Highlights:

• A $10 billion cost-cutting program drove strong gains in operations last year but there is still some upside for margins and profitability

• The company is selling out of some non-core products and could use the cash to invest in stronger brands or return it to shareholders

• The company is a dominant player in multiple product lines with some of the strongest brands in consumer staples

Procter & Gamble (PG) is the global leader in consumer products with more than $84 billion in annual sales and dominant market share in many product lines. It controls approximately 30% of the baby care market through its Pampers line, 70% of the market for blades and razors through Gillette, 30% of feminine protection and 25% of the fabric care market through brands like Tide and Downy.

As with most consumer staples companies, growth is largely coming from international sources and emerging markets. Sales outside the United States account for 65% of the total with emerging market growth around 7% annually. Sales in the United States are growing at a more moderate 2% pace but are stable on the company’s strong brands and customer loyalty.

Procter & Gamble recently announced the sale of its pet food brands Iams, Eukanuba and Natura to Mars Incorporated for $2.9 billion. The sale will drive a restatement of earnings for 2013 and a cut to 2014 guidance by $0.04 per share. The company will maintain operations in the brands for the European market but may also seek a sale to completely separate from the product line.

The company also announced a $10 billion cost-cutting program in 2013 that should help to improve margins and earnings over the next few years. This, combined with the possible sale of more non-core brands, may help drive a higher cash return to shareholders over the near-term.

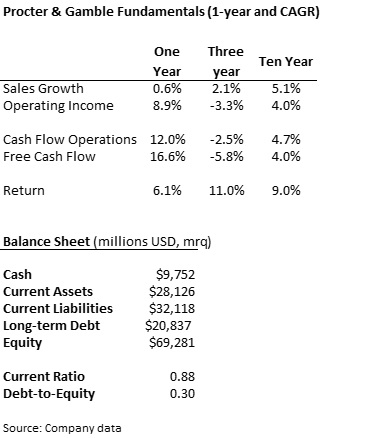

Fundamentals

Sales growth slowed last year as economic weakness in developed markets and currency problems hit the company’s emerging market sales. The cost-cutting program helped to boost operating income substantially but most of these gains were probably front-loaded in the program and may not help as much in later years.

The company uses debt to finance just 34.4% of its capital structure, relatively low for a mature consumer staples company, and issues ten-year notes at a 3.24% yield. Cash on the balance sheet jumped nearly 15% last quarter to $9.7 billion.With cash building on the balance sheet and cash flow growing consistently, the $2.9 billion sale of the pet food brands could go to boosting the dividend or a larger buyback program.

The company has steadily increased capital spending, just over $4 billion last year, to keep sales growing at a consistent rate. Growth in free cash flow has mirrored cash flows from operations for a healthy 4% rate over the last ten years. Working capital increases in 2011 and massive debt repayment in 2010 misrepresents three-year cash flow statistics.

Dividends and Growth

Procter & Gamble is a solid Dividend Aristocrat with 60 consecutive years of increases and a cash payout since 1891. The current yield of 3.2% is just slightly above the 3.1% average over the last five years while the current payout ratio of 65% is significantly above the 57% average payout over the period.

The company has increased the dividend per share amount by 7.5% annually over the last three years, slightly below its longer-term average but still respectable for a mature company. While cost-cutting and strong cash flow may drive a higher rate over the next couple of years, I have used a more conservative estimate for valuation below.

Management consistently returns cash to shareholders through the buyback program as well. More than $17 billion in common stock was repurchased over the last three years. Through the buyback and the dividend, the company returned $13.3 billion to shareholders in the last four quarters alone.

Valuation

Shares trade for 21.2 times trailing earnings, right at the industry average but above the company’s own five-year average of 18.8 times earnings. This is fairly typical of the sector with almost all companies looking a little expensive against historical measures. While the discounted cash flow approach shows some value still in the shares, investors may want to be cautious in their buying.

I used a 7% growth rate in dividends, and a terminal growth of 3.5%, for the discounted cash flow valuation. The near-term growth in dividends may be a little higher on extra cash as a result of the cost-cutting program but I am confident that 7% is sustainable. Increasing the terminal growth rate to 5% does not significantly increase the fair value.

While most consumer staples companies are looking a little expensive these days, I like Procter & Gamble for its strong brands across multiple products and recent cost-cutting program. The sale of non-core lines like pet foods could further help to improve profitability and shareholder cash return. The shares may fluctuate, especially if interest rates increase and make other income investments more attractive, but the long-term upside is firmly intact.

Thanks for the analysis. I own a little PG already but I’m always looking to add more. Great, stable company with a huge product line.

Nice write up Zach. I’ve been a share holder for a long time, and while I don’t think it’s undervalued currently……I sure know it hasn’t lived up to its potential in the last few years. Management has been the biggest problem at PG, in my opinion.

-Bryan

I have PG on my watch list. Although the payout ratio is a bit high, I do like the yield and consecutive dividends. I think it is fairly priced but would prefer to grab shares on a dip. Thanks for the stock analysis…I will add it to my stock analyses collection. 🙂

Best wishes! AFFJ