Investment Highlights

• Shares have fallen over the last year but are looking relatively cheap on next year’s potential earnings and on discounted cash flows

• A turnaround in Canadian operations could help the company improve profitability

• A strong commitment to cash returns may make the shares a good bet but investors need to watch sales growth at stores open more than a year to make sure the company is not following the same path as competitors

Target Corporation (TGT) has about 1,800 stores in the United States and Canada with many adopting the mega-store format adding grocery products to the traditional retail offering. The company entered the Canadian market in early 2014 but has had problems with the rollout. Besides the data breach late last year, for which the company is accruing $111 million for expected charges, the big story for Target is the weakness seen for many traditional retail stores like J.C. Penney (JCP).

Target disappointed the market with second quarter earnings that came in under expectations. Earnings of $0.78 per share missed management’s earlier guidance by 8% on a failed expansion program in Canada and sales weakness after December’s data breach. The company replaced Gregg Steinhafel as CEO a week earlier, naming Brian Cornell to the top seat.

The Canadian division posted a loss of $941 million before interest and taxes last year and led management to announce a revamp of its expansion in the country. The program includes management changes and 30,000 new products to stores.

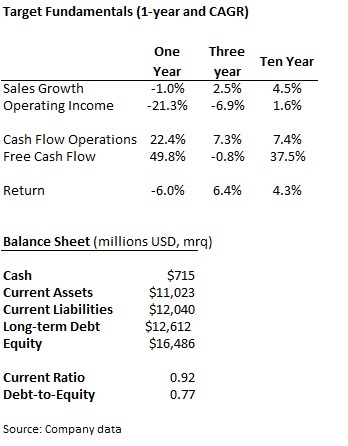

Fundamentals

Sales have taken a hit along with other traditional retailers with a 1% drop last year. Management has not been able to control costs in the shifting sales environment and has incurred extra expenses related to last year’s data security breach. The company’s plan for Canadian operations may help to improve profitability but sales growth is likely to remain weak.

Cash on the balance sheet is low at just $715 million but the company still generates positive free cash flow so it should not be a problem in the near-term. Debt is relatively high at 46% of the capital structure but interest expense of $1.1 billion last year was covered nearly six-fold by EBITDA (earnings before interest, taxes, depreciation and amortization).

Cash flow from operations increased last year on a $3 billion jump in accounts receivable which may be a warning that the company is extending too much credit. Cash flow from operations over the trailing twelve months is down 40% from fiscal 2013 to $3.8 billion.

Dividends and Growth

On a strong trend in dividend growth and weakness in the share price, the yield has grown to 3.6% which is well above the 2.1% average over the last five years. Unfortunately, the payout ratio has also increased to 58% of earnings from the five-year average of 33% of earnings paid out as dividends.

Management has increased the dividend at a 19.8% rate over the last three years and has paid a dividend since 1965. The shares are included in the S&P 500 Dividend Aristocrats with 42 consecutive years of dividend increases. A payout ratio approaching two-thirds of earnings and stagnant sales could mean that dividends will grow at a more moderate pace over the next few years.

Management has slowed the pace of share buybacks to just $921 million repurchased over the last twelve months but is still committed to returning cash to shareholders.

Valuation

The shares are trading at 19.8 times trailing earnings, well over the industry average of 17.2 times and the company’s own five-year average of 14.9 times earnings. Expectations for sales growth are relatively conservative this year and next for a consensus view of $76.34 billion next year. Against this conservative sales estimate, earnings are forecast to jump 17% next year over an 8% gain in this year’s earnings. This is likely overly aggressive even given cost-cutting and the turnaround program in Canada.

Despite the optimism, the shares could still do well on conservative earnings growth. My own estimate for $3.70 in next year’s earnings still yield a return of 7% on the share with a target of $62.90 on a price multiple of 17 times earnings.

Valuation by discounted future cash flows is difficult for traditional brick-and-mortar retailers because of the shift in retail sales. I have used relatively conservative assumptions in the value below with dividend growth of just 9% over the next five years and 7.5% growth in the following period. Even if sales were to weaken further, these estimates are achievable given current cash position and a conservative estimate of future sales.

A strong commitment to shareholder cash return and a plan to turn around Canadian operations may make the stock a good bet for your dividend portfolio. Watch the company’s same-store sales growth to gauge whether this turnaround story will be successful.

It’s really tough to say Zach. On the one hand Target is expensive based on the metrics. On the other hand ANY improvement in Canada will dramatically help the top line. Plus, the (forward) expectations of investors are so incredibly low that it will be almost impossible for Target not be beat them. A great example of these lowered exceptions is how the stock price climbed after disapointing earnings, earlier this week.

From a boots on the ground approach, my shopping experience at Target has greatly improved over the past year, although checking out is still poor.

-Bryan

Thanks for the input Bryan. Hope things are going well.

Personally, I am going to wait and see on TGT. Yeah, the yield is really nice now, but my fear is that it may have been raised too much. Payout is too high for a retailer, which may crimp cash flow that they need for other purposes. Things may work out for them, but I am feeling too much risk at this point for my taste.

I’m not convinced that Target has a sustainable enough value proposition to say with assurance that it won’t be impacted by e-commerce and m-commerce trends. Walmart’s huge scale and sourcing advantages create an enduring low cost competitive advantage, which I’m not sure Target has. I’d need a bigger margin of safety to get me in.