After a short hiatus from dividend investing I’ve started to add a couple of positions back into my portfolio. Last week I decided to make a move on two REITs I’ve had my eye on. Starwood Property Trust and Federal Real Estate Investment Trust. REITs have had a huge run in the last 12 months. I’ll give a breakdown of why I bought into these stocks despite their recent moves higher. Both of these companies report earnings in early May so there is some time before we get any new results from them.

Dividend Growth and Yield

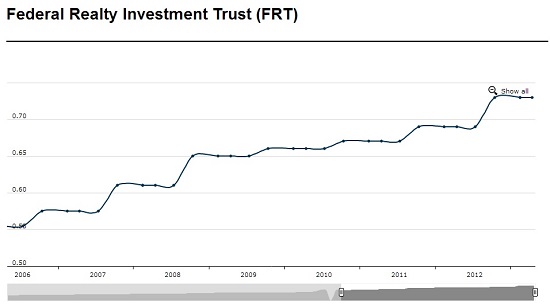

FTR: There is no arguing with Federal REIT’s dividend growth. The company has over 40 years of consecutive increases. Although the growth has been slow in recent years it has been steady. I’m willing to overlook the low 3% dividend growth rate because of what I hope this company will be able to do in the future which should help improve growth rates. FTR’s dividend yield is low at 2.6%. I’m looking for the yield increase or remain the same as the dividend increases and the stock price adjusts.

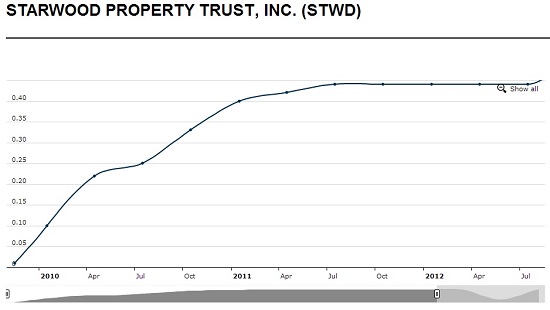

STWD: Starwood’s dividend growth story is still a new one, but I like it. The REIT went public in August of 2009 and has risen 29% over that time period. More importantly the stock is up 21% in 2013. Starwood has increased its dividend each year since 2009 and I believe it’s just the beginning of a long history of consecutive increases. The yield is a strong 6.2% and as Richard Berger states at Seeking Alpha, Starwood may still be undervalued based on yield alone.

The dividend history graphs come from the dividend history tool.

Funds From Operations (FFO)

The FFO metric is an important factor to use when evaluating a REIT. Let’s take a look at each company’s numbers.

FTR: Federal Real Estate Investment Trust increased its FFO from $1,199B in 2011 to $1,658B in 2012. The increase came from higher net income and lower debt costs. That is the kind of growth I’m expecting from FTR going forward.

STWD: Big moves higher here in 2012. Starwood’s FFO increased from $84M in 2011 to $127M in 2012 representing an increase of more than 50%. Net operating cash flow increased by more than 300% as well.

Looking At the Future

FTR: The future looks bright for Federal Real Estate Investment Trust. They have started to invest in urban community developments with walkable amenities that include high end shops and restaurants. This appears to cater well to retirees looking to escape the retirement community lifestyle. My gut feeling is that this will become a long term cash cow for FTR. The idea of living in or near a major city with walkable attractions and high end features is not a trend, it’s here to stay. At least I think so and it appears many others do as well. I don’t think however that this type of property is only going to be attractive to couples in retirement. There are a lot of benefits for all ages and I see this as a major competitive advantage for FTR.

STWD: This is an interesting company with a short but very positive track record. They are focused on commercial mortgages and have been looking to expand recently. Many funds have been buying up the stock in recent months. 80% of the float is now owned by funds. Starwood recently purchased LNR for $1B which will give the company property, access to new networks and mortgage originators. This acquisition just helps drive their goal to a sustainable competitive advantage.

Conclusion

What I found here in these two REITs is solid dividend growth, dividend yield, increasing income and improving cash flow and a lot of hope for future growth. Those are the major factors that drove me to pull the trigger on these stocks. Now we’ll wait and see what the next 5-10 years brings.