Investment Highlights

- Exxon still faces the same challenges I pointed to last October but has released new information that makes it a very interesting bet

- The company has plenty of cash flow to protect strong dividend growth and return enough to shareholders to keep them happy through the tough times

- The company can still conduct some pre-drilling activities on its massive new Russian acreage while waiting for sanctions to lift

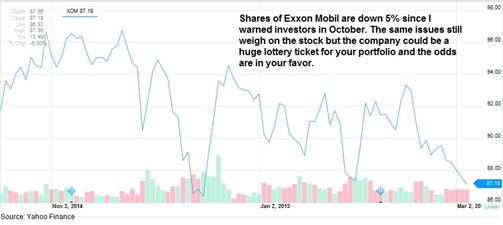

I highlighted Exxon Mobil last October, saying that I liked the company but its exposure to Russia worried me. I warned investors to hold off on the shares until at least after the third quarter conference call and maybe longer, to get a little more flavor on where geo-political issues might take the company.

Shares of the global oil giant are down 5% since my earlier article. The same issues of weak energy prices and Russian exposure remain but new information on drilling rights has turned me positive on the company.

In the company’s annual report for 2014, it was reported that Exxon Mobil held the rights to 63.7 million acres in Russia. To put this into perspective, it had the right to just 11.4 million acres in 2013 and U.S. exploration rights only totaled 14.6 million acres last year.

The increase in exploration rights on Russian soil may seem counterintuitive given a weak environment for oil and tough economic sanctions on the country. In fact, sanctions on drilling forced the company to suspend a partnership with Rosneft in October.

But sanctions only prohibit the company from drilling in Russia. It can still perform seismic research, exploration and even run pipeline in the country. These new fields where the country has bought rights could require years of this pre-drilling work anyway so sanctions on drilling may not mean as much unless they persist for a very long time. While details of the deal for the new acreage are not available, I can imagine Exxon is getting a pretty good deal to bet on Russia when the rest of the world is turning its back.

The new Russian fields are not expected to contribute to production until 2020 and exploration rights are held through 2023, so there is little near-term bite from the sanctions. The company only produced 50,000 barrels of oil a day in Russia before the sanctions, just over one percent of its 4.0 million barrels of oil equivalent product over the last year, so drilling sanctions should not materially hit sales unless they persist for a while.

Just one field in the Kara Sea was estimated to hold nearly a billion barrels of oil equivalent, based on exploration wells before sanctions. The new acreage could represent a massive opportunity for production growth. The U.S. Geological Survey (USGS) estimates that the Arctic region could hold as much as a fifth of the world’s undiscovered and recoverable resources.

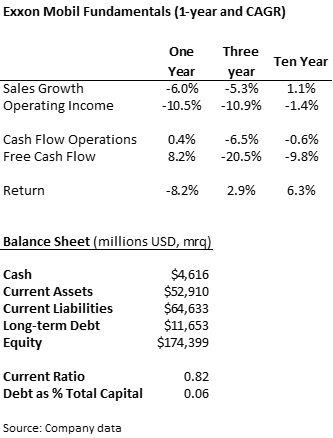

Fundamentals

Fundamentals have not changed much since my October article though we have information for full year 2014. As I pointed out previously, the drop in sales is not quite as worrying as the faster drop in operating income. This means that the company has not done a good job of managing costs during the drop in energy prices. I expect the trend to reverse this year though as management puts a greater focus on expenses and improving profitability.

The company still has a very strong balance sheet and one of the lowest debt ratios in the industry. While cash flow from operations was flat last year, free cash flow grew as management cut back on capital spending. Capital expenditures this year will be $4.5 billion lower to further protect cash flow and the dividend.

Dividends and Growth

On the falling stock price, the dividend has increased to 3.1% and is one of the highest among the S&P Dividend Aristocrats. Dividends have grown at an annual rate of 10% over the last five years with increases over the last 31 consecutive years.

Between the buyback and the dividend, Exxon returned a cash yield of 5.4% on the market capitalization last year. The weak environment for oil prices may weigh on management’s decision to repurchase shares this year but the company will still be able to grow the dividend.

Valuation

Shares look extremely attractive on a trailing basis at a price of 11.8 times earnings over the last twelve months. Analysts expect earnings to shrink by half to $3.70 in 2015 on a 40% drop in sales to $248.7 billion. Earnings in 2016 are expected to rebound 44% to $5.33 per share but this kind of long-term forecast is always hard to perfect.

Even on a relatively high price of 23 times expected earnings for the year, I have a hard time calling the stock expensive. Oil prices will likely remain around $50 and $60 per barrel this year but lower capital spending and marginal economic growth should take prices back up next year. It may not take long for earnings to improve significantly and the outlook for future production growth to drive investor sentiment higher.

The long-term story for energy demand is still good and Exxon’s new Russia exposure represents a bonus lottery ticket for investors. The company has cash flow enough to protect dividend growth even with low oil prices and a solid balance sheet to wait out the rest of the industry. Production growth may be limited over the next few years but could boom higher if Russian production starts towards the end of the decade. Investors should take advantage of the recent drop to add shares for a stable near-term dividend with lots of future upside.

I agree with you Ladder……and I think the Supermajors are the best way to invest in energy at this time. I am a little more wary of my opinion today however, AFTER Goldman Sachs came out with a note saying ExxonMobil is the only Supermajor to have positive free cash flow in 2016…….

-Bryan

Thank you for bringing that new perspective on this stock! I’m still curious to see what will happen in the next months, but could be great timing for some adding!