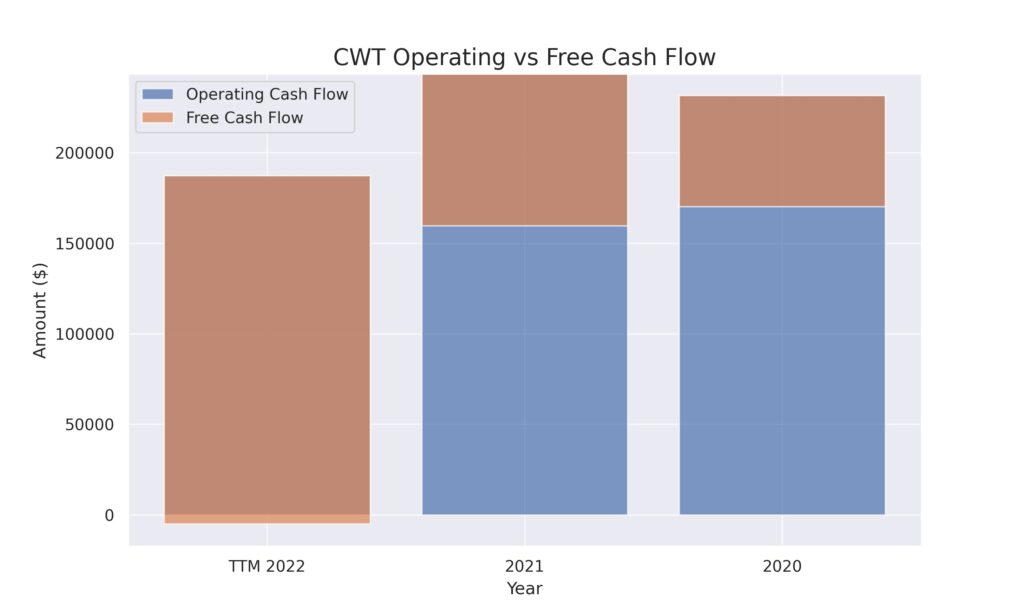

Cash Flow Statement Analysis

The cash flow statement of California Water Service Group gives us a financial narrative with its own plot twists. The operating cash flow, which is the lifeblood of any company, stood strong at $187,439 in the trailing twelve months (TTM), although it couldn’t quite reach the lofty heights of $243,772 seen in 2021. It seems like the cash from operations has been doing a bit of a cha-cha, with a few steps forward and a couple back, but still keeping the rhythm going strong enough to keep the lights on.

When we peek over the fence to the investing cash flow, it looks like someone’s been digging a hole, with a hefty outflow of $386,742 in the TTM, dwarfing the previous years’ outflows. It’s as if the company’s investment strategy includes a fondness for shovels. Meanwhile, the financing cash flow, sitting at $154,911, suggests that the company has been playing the financial markets like a fiddle, drawing in cash to tune up its balance sheet. And despite what looks like a shopping spree in the capital expenditure department, the end cash position remains a comfy $69,050, making sure the company’s financial cushion hasn’t completely deflated.

SWOT Analysis

A SWOT analysis for California Water Service Group (CWT) entails examining the company’s internal strengths and weaknesses, as well as the external opportunities and threats it faces within the water utility industry. This analysis can help understand CWT’s position in the market and potential strategic directions.

Strengths:

- Established Market Presence: CWT has a long history and significant experience in the water utility industry, serving various communities across the United States. This longstanding presence has helped it build a strong brand and customer trust.

- Diverse Geographic Footprint: With operations in multiple states, CWT is not overly dependent on a single geographic area, which can help mitigate regional risks such as droughts or regulatory changes.

- Consistent Dividend Payer: The company’s track record of consistently increasing dividends, becoming part of the Dividend Kings, signifies strong financial health and commitment to returning value to shareholders.

Weaknesses:

- Regulatory Constraints: Being in a heavily regulated industry, CWT’s operations and profitability are subject to the decisions of regulatory bodies, which can impact rates and investments.

- Capital Intensity: The water utility sector requires substantial ongoing investments in infrastructure to ensure service quality and regulatory compliance, which can strain financial resources.

Opportunities:

- Infrastructure Upgrade and Expansion: There is a growing need for upgrading aging water infrastructure in the United States. CWT can capitalize on this trend through strategic investments and potentially secure government funding or incentives.

- Technological Advancements: Investing in new technologies for water treatment, conservation, and infrastructure monitoring could improve efficiency, reduce costs, and enhance service quality.

- Sustainability Initiatives: Increasing focus on environmental sustainability presents opportunities for CWT to lead in water conservation practices and renewable energy usage, aligning with consumer and regulatory expectations.

Threats:

- Environmental Risks: Climate change, including the increased frequency of droughts and extreme weather events, poses significant risks to water resources, affecting supply and increasing treatment costs.

- Competitive Pressure: The water utility market is becoming increasingly competitive, with both public and private entities vying for customers and investment opportunities.

- Regulatory Changes: Potential shifts in environmental and utility regulations can impose new requirements on CWT, affecting its operational costs and strategic planning.

This SWOT analysis highlights CWT’s solid foundation in the water utility industry, underscored by its financial stability and market presence. However, navigating regulatory, environmental, and competitive challenges will be crucial for its ongoing success and growth.

Competitors

Here are five of CWT’s top competitors, based on their size, market presence, and impact on the industry:

- American Water Works Company, Inc. (AWK): AWK is the largest publicly traded water and wastewater utility company in the U.S. With operations across numerous states, American Water Works serves millions of customers and represents significant competition for companies like CWT in terms of scale and resources.

- Essential Utilities Inc. (WTRG): Formerly known as Aqua America, Essential Utilities is one of the largest publicly traded water utilities in the U.S. It provides water and wastewater services in several states, offering a broad range of operational capabilities and financial resources that compete with CWT.

- Veolia Environnement S.A. (VEOEY): A global leader in optimized resource management, Veolia operates in the water, waste, and energy management sectors. Although based in France, Veolia’s extensive operations in the U.S. and around the world make it a formidable competitor in the water utility market.

- Suez Environnement S.A.: Another global giant, Suez, provides similar services to Veolia, including water supply and treatment. Suez’s international presence and expertise in water management solutions pose competitive pressures on companies like CWT, especially in markets that value sustainable and advanced water treatment technologies.

- Xylem Inc. (XYL): Xylem specializes in water technology and provides equipment and services for water and wastewater applications. While not a direct competitor in the utility provision sense, Xylem competes with CWT in the broader water industry, particularly in technological advancements and infrastructure solutions.