This last year continued to frustrate the bears looking for an end to the four-year bull run, or at least a slowdown in the pace of stock gains. That correction never happened, in fact the S&P500 saw its largest correction of just 5.6% in May after the Federal Reserve first signaled its tapering plans.

Dividend investors in stocks enjoyed the ride along with the rest of the market while bond investors and those looking for a rebound in emerging markets were left cold. Rising interest rates through most of the year drove bond prices down and a stronger U.S. economy boosted U.S. shares.

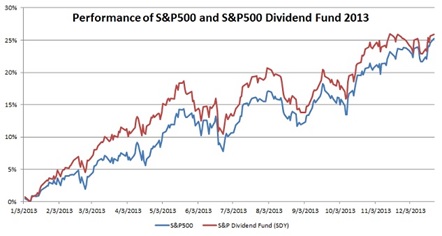

Once again, the market proves that dividend investing trumps the general market. The return on the S&P Dividend ETF (SDY) outperformed the overall index for most of the year.

As investors, we are simultaneously reminded that past performance is no guarantee of future returns and that those with no knowledge of the past are doomed to repeat it. With a skeptical eye to the markets, we look back on the lessons of 2013 as we position for the next year.

Bonds and rates

The Federal Reserve has officially started to reduce its monthly purchase of bonds, from $85 billion to $75 billion a month. The move caps a tough year for bond investors as interest rates increased 1.13% to almost 3% before Christmas. Even with the 2.3% yield, the iShares Total Aggregate U.S. Bond Fund (AGG) lost 1.3% on the year. Accounting for inflation, bond investors lost 2.5% in an end to the 30-year bull run in fixed income.

While inflation is still under the central bank’s target, unemployment has come down and the Fed will continue to taper its bond purchases. The U.S. economy doesn’t look to explode higher anytime soon but interest rates will increase with a general economic rebound. Unless stocks completely fall apart, unlikely with modest economic growth and relatively inexpensive valuations, then it looks like bonds will have a tough year again in 2014.

Emerging Markets

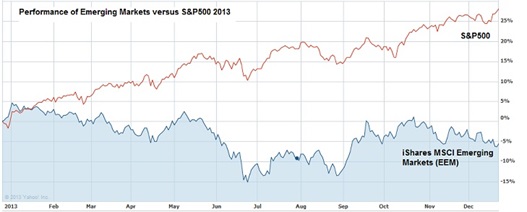

Stocks of developing countries hugely disappointed in 2013 as stronger U.S. economic growth brought investors back home. The emerging markets had outperformed the S&P500 since the March 2009 lows but lost 5% this year.

The U.S. economy should continue to benefit from a revolution in energy production and strong manufacturing growth but there are several reasons you still need exposure to emerging markets. After spectacular runs in U.S. stocks over the last several years, the S&P500 is trading at 17 times earnings of the companies in the index. This isn’t terribly expensive by any measure but it certainly is not cheap. After the selloff this year, stocks of companies in the emerging markets are selling at a 40% discount to their U.S. counterparts.

While the red, white and blue may be looking at a few more years of economic growth, the emerging markets are still where global growth will come from over the next several decades. From high debt and aging populations in the developed world to global trade, the future belongs to the little guys and you need diversification in your portfolio.

While the popular iShares MSCI Emerging Markets Fund (EEM) only offers a 1.8% yield, other emerging market funds offer stronger cash returns and can be good bets while waiting for an EM rebound. The WisdomTree Emerging Markets Equity Fund (DEM) pays a 3.95% dividend and trades at just 10 times the earnings of stocks in the index.

Stocks

Investment managers were reminded this year that diversification can be a double-edged sword. No rational investor would dream of being 100% in U.S. stocks without some exposure to other asset classes like bonds, real estate and commodities. Unfortunately, compared to stocks every other asset class had an abysmal year and most managers will be offering a big mea culpa come January.

While you will always need diversification in your portfolio, stocks of U.S. companies continue to look good from an investment and income standpoint. Companies are sitting on record amounts of cash and will continue to return it to investors in the form of dividends and share buybacks. The boom in energy production and eventual increase in exports will support the economy and manufacturing looks to rebound after nearly three decades of outsourcing.

The S&P SPDR Dividend Fund (SDY) pays a fairly strong 2.4% yield and has followed the rest of the market up in price this year. Stocks had a big run in 2013 and you shouldn’t expect the same return over the next couple of years, but there is really no reason for an end to the bull market either.

It was a stellar year for investors in the US equity markets but the key is to remember that it’s not always a straight up journey. The markets will ebb and flow. As for me I’m hoping to diversify into some real estate opportunities and then just continue chugging away with investing capital as it’s available and valuations warrant it.