Pentair Plc Investment Highlights

- A dividend yield of 2% is augmented by a buyback yield of between 4% and 6%

- Shares have fallen on weakness in the energy sector and currency impact but could offer a good entry price to long-term investors

- The company’s position in water purification could be a lottery ticket for investors as resource scarcity grows larger as an issue

Pentair plc (NYSE: PNR) is an $11.5 billion industrial equipment manufacturer headquartered in the United Kingdom. The company operates in two distinct segments, water and electronic enclosures. Within the water segment, the company makes pumps for commercial and residential usage including sump, well and fire-protection pumps. Pentair is a leader in filters and pumps for pools and hot tubs. Within the electronic enclosure segment, the company makes casings to protect electronic material like cabinets and casing systems.

The company is relatively well diversified with sales spread across five customer segments; industrial (27% of 2014 sales), residential & commercial (27%), energy (27%), food & beverage (10%) and infrastructure (7%).

Shares have fallen 12.5% over the last year, primarily as a result of two factors. The steep drop in oil prices has led to reduced spending by companies in the energy sector and has hit sales at Pentair. The strong British Pound (GBP) has also been a problem as the company books sales in other currencies and translates them to fewer GBP for reporting results.

First quarter sales dropped 10% from the same quarter last year with 6% of the loss due to the currency impact and 4% due to weaker sales to energy customers. Both factors seem to be moderating a little in the second quarter. Management is estimating a 2% hit to 2015 sales on the currency impact and has provided earnings guidance based on $60 per barrel oil prices.

Over the longer-term faster international growth should even out the currency impact. Oil production is still forecast at an annual deficit to demand through 2035 by British Petroleum so prices should see some relatively good support as well. The recent share weakness could be a buying opportunity for a stock with some good catalysts to the upside.

Water purification could be the future for Pentair and its investors. The company has developed a strong product portfolio in water filtration over the last decade and should be able to leverage this as the world’s growing population demands more H2O. The historic drought in California has put water conservation and purification center stage with many people looking to the future for how we will supply our most needed resource.

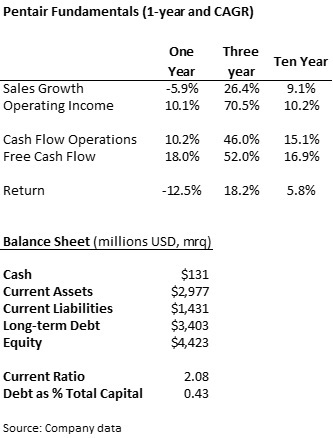

Pentair Company Fundamentals

Sales were down nearly 6% in 2014 but jumped over the prior two years on strong buying in the energy space. Despite the weakness in sales over the last year, management has done a very good job of controlling costs. The decline of $441 million in revenue was almost completely covered by lower cost of raw materials. Add in some cuts to operating expenses and the company’s operating profit actually increased in the year through 2014. While it may get harder to cover declining sales with lower expenses in the future, it is a good sign of management capability.

One of the few things that really make me hesitant on shares of Pentair is its cash position. The company holds just 1% of its market capitalization ($131 million) in cash on the balance sheet. The company maintains a good debt rating and generates a lot of cash so liquidity shouldn’t be a problem. Cash on hand covers just 8% of the current liabilities compared to most companies that keep upwards of 15% of their near-term liabilities in liquid assets.

Cash flow has grown close to the same rate as profits, a good sign that management is not manipulating accounting standards to show stronger growth in income. Slightly lower investment spending last year produced stronger free cash flow.

Pentair Dividend and Growth

Shares of Pentair pay a market-average 2% yield, slightly lower than the 2.2% five-year average. Despite the weak environment for sales, management has remained committed to a strong cash return policy. The company pays out about 55% of its earnings as dividends, close to the five-year average, and has increased the per share dividend for 39 consecutive years.

The dividend, paid since 1976, has increased at a compound annual rate of 11% over the last five years. The company has more aggressively increased its share buybacks over the last few years, from just $13 million in 2011 to $1.15 billion last year. The board of directors authorized another $1 billion in share repurchases last December.

Pentair Stock Valuation

Shares are trading for 17.2 times trailing earnings, well under the industry average of 29.2 times earnings. Pentair has provided guidance of between $4.20 and $4.35 per share in 2015 earnings and free cash flow of $925 million. Earnings guidance is based on sales growth of 2% to 4% and further gains in margins.

The consensus earnings estimate among 21 analysts reporting to Yahoo Finance is for just $3.76 per share this year, well below management’s guidance and a little odd. Even next year’s estimate for $4.14 per share is below guidance. While it might be difficult for management to meet its guidance for 11% earnings growth over the $3.78 per share reported last year, I think earnings will come out higher than the market’s expectation.

The company’s near-term potential rests with some stability in oil prices and a return of global economic growth, particularly from the eurozone. We could see oil prices a little lower but things start looking better beyond 2015. A new monetary stimulus program from the European Central Bank is already starting to boost economic growth and could help on the currency and oil price front.

Pentair’s position in water purification and a good cash return policy makes it a solid buy for long-term investors. The dividend and repurchase programs should yield between 5% and 8% over the next year while longer-term upside could provide for even better returns. With the company’s leading position in water, it may even become a takeover target at some point as resource efficiency becomes a bigger concern.