Investment Highlights

• Massive scale with the ability to reach nearly the entire U.S. population leads to cost savings and brand identity

• Extremely low debt provides an opportunity to increase leverage and return

• A Dividend Aristocrat with a strong commitment to shareholder cash return but just too expensive right now

Walgreen (WAG) is the largest retail pharmacy in the United States with more than 8,600 drugstores and a market capitalization of $67.7 billion. The company filled 721 million prescriptions last year, accounting for about 19% of the total retail drug market. The company’s Take Care Health Systems subsidiary manages more than 700 in-store care clinics and wellness centers.

While the company will benefit from an aging U.S. population and increased demand for prescription drugs, competition in the retail drug market will likely also increase over the next decade. A key to the trade-off will be how the company manages its operating expenses. Management has noted pricing problems on both the supplier and payer sides lately. Generic drugs do not offer the same profitability as patented-products and government-reimbursement programs have been limiting the amount charged to customers.

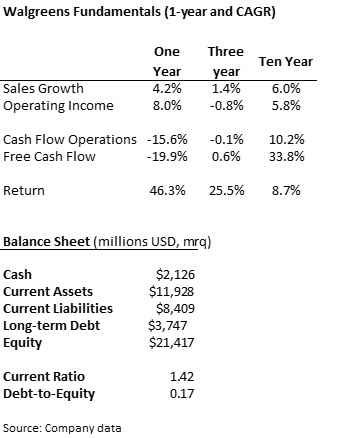

Fundamentals

Walgreen’s sales growth of 5.9% reported last quarter was a welcome change from two years of weak growth. Sales were basically flat in the two years through 2013 but growth should rebound to around a 6% average over the long-term. Stronger demand for prescription drugs could be offset a little by higher use of generics and pricing pressure from reimbursement plans.

The company’s operating margin, a key measure of profitability, has been relatively consistent between 5% and 6% over the last decade. Eventually the company may have to focus on cost management when the demographic boom levels out but growth is the bigger focus currently.

Walgreen paid down $742 million in debt last quarter and holds just 17% of its capital structure in bonds. While this helps make the balance sheet incredibly solid, I think management is not taking advantage of low rates. A company like Walgreen, in a mature market with tens of billions in assets, could easily increase its percentage of debt without any problems to liquidity. This would help to increase returns through higher financial leverage.

Free cash flow increased in 2013 on slightly lower investment spending but has decreased significantly to $2.47 billion over the last four quarters. Even on the decrease in free cash flow, the company still generated nearly $2.5 billion after capital expenditures over the last year.

Dividends and Growth

Walgreen is one of the few companies on my radar with a dividend yield below the 2% threshold. Shares currently pay just 1.7% against a 2.0% five-year average. While management has increased the dividend at a 21.4% rate over the last three years, a doubling in the stock price since the beginning of 2013 has brought the yield down.

The company is paying 43% of its income out as dividends, above the 35% average payout ratio over the last five years. Combine a high payout ratio with weak cash flow and the company may not be able to get back to a 2% yield without the share price coming down.

Despite its low yield, Walgreen has paid a dividend since 1933 and has increased its payout for the last 38 consecutive years. It is a member of the S&P 500 Dividend Aristocrats and has made a strong commitment to shareholder cash returns. The company has slowed its share repurchase program to $615 million last year but has returned over $3.8 billion to investors in repurchases over the last three years.

Valuation

Shares are trading relatively expensively at 24.9 times trailing earnings, above the industry average of 21.6 times and well above the company’s five-year average of 16.6 times earnings. While the shares normally trade at a premium to the general market, the 33.4% premium compared to the price-earnings multiple of 18.6 times for the S&P 500 is well above what we’ve seen in the past.

The market is expecting earnings of $3.35 per share this year and a 14.6% increase to $3.84 per share in 2015. Expectations for earnings growth next year are likely too high, especially considering expectations for sales growth of just 4.5% and lack of a management plan to control costs. I would put a more conservative estimate around $3.70 per share in 2015 earnings which would bring the price multiple down to 19.1 times on the current price. This is still well above the stock’s five-year average price multiple and doesn’t leave much room for price appreciation over the next 18 months.

I love Walgreen’s position ahead of a demographic boom in prescription drugs but the shares are just too pricey right now. I would feel comfortable buying shares for a long-term portfolio around $65 each which would bring the price closer to the long-term P/E multiple against my estimate for 2015 earnings. The company could unlock some value through lower taxes if it completes an acquisition of Alliance Boots but this may also cause a backlash among loyal U.S. customers.

Thanks for the analysis. Did a review of WAG myself a while ago. I’m sure your glad with the recent move in pps. Thinking about picking up a few shares now myself. I’ve owned RAD for a while, but it would be nice to have a pharmacy stock that pays me a dividend 🙂

Thanks, Sam