Investment Highlights

- Uncertainty around the company’s spinoff transition may be holding back sentiment and provide an opportunity for long bets

- Abbot trails competitors on profitability metrics but may catch up as management focuses on a more narrowly-defined company

- Cash flow and dividends should increase with profitability over the next several years

Abbot Laboratories (NYSE: ABT) completed the spinoff of its pharmaceuticals business in 2013, now AbbVie (NYSE: ABBV), and now operates in the remaining segments: nutritionals, devices, diagnostics and established pharmaceuticals. The company is less than half its prior size with a market capitalization of $70 billion and annual sales of $20.2 billion.

Management had argued that the operations had grown into two distinct businesses and were better as separate entities. While there are other companies that compete in both pharma development and equipment, the move was probably a good one. It helps respective management focus on competitive advantages within each separate business and be accountable for results.

It’s now easier to see how Abbot stacks up against other device & diagnostics companies, and the picture is not necessarily good. The company trails in profitability with a 12.8% operating margin, trailing competitor Medtronic (NYSE: MDT) with its 22.4% margin but close to competitor Stryker Corporation (NYSE: SYK) with a 12.9% margin.

The company has taken steps to improve profitability and that may be the best thing going for it. It has streamlined distribution and moved some manufacturing to China and India. It has increased its focus on emerging markets and is seeing solid growth. Management efforts should start paying off and could result in stronger cash flow over the next couple of years, leading to a higher dividend and share price.

I would expect the new company to acquire some smaller players in the medical devices segment to compete primarily in that area. Another sale or spinoff of the nutritionals segment, with its strong brand in Similac baby formula, could be a possibility to further drive the focus on medical equipment and diagnostics.

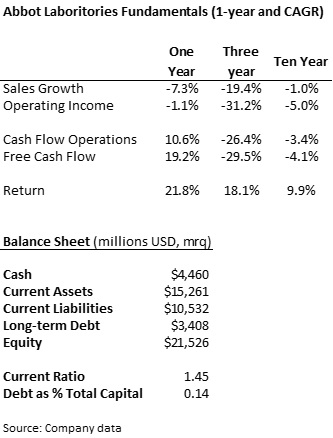

Fundamentals

The spinoff has clouded fundamentals with sales nearly halving over the last few years. The decline in sales over the last year is worrisome but was a major transition year for the company. The fact that operating income did not fall as much as top-line sales speaks to management’s control of costs. The outlook for sales is favorable this year with an increase of 3.4% expected. Longer-term, sales should increase at a respectable 5% to 7% pace and will be much less volatile without the drug development side of the business.

The balance sheet is relatively strong with nearly $5 billion in cash to be used for acquisitions. The company has little debt on the balance sheet and may use a bond issue to help pay for purchases as well. There are no debt maturities until 2017 ($1.75 billion) and then until 2019.

Cash flow has already rebounded from the post-spinoff results and should support cash return to investors. The company is now in a relatively mature set of businesses and should be able to increase dividends at a faster rate than in the past. I would look for management to take the rest of the year for transition and then start to increase cash return more quickly.

Dividends and Growth

The dividend yield has fallen to 2.1% compared to a five-year average of 4.4% during the transition phase. Shares have jumped more than 18% annually over the last three years and cash flow has not been able to keep up. The payout ratio has increased to 60% from the longer-term average of 54% so management may not have much room for dividend increases until sales and cash flow picks up.

Management has increased the dividend by just 1.4% annually over the last three years, on a post-spinoff basis. Over the longer ten-year period, dividends increased at a compound rate of 6.2% and I would expect this growth rate to return within a year or two.

Abbot Labs has continued to return cash to shareholders through the stock repurchase, buying back $2.2 billion in shares last year. Buybacks may slow marginally if the company acquires a large player in medical devices but cash return should offer a good yield over the long-run.

Valuation

Investors have applauded the spinoff with stronger sentiment on the shares. Abbot trades for 20.4 times trailing earnings, just over the average 18.0 times multiple over the last five years. Larger rival Medtronic trades relatively cheaply at 17.5 times while Stryker trades for 19.5 times earnings and Boston Scientific (NYSE: BSX) trades for 21.5 times earnings.

Expectations are for earnings to fall 5.7% to $2.15 per share this year but to increase to $2.41 per share in 2016. The company regularly beats expectations and I would expect earnings this year to come in close to last year’s numbers.

While shares of Abbot are relatively expensive, especially considering earnings weakness as the company transitions, there is still a lot to like about the new company. It is in a more mature business line and stable cash flows should help to drive cash return higher. The potential is there for an earnings surprise as management improves profitability. Investors can start buying shares at this point but may want to spread purchases throughout the year. The relatively high valuation means there’s no rush to get into the shares but they should provide for a good long-term return.

I liked ABT a lot, but after the spinoff it became an uncertain stock for me and decided to get rid of it and return (maybe) a bit later. I agree that the company seems expensive mainly compared to dividend it pays. For one stock I can get a better pay elsewhere. It’s not that bad however, but still my valuation says “wait”.