Investment Highlights

- The company is extremely consistent in operations and cash flow, leading to a great track record of dividends

- An increasing age of light vehicles on the road should help support sales growth at least over the next several years

- As with many stocks lately, shares are overvalued on historic multiples and investors might prefer to wait for a better opportunity

Genuine Parts (NYSE: GPC) is a parts manufacturer best known for its distribution through NAPA for the automotive industry. With a market cap of $14.8 billion, has a commanding size advantage over competitors and control of the popular NAPA brand helps protect pricing power.

Despite what you may think, the company is not just a supplier of auto parts. The industrial parts segment, through ownership of Motion Industries, accounts for 28% of profits followed by office parts (11%) and electrical (4%). This diversification helps to lower the risk in the shares due to any weakness in the automotive industry.

Genuine Parts completed its acquisition of Exego Group, a leading distributor of auto parts to Australia and Asia, for $800 million in 2013. The company already controlled 30% of the foreign distributor and adds an international growth story that you do not find in most of its competitors.

The average age of light-vehicles in the U.S. increased to 11.4 years in 2013, well above the average of 8.9 years in 2001. Older cars on the road means higher demand for replacement parts and this should support sales at Genuine Parts over the next several years.

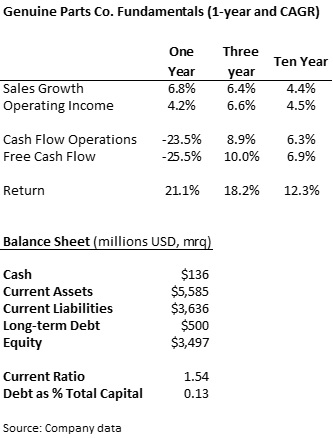

Fundamentals

Sales growth has picked up over the last few years with the success of the auto industry and increasing age of cars on the road. Besides higher sales growth, the company has been able to control costs and keep operating income growing at a comparable rate.

Genuine Parts has a relatively strong balance sheet with just over a tenth of the capital structure financed with debt. It has consistently refinanced its debt over the last three years, leading to fairly stable debt measures. Since the company is able to use its size advantage for better profitability than peers, I would actually like to see it use more debt to acquire some competitors.

One troubling point for Genuine Parts is the increase in accounts payable over the last year. The money the company owes its suppliers and other payables jumped from $2.2 billion in 2012 to $2.6 billion in the most recent quarter. Payables have come down from a high of $2.9 billion over the last couple of quarters but it is a pretty big question mark for the company. Why the change in payments? It does not seem to be for lack of cash flow or ability to pay but the question remains.

The real draw of Genuine Parts Company for investors is its consistency of operations and cash flow. Sales have grown at an extremely consistent rate and management has not lost focus of cost management. With the exception of the already mentioned change in accounts payable, this has led to consistent operational cash flow. A consistent investment in capital expenditures has helped keep sales growing regularly and free cash flow has grown in-line with other metrics.

Dividends and Growth

It would seem consistency is the name of the game for Genuine Parts with cash return as well. The shares pay a 2.4% yield, just below the 2.8% average over the last five years. The company pays out 51% of its income as dividends, equal to its five-year average payout ratio.

Steady cash flows have allowed the company to pay a dividend since 1948 and to raise that dividend over 58 consecutive years. Over the last five years, the dividend has grown at a 7.5% annual rate.

The company has also been consistent with its share repurchase program, buying back $144 million in stock last year and adding about a percent to investor cash return.

Valuation

Shares trade for 21.6 times trailing earnings, well above the five-year average of 18.4 times earnings and above the price on the general market. Shares have climbed over the last three years and earnings, while relatively strong, have just not been able to keep up.

Sales are expected to increase 4.4% in 2015 to $15.9 billion while earnings are expected to increase at a higher 9.5% rate to $5.05 per share. The market forecast for sales growth is a little lower but earnings expectations are in-line with 2014 performance. Even on 2015 earnings expectations, the shares would be slightly overvalued compared to the five-year P/E average.

A discounted cash flow analysis, assuming a 7.5% dividend growth and a 5.4% cost-of-capital, puts the shares at a fair value of $83 or about 14% lower than the current price. There are a lot of assumptions that go into DCF analysis and the method doesn’t give you an exact target but the price does seem to confirm that the stock is somewhere around 15% too expensive.

I like Genuine Parts for its consistency and think the average age of cars on the road will help to support sales growth. Sales could also get a boost from international markets and the company is well-diversified.

As with a lot of dividend payers over the last year, price is the big issue. I just have a hard time committing much to shares so high above their average price-earnings ratio. I think GPC is a good buy relative to other expensive stocks so you can probably start a position at this level. If you are not in a hurry, and you shouldn’t be as an investor, you might consider waiting for a target of $90 per share to commit too much.

I would definitely wait for a lower price. Thank’s for pointing out the money in accounts payable. That puts a big question mark in my mind as well. I’d probably try searching that further before buying.

It’s still a great dividend though! I might have wrote too fast! 😉 It is a great addition in a dividend portfolio. I’m just not sure I would buy at that price when compared to other stocks I follow that are cheaper.

I especially like the FCF growth but like DivGuy, I’m stingy about the price here. One might consider writing out of the money puts while waiting.

With the oil price falling, saving china billion of dollars, china was getting less competitive, now they can be more competitive. I’m wondering what happen in china would affect this company?