Investment Highlights

• Massive scale in an industry with demographic tailwinds and the potential for steady growth

• Strong commitment to shareholder cash returns with the potential to boost payout on acquisition benefits

• An undervalued stock that can help investors hedge rising healthcare costs

Medtronic (MDT) is the second largest manufacturer of medical devices in the United States with annual sales over $17 billion last year. I am a big fan of investing in healthcare companies within a retirement portfolio. As the cost of healthcare continues to rise faster than general inflation, what better way to prepare for your own costs than buying a share of the companies that will benefit from higher costs? Sales in the U.S. account for 59% of the company’s total sales and are primed to take advantage of the demographic boom in healthcare over the next several decades.

The company operates in three segments; Cardiac and Vascular, Restorative Therapies and Diabetes. Medtronic’s focus on chronic diseases means that devices are used continuously and improves stability in sales growth.

The company has been one of the many to recently announce a tax-inversion deal where a U.S.-based company acquires a foreign company and moves its official domicile to the country with the lower tax regime. Medtronic announced in June that it would buy Ireland-based Covidien Plc (COV) for $42.9 billion in a move that will bring tax-savings and a more diversified product line. The acquisition is expected to free up $14 billion in overseas cash that Medtronic has not repatriated because of a higher rate in the United States. After the deal closes, Covidien investors will be paid $35.19 in cash and 0.956 shares in Medtronic. The company says it will keep its operational headquarters in Minnesota.

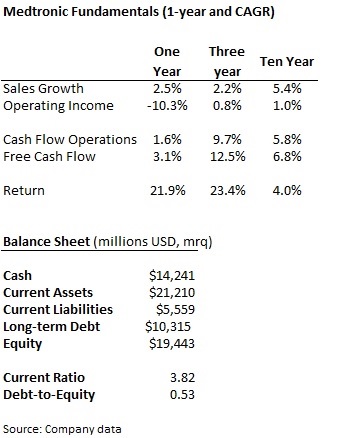

Fundamentals

Sales have grown at a reasonable rate over the last decade though the company has struggled over the last few years. Operating income has grown well below the rate of sales growth so it appears there could be an issue with cost controls. After integrating operations with Covidien, I would expect management to announce a focus on cost controls and creating a more efficient company.

Covidien has been more active in emerging market growth than Medtronic so the acquisition could help give the company a boost in faster-growing markets. The combined company should be able to top $2 billion in China sales next year.

The only real risk to revenue growth is the outlook for Medicare reimbursement rates in the United States. As healthcare costs rise, the government has sought to limit increases in reimbursement programs. This could limit sales growth but the relative size of Medtronic should help to give it some bargaining power with hospitals and physicians.

The company has a ton of cash on the balance sheet but this is likely a build-up ahead of the Covidien acquisition. Debt is used to finance approximately 38% of the capital structure and is issued at a rate of just 3.3% for 10-year bonds.

Free cash flow increased $137 million last year but partly on a $61 million decrease in capital expenditures. Cash flow from operations and after capital expenditures has increased at a good rate and the Covidien acquisition could create a cash flow powerhouse. Former CEO Bill George estimates that the combined Medtronic-Covidien will generate $7 billion in free cash flow annually, 14% higher than the companies posted in aggregate last year.

Dividends and Growth

Medtronic is a member of the S&P 500 Dividend Aristocrats with 37 years of consecutive increases and a dividend payout since 1977. The current yield of 2% is slightly below the 2.2% average over the last five years. The company is paying out 38% of income as dividends, above the 32% average over the last five years.

Medtronic increased the dividend by 9% in June and has increased the payout by 7.7% over the last three years. Management has a stated goal of paying out 50% of free cash flow to shareholders and has done it in the form of dividends and share repurchases.

Medtronic doubled its share repurchase program last year and returned $2.55 billion in cash to shareholders. The company has continuously returned cash through share repurchases and is likely to continue to retire shares after the Covidien deal.

Valuation

Shares of Medtronic trade for 16.2 times trailing earnings, well below the industry average of 31.4 times and only slightly above the company’s average multiple of 15.1 times over the last five years. Earnings for the full year are expected higher by 6% to $4.05 per share.

Setting the Covidien deal aside, Medtronic is expected to increase earnings by 6.9% to $4.33 next year on a 4.1% increase in sales. This alone would bring the value down below the five-year price multiple and that is without factoring in cost- and tax-savings from the Covidien acquisition. On a price multiple of 16.0 times earnings, the stock could climb over $69 per share next year.

Free cash flow at Medtronic has grown close to 7% annually over the last ten years and the Covidien acquisition is expected to boost FCF by 14% on tax and cost savings. This could translate into a strong jump in dividends for 2015 and 2016 with a stable 7% increase annually afterwards.

I haven’t included a discounted cash flow analysis here because the Covidien deal makes it a tough call on future cash flows. The deal still has to pass regulatory hurdles and shareholder votes but is likely to go through eventually. Medtronic looks to be a solid value on a stand-alone basis with the combined company offering the potential for stronger competitiveness and higher cash flows. The company is set for a strong position in medical devices through the demographic boom that could cause a surge in demand over the next couple of decades.

I really like MDT but wish the yield was a bit higher. I’ve been adding quite a bit of 2.5% or less companies so I want to add a bit more to some higher yielders. I love the industry because healthcare is going to continue to grow. Would love to add some more though and it looks like MDT is trading at a good relative value. Guess I’ll have to look at this one again.

As you already know sometimes growth is better than yield. Other times it just provides some balance. Thanks for stopping by JC.